Telangana is known for the technology driven state and now welcoming new startups to make their place. Startupfino CAs help startups to navigate complex financial matters right from the outset. CA services for startups offers business incorporation, including guidance on choosing the appropriate legal entity structure and assisting with the registration process. CAs also provide assistance in preparing financial statements, managing tax obligations, and ensuring compliance with applicable laws and regulations. They help startups develop robust accounting systems, implement efficient bookkeeping practices, and maintain accurate records.

Additionally, Startupfino CAs can provide valuable advice on financial planning, budgeting, and cash flow management, enabling startups to make informed decisions and achieve their growth objectives. Overall, CA services in Telangana play an indispensable role in supporting startups by offering comprehensive financial guidance and ensuring compliance, ultimately contributing to their success and sustainability.

How CA services in Telangana help in Accounting and Bookkeeping?

CAs of the companies is most trusted persons as they help in every aspect of growing the business and hence they put their valuable assistance in maintaining accounting and bookkeeping by doing the following:

Setting up Accounting Systems

Startupfino CA can assist in setting up an effective accounting system for your startup. They can help you determine the appropriate chart of accounts, design the accounting structure, and choose suitable accounting software. This ensures that the financial transactions are properly recorded from the beginning.

Recording Financial Transactions

Starupfino CAs can also help in accurately recording all financial transactions including sales, purchases, expenses, and revenue. They ensure that the transactions are categorized correctly and adhere to accounting principles and standards.

Compliance with Accounting Standards

Startupfino CAs are well-versed in accounting standards and regulations. They can ensure that your startup's financial statements comply with the applicable accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Financial Statement Preparation

Startupfino CAs can prepare financial statements such as the income statement (profit & loss statement), balance sheet, and cash flow statement. These statements provide a snapshot of your startup's financial performance, position, and cash flow. They are essential for assessing the financial health of your business and making informed decisions.

Financial Analysis and Interpretation

Startupfino CAs analyses your financial statements and provides valuable insights into your startup's financial performance. They can help identify trends, assess profitability, evaluate liquidity, and provide recommendations for improvement.

Periodic Financial Reporting

Startupfino CAs can help you generate periodic financial reports, such as monthly, quarterly, or annual reports. These reports provide insights into your startup's financial performance and help you monitor key metrics and indicators.

Regulatory Compliance

Starupfino CAs is knowledgeable about various regulatory requirements related to financial reporting and taxation. They can ensure that your startup complies with applicable laws and regulations, reducing the risk of penalties or legal issues.

Internal Controls and Risk Management

Startupfino CAs can assist in establishing internal controls and processes to safeguard your startup's assets, prevent fraud, and ensure accurate financial reporting. They can identify potential risks and provide guidance on mitigating them.

CA services monitors Tax Compliances

Taxes are the most important compliances for any business. Therefore Startupfino CA monitors the tax compliances for startups to avoid penalties and fines in future by following ways:

Tax Registration

Startupfino CAs can guide through the process of obtaining tax registrations, such as Goods and Services Tax (GST) registration, employer identification number (EIN), and professional tax registration, depending on the jurisdiction and nature of the business.

Tax Planning

Startupfino CAs can develop tax planning strategies to minimize the tax liability while ensuring compliance with tax laws. They can identify available deductions, exemptions, and credits, helping to optimize the tax position.

Tax Return Filing

Startupfino CAs can prepare and file the tax returns, such as income tax returns and GST returns. They ensure accurate reporting of income, expenses, deductions, and tax credits, reducing the risk of errors and penalties.

Tax Compliance Reviews

Startupfino CAs can conduct periodic reviews of your startup's tax compliance to identify any potential issues or areas for improvement. They help ensure that you are meeting the tax obligations and keeping up with changes in tax laws.

Tax Audits and Assessments

If your startup is selected for a tax audit or assessment by tax authorities, a Startupfino CA can represent you and assist in responding to queries, providing necessary documentation, and ensuring compliance with audit procedures.

CA services monitors Legal Compliances

Legality in the business makes your business running and helps in business growth. Hence, Startupfino CA monitors the legal compliances for startups by helping in following areas:

Incorporation of Company

Startupfino CAs can assist in registering the startup as a legal entity and ensure compliance with company laws and regulations. They can help with the preparation and filing of documents required for company incorporation and maintain statutory registers and records.

Annual Compliance

Startupfino CAs can helps in meeting annual compliance requirements, such as filing annual returns, conducting annual general meetings, and maintaining company registers. They ensure that the startup complies with legal obligations, minimizing the risk of penalties or non-compliance issues.

Intellectual Property Protection

Startupfino CAs can provide guidance on protecting the startup's intellectual property, such as trademarks, copyrights, and patents. They can assist in the registration process and help in understanding the legal implications of intellectual property rights.

Contracts and Agreements

Startupfino CAs can review and advise on various contracts and agreements, including vendor contracts, client agreements, employment contracts, and lease agreements. They help ensure that the legal interests are protected and the contracts are in compliance with relevant laws and regulations.

What are Labour Law Compliances in Telangana?

Starupfino CAs can provide guidance related to labor law compliance for startup companies by performing the following compliances:

Payroll Compliance

Startupfino CAs can assist in ensuring proper payroll compliance with labor laws. They can help in accurately calculating the employee salaries, by keeping in view the minimum wage requirements, overtime pay, and statutory deductions. They can also guide in complying with tax regulations related to employee income tax withholding and social security contributions.

Benefits and Perquisites

Startupfino CAs can provide guidance on the employee benefits and perquisites that need to be offered in compliance with labor laws. They can help in understanding the applicable laws related to healthinsurance, provident fund contributions, gratuity, and other employee benefits. Starupfino CAs will assist in calculating and structuring these benefits to meet legal requirements.

Recordkeeping

Startupfino CAs can advise on the maintenance of employee-related records required for labor law compliance. This includes employee attendance records, leave registers, salary details, and other relevant documentation. They can help establish proper recordkeeping practices to ensure compliance with labor law requirements.

Audits and Assessments

Startupfino CAs can participate in internal audits or assessments to evaluate compliance with labor laws. They can review payroll records, employment contracts, and other relevant documents to identify any potential non-compliance issues. CAs can provide recommendations to rectify non-compliance and ensure adherence to labor law requirements.

Statutory Deductions and Contributions

Startupfino CAs can guide on statutory deductions and contributions related to labor laws, such as social security, employee provident fund, health insurance, and other mandated benefits. They can help you calculate and correctly withhold these amounts from employee salaries and ensure their proper remittance to the respective authorities.

CA manages Compliance Reporting

Startupfino CAs can assist in preparing reports and filings required for labor law compliance. This may include filing necessary forms or returns with labor authorities, such as employee provident fund returns, annual labor law compliance reports, and other mandated filings.

Compliance Documentation

Startupfino CAs can help in preparing and maintaining the necessary compliance documentation related to labor laws. This may include maintaining employee records, attendance registers, employment contracts, and other documents as required by local labor regulations.

Compliance Audits

Startupfino CAs can assist in conducting internal compliance audits to ensure adherence to labor laws. They can review the payroll processes, employment practices, and records to identify any potential areas of non-compliance and recommend corrective measures

How CA seeks for Fundraising Assistance in Telangana?

Startups typically require financial resources to fund their operations, product development, marketing efforts, hiring employees, and scaling their business. Therefore CAs helps the Startups in raising capital or funding to support the growth and development of a new business venture by following ways:

Valuation Services

Startupfino CAs can provide valuation services to determine the worth of the startup. They use various methods, such as discounted cash flow (DCF) analysis, market multiples, or comparable transactions, to estimate the value of the company. This valuation helps set a reasonable price and negotiate terms during fundraising rounds.

Financial Modelling and Projections

Startupfino CAs can assist in creating financial models and projections that showcase the financial potential of your startup. They can help prepare detailed financial forecasts, including revenue projections, expense budgets, and cash flow estimates. These projections are essential for investors to assess the financial viability and potential returns for the startup.

Fundraising Strategy

Startupfino CAs can assist in developing a fundraising strategy tailored to the startup's needs. They can help identify appropriate funding sources, whether it's through equity financing, debt financing, government grants, or other options. CAs can advise on the optimal capital structure and funding mix for your startup.

Investment Readiness

Startupfino CAs can help ensure the startup is ready for investment. They can review the financial statements, business plans, and investor presentations to ensure they are comprehensive, accurate, and appealing to potential investors. CAs can provide guidance on presenting financial information in a clear and transparent manner.

Due Diligence Support

Startupfino CAs support the due diligence process while engaging with the potential investors. They can help gather and organize financial documents, perform financial analysis, and address any financial-related queries from investors. CAs can ensure that the due diligence process goes smoothly and instills confidence in potential investors.

Tax Planning and Incentives

Startupfino CAs can provide advice on tax planning strategies related to fundraising. They can help structure investments in a tax-efficient manner and explore any available tax incentives or benefits that could be relevant to investors or for startups.

Investor Relations

Startupfino CAs can play a role in managing investor relations. They can assist in preparing financial updates, investor communications, and reporting on financial performance to stakeholders. CAs can help maintain transparency and establish trust with investors by providing accurate and timely financial information.

Compliance and Reporting

Startupfino CAs can help in navigating the financial reporting and compliance requirements associated with fundraising. They can assist in preparing financial statements and reports required by investors, ensuring they comply with relevant accounting standards and regulations. CAs can also help maintain proper financial records and assist with ongoing reporting obligations to investors.

How CA's Assist in Getting Business Grants & Loan?

Startups loans and grants are types of financial resources available to companies at the early-stage to support their business operations and ventures. Startupfino CAs can play a role in helping startup companies secure grants and loans. Some of the key points are mentioned as under:

Grant Research and Application

Startupfino CAs can help identify potential grant opportunities that align with the startup's industry, location, and business objectives. They can conduct research to identify government grants, industry-specific grants, or other funding programs that may be suitable for the startup. CAs can then assist in preparing grant applications, ensuring all required information and documentation are included.

Loan Documentation

Startupfino CAs can help in loan application in case startup requires loan in order to present the business in the most favorable to lenders. They can assist in preparing the necessary financial statements, cash flow projections, and other documentation required by lenders. CAs can ensure that the loan application aligns with the lender's requirements and addresses key aspects of the startup's financial health.

Financial Projections

Startupfino CAs can help prepare financial projections and reports that are often required as part of grant applications. They can assist in creating a comprehensive financial forecast that showcases the potential impact of the grant funding on your startup's financials. CAs can also prepare financial reports that demonstrate the startup's financial stability and credibility, increasing the chances of securing grants.

Financial Due Diligence

Starupfino CAs can conduct financial due diligence on behalf of lenders or grant providers. This involves reviewing the startup's financial records, assessing financial stability, analyzing cash flow, and identifying any potential risks or concerns. CAs can help ensure that the financial information is accurate, reliable, and transparent, increasing the chances of obtaining funding.

Financial Monitoring

Startupfino CAs can provide ongoing financial management support to startups that have received grants or loans. They can help with budgeting, expense tracking, and financial monitoring to ensure the funds are used as intended. CAs can help establish financial controls and provide financial advice to help maximize the impact of the funding received.

Compliance and Reporting

Starupfino CAs can assist in ensuring compliance with the associated financial reporting requirements. They can help prepare financial statements, reports, and other documentation needed to fulfill reporting obligations to grant providers or lenders. CAs can ensure that the startup meets all compliance requirements, helping maintain a positive relationship with funding entities.

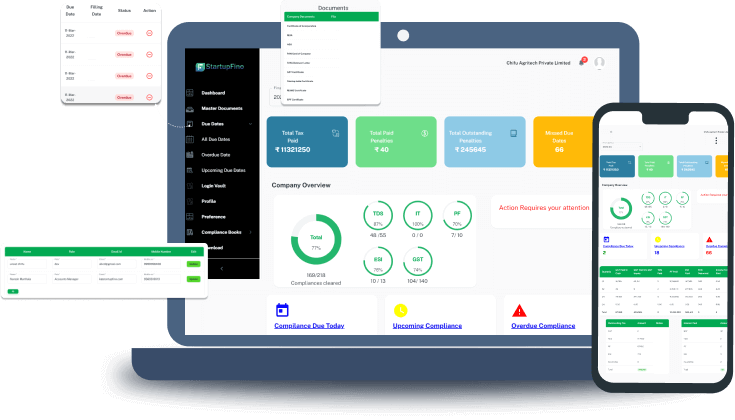

CA assistance upon MIS Reporting in Telangana

Startupfino CAs can provide assistance in MIS (Management Information System) reporting for startup companies by helping in following ways:

Understanding Business Objectives

Starupfino CAs can work closely with startup management to understand the specific objectives and information requirements for MIS reporting. They will identify the key performance indicators (KPIs) that are critical to monitoring the startup's performance and aligning them with the overall business strategy.

Report Design and Development

Starupfino CAs can design and develop MIS reports which present the data in a clear and meaningful manner. They create report templates or dashboards that provide insights into key business metrics, financial performance, sales analysis, operational efficiency, and other relevant areas. CAs ensure that the reports are user-friendly and tailored to the needs of different stakeholders, such as management, investors, or regulatory bodies.

Data Collection and Integration

Starupfino CAs can help establish processes for collecting, validating, and integrating data from various sources within the startup. They ensure that the data is accurate, complete, and relevant for generating MIS reports. This may involve working with different software systems, databases, and APIs to extract and consolidate the required data.

Data Analysis and Interpretation

Startupfino CAs possess analytical skills to analyze the data presented in MIS reports. They can perform trend analysis, variance analysis, and other analytical techniques to interpret the data and provide meaningful insights to management. CAs can identify patterns, anomalies, and opportunities for improvement based on the data analysis.

Continuous Improvement and Feedback

Startupfino CAs can review and refine MIS reporting processes over time. They provide feedback on the effectiveness and relevance of the reports, ensuring that they meet the evolving needs of the startup. CAs can suggest improvements in data collection, reporting tools, or data visualization techniques to enhance the quality and usefulness of MIS reports.

Compliance and Regulatory Reporting

Startupfino CAs ensure that the MIS reports comply with applicable accounting standards, regulatory requirements, and industry-specific guidelines. They can assist in preparing reports required by regulatory bodies, such as financial statements, tax filings, or industry-specific disclosures. CAs help ensure accuracy, consistency, and compliance in reporting to avoid legal and compliance issues.

Startups require Legal Entity Registration

As startups are newly incorporated companies so these require registering themselves and obtaining a separate legal entity. It is important that proper incorporation process must be follow to get the legal status, hence our CAs helps in following manner:

Company Incorporation

Startupfino CAs can guide startups through the process of company incorporation. They can help determine the appropriate legal structure for the business, such as a private limited company, partnership, or LLP (Limited Liability Partnership) etc. CAs assist in preparing and filing the necessary documents with the relevant authorities, such as the Registrar of Companies, to ensure proper incorporation.

Regulatory Filings and Documentation

Starupfino CAs can assist in preparing and filing various statutory documents and returns required by regulatory authorities. This may include filing annual financial statements, resolutions, and changes in directorship, share allotments, or any other mandated filings. CAs ensure that these filings are accurate, complete, and submitted within the specified timelines.

Corporate Governance

Starupfino CAs can advise startups on corporate governance practices and ensure compliance with corporate governance principles. They can help establish and maintain proper governance structures, including the appointment of directors, adherence to fiduciary duties, and implementation of internal controls. CAs can assist in drafting governance-related policies, such as a code of conduct.

Secretarial Services

Starupfino CAs can provide secretarial services for startups, assisting with tasks such as drafting board minutes, maintaining corporate records, preparing resolutions, and ensuring compliance with board meeting requirements. They can act as the company secretary or work in collaboration with a qualified company secretary to fulfill these responsibilities.

Compliance with Company Laws

Startupfino CAs can help startups navigate through various legal and regulatory requirements applicable to their legal entity. They can provide guidance on compliance with company laws, including maintaining statutory registers, filing annual returns, convening board meetings, and complying with other reporting obligations as per the Companies Act or relevant local legislation.

Legal Compliance Review

Starupfino CAs can conduct periodic reviews to assess the startup's compliance with legal and regulatory requirements. They can review corporate records, documentation, and processes to identify any areas of non-compliance or potential risks. CAs provide recommendations to rectify non-compliance issues and ensure adherence to legal obligations.

CA acts as Growth Strategy Partner

Startupfino CAs act as growth strategy partners for startup companies by providing valuable financial and strategic insights. They help in following manner:

Financial Planning and Forecasting

Startupfino CAs can help startups develop comprehensive financial plans and forecasts. They analyze historical financialdata, market trends, and business goals to create realistic projections. CAs assist in budgeting, cash flow management, and financial modeling, enabling startups to make informed decisions and plan for growth effectively.

International Expansion and Tax Planning

Starupfino CAs can provide guidance on tax planning and compliance in foreign jurisdictions and in considering international expansion. They help navigate tax regulations, identify tax incentives, and minimize tax liabilities associated with cross-border operations. CAs assists with transfer pricing, structuring international transactions, and addressing regulatory complexities.

Performance Measurement and Key Metrics

Startupfino CAs help identify and track key performance indicators (KPIs) relevant to the startup's growth objectives. They design and implement management reporting systems to measure and monitor business performance. CAs assist in analyzing financial and operational data to identify areas for improvement, capitalize on opportunities, and optimize growth strategies.

Financial Analysis and Decision Support

Startupfino CAs analyze financial statements, profitability ratios, and other financial indicators to provide insights for strategic decision-making. They assess the financial implications of growth initiatives, evaluate investment opportunities, and advise on resource allocation. CAs can help startups understand the financial risks and rewards associated with different growth strategies.

Fundraising and Capital Structure

Starupfino CAs can provide guidance on fundraising strategies and optimal capital structure for startups. They assist in determining the appropriate mix of equity financing, debt financing, and other funding options. CAs can help prepare financial documentation, pitch decks, and financial projections to attract potential investors and secure funding.

Merger and Acquisition Advisory

Starupfino CAs can provide guidance on M&A opportunities as part of a growth strategy. They assist in identifying potential acquisition targets or partnership opportunities, conducting financial due diligence, and evaluating the financial impact of M&A transactions. CAs can also help with valuation, negotiation, and post-merger integration.

Risk Management and Compliance

Startupfino CAs help identify and mitigate financial and operational risks associated with growth strategies. They ensure compliance with accounting standards, regulatory requirements, and governance frameworks. CAs can implement internal control systems, review processes, and help manage risk to safeguard the startup's assets and reputation.

Does CA Act as a Virtual CFO for startups?

Yes, Chartered Accountants can act as virtual CFOs (Chief Financial Officers) for startup companies. Virtual CFO services involve providing financial expertise and strategic guidance on a part-time or outsourced basis, typically for startups that may not have the resources to hire a full-time CFO. As virtual CFOs, CAs assume key financial responsibilities and provide valuable support to startup companies.

CAs can assist startups in developing a financial strategy aligned with their business goals. They analyze the company's financial position, market conditions, and growth objectives to create a roadmap for financial success. CAs help formulate financial plans, set targets, and create budgets to drive the startup's growth strategy. They establish financial management systems and reporting frameworks to provide timely and accurate financial information to management and stakeholders.

Financial modelling and analysis are key areas where CAs provides expertise. They assist in building financial models that help evaluate the financial impact of various business scenarios, investment decisions, and growth strategies. CAs perform financial analysis to assess profitability, ROI (Return on Investment), and other financial metrics, providing insights for strategic planning and decision-making.

Managing cash flow is critical for startups, and CAs can play a crucial role in optimizing cash flow. They help monitor and project cash flow, create cash flow forecasts, and implement strategies to improve working capital management. CAs can provide advice on cash flow optimization, cost reduction, and efficient cash utilization.

Risk management and compliance are important considerations for startups, and CAs can help identify and mitigate financial risks. They ensure compliance with accounting standards, regulatory requirements, and governance frameworks. CAs can implement internal controls, assess risks, and provide guidance on risk management strategies. They help startups navigate through financial and compliance challenges.

Fundraising is often a challenge for startups, and CAs can support in this area. They provide guidance on fundraising strategies, assist in attracting investors, and help prepare financial documentation, investor presentations, and pitch decks. CAs can also support negotiations, valuation exercises, and due diligence processes. They play a role in investor relations, providing financial updates, addressing investor queries, and managing financial aspects of investor relationships.

In addition to financial matters, CAs can offer strategic business advisory services. They provide insights on business growth, expansion plans, market analysis, and operational efficiency. CAs can assist in evaluating new opportunities, conducting feasibility studies, and formulating strategic initiatives.

As virtual CFOs, CAs act as trusted advisors to startup management, providing financial guidance and supporting sustainable growth. They bring financial expertise, strategic thinking, and a deep understanding of startup dynamics to help startups navigate financial challenges, make informed decisions, and achieve their growth objectives. CAs can assist in evaluating new opportunities, conducting feasibility studies, and formulating strategic initiatives.

How CA manages Payroll Services in Telangana?

CAs play a crucial role in providing payroll services for startup companies. Managing payroll is essential for any business, and CAs bring their financial expertise and knowledge of tax regulations to ensure accurate and compliant payroll processing. Their role in payroll services for startups can be summarized as follows:

Payroll Calculation and Processing

CAs assist startups in accurately calculating employee salaries, considering factors such as base pay, overtime, commissions, and bonuses. They ensure compliance with relevant labor laws, tax regulations, and social security contributions. CAs handle the entire payroll processing cycle, including data entry, deductions, reimbursements, and generating payslips.

Tax Withholding and Reporting

Startupfino CAs ensure that proper income tax deductions are made from employee salaries as per applicable tax laws. They stay updated on tax regulations, changes in tax rates, and thresholds. CAs prepares and files tax reports, such as TDS (Tax Deducted at Source) returns, ensuring compliance with tax withholding obligations. They also provide guidance on employee tax-related queries.

Employee Data Confidentiality

Starpfino CAs understands the importance of maintaining employee data confidentiality and ensuring compliance with data protection regulations. They establish secure processes for handling employee information, maintaining confidentiality, and implementing appropriate security measures to protect payroll data.

Employee Benefits Administration

Starupfino CAs can handle the administration of employee benefits programs such as health insurance, employee provident fund, and gratuity. They assist in the calculation and deduction ofemployee contributions and ensure proper remittance to the respective authorities. CAs help maintain accurate records and manage the documentation required for employee benefit programs.

Payroll Audit and Review

Startupfino CAs conducts periodic payroll audits to ensure accuracy, compliance, and identify any discrepancies or potential issues. They review payroll processes, employee records, and payroll-related documentation to identify areas for improvement and suggest corrective measures. CAs provide assurance that payroll operations are conducted in accordance with the regulations and best practices.

Statutory Compliance

Starupfino CAs help startups adhere to various statutory requirements related to payroll. They assist in compliance with labor laws, ensuring accurate calculation of leave entitlements, provident fund contributions, and other mandatory employee benefits. CAs helps with timely filing of statutory reports and contributions to government authorities, minimizing the risk of penalties or legal issues.

Startupfino Expert CAs Solutions

Startupfino CAs brings financial expertise, analytical skills, and a deep understanding of business dynamics. The team of professionals here strives to support the newly emerging businesses without any hassles. Hence, we do our best to monitor the CA services with utmost care and responsibility.

By helping the startups, we offer guidance on financial aspects, assist in decision-making, and provide insights to drive sustainable growth. It's important for startups to collaborate with CAs at Startupfino in Delhi who have experience working with startups and understand their unique challenges and growth opportunities.