Services related to accounts receivable management play an important role in helping organisations efficiently manage their key financial functions, directly impacting the cash flow. Accounts receivable management services enable the organisation to access faster payments, which is important in meeting cash flow needs within a specific timeframe.

An effective accounts receivables process is necessary for ensuring timely payments to the company. This, in turn, enhances collection rates and expedites the invoicing process, ultimately bolstering cash flow.

The management of accounts receivables significantly influences an organisation's cash flow operations. Ineffective handling can weaken the company's financial health, while a strong system contributes to increased revenues. Outsourcing these services to a proficient team like StartupFino can yield successful outcomes for your organisation.

Understanding Concept of Accounts Receivable

Accounts Receivable, known as "receivables," signifies the money that customers owe a business for goods or services received. It happens when a company lets customers buy on credit, meaning they can pay later instead of right away. It signifies a legal claim or right of the business to receive payment from its customers within a specified timeframe.

Key Points about Accounts Receivable:

- Extension of Credit:

Accounts receivable indicates that a business has provided goods or services to customers on credit, allowing them to defer payment for a defined period, typically ranging from a month to a year.

- Record of Debt:

It serves as a record of the money that customers owe to the company for the work or products provided.

- Financial Health Indicator:

The management of accounts receivable is important for assessing a company's financial health and liquidity. Efficient management ensures that payments are collected on time, supporting cash flow stability.

- Terms and Conditions:

Credit terms, payment due dates and other conditions are typically outlined in an invoice or contract, specifying when customers should settle their accounts.

- Tracking Receivables Over Time:

Companies frequently use an aging schedule to monitor the status of unpaid receivables, sorting them based on how long they've been outstanding, such as 30 days, 60 days, 90 days and so on.

- Efforts to Collect:

When customers don't pay on schedule, companies might start collection activities, which could involve reminders, notices and occasionally legal steps to reclaim the overdue amounts.

Understanding Concept of Accounts Receivable

Accounts Receivable, known as "receivables," signifies the money that customers owe a business for goods or services received. It happens when a company lets customers buy on credit, meaning they can pay later instead of right away. It signifies a legal claim or right of the business to receive payment from its customers within a specified timeframe.

Key Points about Accounts Receivable:

Accounts Receivable, known as "receivables," signifies the money that customers owe a business for goods or services received. It happens when a company lets customers buy on credit, meaning they can pay later instead of right away. It signifies a legal claim or right of the business to receive payment from its customers within a specified timeframe.

- Extension of Credit:

Accounts receivable indicates that a business has provided goods or services to customers on credit, allowing them to defer payment for a defined period, typically ranging from a month to a year.

- Record of Debt:

It serves as a record of the money that customers owe to the company for the work or products provided.

- Financial Health Indicator:

The management of accounts receivable is important for assessing a company's financial health and liquidity. Efficient management ensures that payments are collected on time, supporting cash flow stability.

- Terms and Conditions:

Credit terms, payment due dates, and other conditions are typically outlined in an invoice or contract, specifying when customers should settle their accounts.

- Tracking Receivables Over Time:

Companies frequently use an aging schedule to monitor the status of unpaid receivables, sorting them based on how long they've been outstanding, such as 30 days, 60 days, 90 days and so on.

- Efforts to Collect:

When customers don't pay on schedule, companies might start collection activities, which could involve reminders, notices, and occasionally legal steps to reclaim the overdue amounts.

Role of Accounts Receivable Management

Managing accounts receivable is a crucial financial process focused on improving the collection of payments from customers who've purchased goods or services on credit. It involves different strategies and methods to ensure customers pay their outstanding bills promptly and completely. Accounts Receivable Management includes the following:

- Working Capital Management:

Managing accounts receivable effectively contributes to improved working capital management. It allows businesses to strike a balance between short-term assets and liabilities, ensuring they have sufficient resources to meet operational needs.

- Avoiding Late Payments:

Managing accounts receivable works to stop customers from delaying or not paying the money they owe. It means keeping a close eye on accounts and taking action to get payments before they become overdue.

- Boosting Financial Stability and Liquidity:

Effective Accounts Receivable Management contributes to a business's financial stability and liquidity. An efficient process helps a company stay financially sound, ensuring it can fulfill its financial responsibilities.

- Reducing Unrecoverable Debts:

A key aim of accounts receivable management is to lower the risk of uncollectible debts. By closely watching accounts and collecting payments promptly, a company can minimize the financial losses connected to debts that can't be recovered.

- Identifying Payment Delay Causes:

Effective Accounts Receivable Management goes beyond simple reminders and collections. It involves identifying the root causes of payment delays, whether due to disputes, financial difficulties, or other issues. Identifying these causes allows a business to address them and prevent future delays.

- Implementing Solutions:

Once the causes of payment delays are identified, accounts receivable management includes implementing solutions to resolve these issues. This may involve offering flexible payment terms, resolving disputes, or working with customers to find mutually beneficial solutions.

Importance of Accounts Receivable Management

Accounts receivable management is an important aspect of a business's financial operations, and its significance lies in several key factors:

- Maintaining Balance in Financial Statements:

Accounts receivable management helps balance a company's financial statements, especially the balance sheet. While inventory decreases when goods are sold, accounts receivable increases, serving as an asset to maintain equilibrium.

- Cash Inflow Generation:

Accounts receivable represents a claim on payment from customers for products or services delivered on credit. It signifies a future cash inflow, which is vital for a company's liquidity and financial stability.

- Asset on the Balance Sheet:

Accounts receivable management is recognized as an asset on the balance sheet, showcasing the value of outstanding payments owed to the company. This adds to the overall financial worth of the business.

- Facilitating Transactions:

Offering a credit facility to customers makes transactions more accessible and flexible. It can attract more customers, lead to larger purchase orders, and promote stronger business relationships.

- Credit Relations Building:

Extending credit can help build and strengthen credit relations between the business and its customers. This trust can lead to long-term, mutually beneficial partnerships, as well as potential for more significant business opportunities.

- Enhancing Sales Opportunities:

Accounts receivable management enables businesses to reach a broader customer base by accommodating credit sales. This can result in increased sales and market share.

- Credit Terms Flexibility:

It allows companies to offer flexible credit terms, such as net-30, net-60, or other payment schedules, catering to different customer needs and preferences.

- Improved Negotiation Power:

A positive history of accounts receivable management may provide businesses with better negotiation power when dealing with suppliers and financial institutions.

Benefits of Accounts Receivable Management Services

Availing accounts receivable services can offer many advantages to your organisation. These services result in time, cost and resource savings while enhancing the efficiency of your accounts receivable processes. The benefits of availing these services include:

Upgrade Your Accounts Receivable Process

One of the primary benefits of outsourcing Accounts receivable management is the ability to expedite payment collections and ensure timely processing. Service providers in this field prioritise customer-friendly options and advanced electronic billing, eliminating payment delays. Moreover, offering various payment methods allows clients to choose their preferred mode of payment and submit payments ahead of the due date, significantly improving your organisation's cash flow.

Reduce Time and Cost

Handling accounts receivable in-house can be both costly and time-consuming. Building an internal accounts receivable department requires significant investments in terms of time, money and infrastructure. In contrast, outsourcing Accounts receivable management services allows you to pay only for the specific services you require, resulting in substantial time and cost savings for your organisation.

Focus on Core Business Operations

By entrusting your Accounts receivable management services to experts, you can redirect your attention to core business operations, promoting growth and expansion. Service providers specialising in accounts receivables actively monitor and manage late payment issues, providing you with the time and space to focus on realising your company's full potential.

Effective Customer Screening

Professionals with expertise in accounts such as StartupFino are better equipped to establish clear credit policies and evaluate the creditworthiness of your customers. They possess the skills to identify customers with a strong credit history, ensuring timely payments and long-term financial stability. This capability can lead to significant cost savings for your organisation.

Quicker Collections

The longer you wait to collect the overdue amount, the less money your organisation will recover. The longer your accounts are late by a month or year, the more money you will lose, which will directly affect your cash flow. This is another major benefit of Accounts receivable management that you get from outsourcing these services to StartupFino’s experts.

Recording Accounts Receivable in the Financial Statements

Accounts receivable is an essential component of a company's financial statements and is recorded in the following manner:

1. Recognition of Revenue and Accounts Receivable:

- When a company sells goods or provides services on credit, it recognises revenue at the time of the sale. This revenue is included in the income statement as sales or revenue.

- Simultaneously, the company records the amount owed to it by the customer as accounts receivable. This addition is made to the balance sheet, specifically under the "Current Assets" section.

2. Credit Policy and Agreements:

- Before extending credit to customers, businesses typically establish a credit policy that outlines the terms and conditions of credit transactions. This policy defines credit limits, payment terms and any penalties for late payments.

- The credit agreement between the seller and the customer formalises the credit terms and conditions. Both parties agree to these terms to facilitate credit sales.

3. Assessing Customer Creditworthiness:

- Businesses must assess the creditworthiness of their customers before offering credit terms. This evaluation helps minimise the risk of defaults and bad debts.

- Credit checks may include reviewing a customer's financial history, credit scores and payment track record.

4. Recording Due Dates:

- The accounting team maintains a record of due dates for payments from customers. This record ensures that payments are received on time and helps with follow-ups on overdue accounts.

- Timely and accurate recording of accounts receivable due dates is essential for effective accounts receivable management.

5. Collection and Settlement:

- Once the payment is received from the customer, the accounts receivable account is settled. The specific customer account is credited with the received amount, reducing the accounts receivable balance.

- The company records this transaction in its accounting system and it reflects the actual cash inflow.

6. Reporting in Financial Statements:

- Accounts receivable is listed on the company's balance sheet as a current asset and is categorised under "Accounts Receivable" or "Trade Receivables."

- The figure that is there in the accounts receivable account shows the complete amount owed by customers on the reporting date.

7. Regular Reconciliation:

- Businesses often perform regular reconciliations to ensure that the accounts receivable balance in the financial statements matches the actual amounts owed by customers.

- Accurate recording and management of accounts receivable are vital for maintaining healthy cash flow and financial stability.

Tracking Payments and Accounting for Accounts Receivable

Tracking payments and accounting for accounts receivable are very important aspects of effective financial management. This process includes:

1. Tracking Payments:

- An accountant or financial team tracks payments received from customers. This involves recording the details of the payment method and the date of payment.

- These records are typically maintained in the customer's ledger account, where each customer's financial transactions are tracked.

2. Timely Reminders:

- To ensure that payments are received on time, businesses often generate timely reminders for customers with pending dues.

- These reminders serve as a proactive measure to prompt customers to settle their accounts within the agreed-upon terms.

3. Accounting for Accounts Receivable:

- The accountant or responsible personnel must record all due dates for payments that are expected to be received from customers.

- This step is important to maintain accurate accounting records and ensure that all payments are received on time.

- Once the accounts receivable is recorded and payment is received, the financial transaction is settled in the books of accounts for the respective customer.

Understanding Invoicing and Billing

Invoicing and billing are integral components of financial transactions in business. They play an important role in ensuring the timely receipt of payments for goods or services provided.

Invoicing is the process of generating a formal document that itemises the products or services delivered to a client or customer. This document typically includes details such as the quantity, description, price and total amount owed for the goods or services. Invoices serve as a clear record of the financial obligations a client or customer has to the business. They are usually issued after the completion of a transaction or as part of an ongoing billing cycle, often with specific payment terms and due dates.

Invoicing, however, is a wider process that covers the entire system of handling and gathering payments from clients or customers. This process involves creating invoices, keeping an eye on payment deadlines and making sure that payments arrive on time. Successful invoicing systems aid businesses in maintaining a strong cash flow by accurately and promptly monitoring owed and received amounts.

Role of Accounts Receivable Management

Managing accounts receivable is a crucial financial process focused on improving the collection of payments from customers who've purchased goods or services on credit. It involves different strategies and methods to ensure customers pay their outstanding bills promptly and completely. Accounts Receivable Management includes the following:

- Working Capital Management:

Managing accounts receivable effectively contributes to improved working capital management. It allows businesses to strike a balance between short-term assets and liabilities, ensuring they have sufficient resources to meet operational needs.

- Avoiding Late Payments:

Managing accounts receivable works to stop customers from delaying or not paying the money they owe. It means keeping a close eye on accounts and taking action to get payments before they become overdue.

- Boosting Financial Stability and Liquidity:

Effective Accounts Receivable Management contributes to a business's financial stability and liquidity. An efficient process helps a company stay financially sound, ensuring it can fulfill its financial responsibilities.

- Reducing Unrecoverable Debts:

A key aim of accounts receivable management is to lower the risk of uncollectible debts. By closely watching accounts and collecting payments promptly, a company can minimize the financial losses connected to debts that can't be recovered.

- Identifying Payment Delay Causes:

Effective Accounts Receivable Management goes beyond simple reminders and collections. It involves identifying the root causes of payment delays, whether due to disputes, financial difficulties, or other issues. Identifying these causes allows a business to address them and prevent future delays.

- Implementing Solutions:

Once the causes of payment delays are identified, accounts receivable management includes implementing solutions to resolve these issues. This may involve offering flexible payment terms, resolving disputes, or working with customers to find mutually beneficial solutions.

Customer Accounts Reconciliation

Efficiently managing customer accounts and ensuring timely payments is a vital aspect of business operations. Regularly checking receivables, conducting follow-ups, and addressing client concerns are essential for maintaining a healthy financial relationship.

Some key Practices for Customer Accounts Reconciliation include:

- Regular Receivables Monitoring:

Periodically review your accounts to track outstanding payments and identify any discrepancies.

- Follow-Up Procedures:

Establish a consistent follow-up process to prompt clients to make timely payments and address any issues like late fees or short pays.

- Proactive Communication:

Maintain open lines of communication with clients, encouraging them to reach out regarding any payment concerns.

- Accounts Statements:

Send periodic accounts statements to clients to provide a clear overview of outstanding balances, invoices, and payment due dates.

- Dedicated Collaboration:

Collaborate closely with your client's primary contact to update account information, address concerns, and ensure smooth financial interactions.

Business to Business Collections

Business to Business (B2B) Collections refers to the process of managing and collecting overdue payments from other businesses. If you frequently encounter overdue receivables from your customers, it's essential to adapt your approach to prevent issues with payment delays.

Some key Strategies for B2B Collections include:

- Regular Engagement:

Maintain consistent communication with your customers beyond payment reminders. Engage with them for product feedback, updates on charges or services, and to build a strong business relationship.

- Accounts Review:

Review the statement of accounts with your customers, sharing aging of invoices to identify overdue payments.

- Issue Identification:

Work with your customers to understand the reasons for payment delays. Identify any issues or discrepancies and resolve them promptly.

- Process Optimization:

Create a simplified process flow with control checks to prevent future payment delays. Implement improvements to make payments more efficient.

By adopting these practices, businesses can build stronger relationships with their B2B customers, resolve payment issues effectively, and ensure a smoother and more consistent flow of receivables.

Services Available on Outsourcing Accounts Receivable Management

StartupFino offers a comprehensive suite of services to manage your accounts receivables efficiently and ensure a smooth financial operation. Our range of services covers every aspect of the accounts receivables process, allowing you to focus on your core business while we handle the financial aspects with expertise. These services include:

- Sales Orders Processing:

Efficiently process and manage sales orders to streamline your sales operations.

- Bookkeeping:

Maintain accurate and up-to-date financial records to track your receivables effectively.

- Invoicing and Billing:

Generate invoices and billing statements for your customers promptly and accurately.

- Invoice Receipt Verification:

Verify the receipt of invoices to ensure all transactions are properly recorded.

- Invoice Reconciliation with Payments:

Match incoming payments with corresponding invoices for precise financial management.

- Monthly Open Balance Statements to Customers:

Provide clear and regular open balance statements to customers for transparent financial communication.

- Debtor Aging Report Preparation and Processing:

Prepare reports that categorise outstanding receivables by age, helping you identify areas that require attention.

- Payment Follow-Ups:

Proactively follow up with customers to ensure timely payments and resolve payment-related issues.

- Credit Memo Processing:

Handle credit memos efficiently, whether for returns, discounts, or other adjustments.

- Customer Reconciliations:

Reconcile accounts with customers to resolve discrepancies and ensure accurate financial transactions.

- Credit Control Tools with Continuous Monitoring:

Implement credit control measures and continuously monitor creditworthiness to minimise risks.

- Dispute / Chargeback Management:

Manage and resolve disputes and chargebacks promptly to maintain a positive financial relationship with customers.

- CST C-Forms / GST Form Collection:

Handle the collection and processing of CST C-Forms and GST Forms for tax compliance.

- Bad Debts / Delinquency Management:

Develop strategies for managing bad debts and delinquent accounts to minimise financial losses.

- Recovery Suites Handling:

Utilise specialised recovery suites to recover outstanding debts effectively.

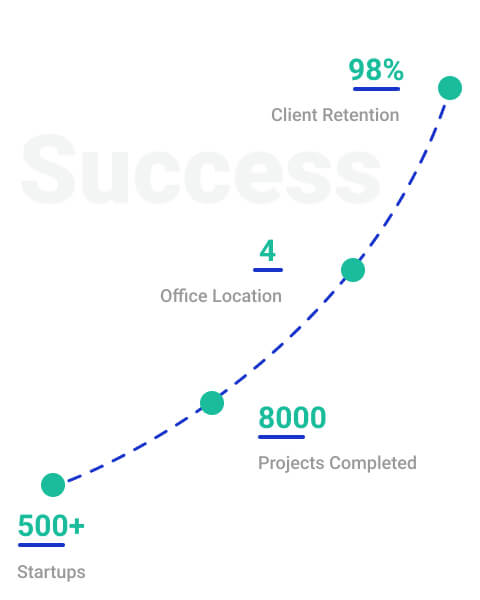

Why Choose StartupFino for Accounts Receivable Management?

StartupFino is a company that specialises in offering complete Accounts Receivable Management services. We're here to assist you every step of the way, right from offering guidance during the initial phase to making sure you fulfil all the essential requirements and comply with regulations for your account receivables.

StartupFino's comprehensive accounts receivables services ensure that your financial operations run smoothly, payments are received on time and financial risks are minimised, allowing you to focus on growing your business with confidence.