The Central KYC registry in India is the centralised database where user KYC (Know Your Customer) records are maintained. It follows standardised KYC guidelines and facilitates the sharing of KYC records across various sectors. The primary aim of CKYC is to simplify the KYC process for customers, eliminating the need to repeatedly submit and verify KYC documents each time they establish a relationship with a financial institution.

CERSAI (The Central Registry of Securitisation and Asset Reconstruction and Security Interest) is responsible for managing the Central KYC norms in India. The adoption of Central KYC is rapidly increasing across the country. Individuals seeking central KYC can approach financial institutions regulated by authorities such as RBI, SEBI, etc. to complete the KYC process. Also, KYC can also be carried out through banks, insurance companies, mutual fund companies and stockbrokers.

Role of Central KYC Registry in India

The Central KYC Records Registry is an important entity in the financial sector of India, established to centralise and safeguard Know Your Customer (KYC) records in digital form. It operates under the ownership, control and authorisation of the Central Government, as officially notified in the official gazette. The primary functions of this registry include receiving, storing and retrieving KYC records of clients, contributing to the efficiency and security of the KYC process.

Access to the Central KYC Registry is limited to authorised institutions and entities designated under the Prevention of Money Laundering Act and other pertinent government regulations. These authorised institutions comprise regulatory bodies like SEBI, RBI, IRDAI, PFRDA.

Benefits of Central KYC Registry in India

The Central KYC Registry offers several significant benefits for both financial institutions and investors, simplifying the KYC process and enhancing the efficiency of financial transactions. Some of its key advantages include:

- Effortless Document Verification:

Central KYC registry in India simplifies the document verification process for financial companies, making it easier to validate the identity and credentials of investors.

- Elimination of Repeated KYC Submissions:

Investors are not required to submit KYC documents repeatedly when establishing new financial relationships with different companies. The CKYC database serves as a centralised repository of KYC information, saving time and reducing redundancy.

- Self-Service Updates:

Investors have the convenience of updating their personal details in the Central KYC registry in India as needed. This ensures that their KYC information remains accurate and up to date.

- Universal KYC Number:

The CKYC number can be used across various financial instruments and institutions, including purchasing insurance policies, investing in mutual funds and participating in stock markets. This simplifies the KYC process and facilitates seamless investment and financial transactions.

- Simplified Documentation:

The introduction of the CKYC registry has significantly simplified the documentation process, making it way quicker as well as more secure.

Salient Features of Central KYC Registry in India

The Central KYC Registry is an important system in India that offers several salient which are designed to ensure efficiency, security and uniformity in customer identity verification. The salient features of CKYC are:

1. Single KYC Process

The CKYC registry introduces a unified KYC process mandated by the Government of India. This centralisation ensures uniformity in accessing customer records and financial information. Instead of multiple, disjointed KYC processes, Central KYC registry in India establishes a single, standardised KYC procedure for all customers.

2. Comprehensive Due Diligence

Prior to engaging in any transaction or contract, comprehensive due diligence is conducted to verify the legitimacy of customer information. This due diligence process reduces the risk of fraudulent activities by ensuring that customer details are accurate and legitimate. Central KYC registry in India facilitates various forms of due diligence across different sectors, eliminating the need for redundant Customer Due Diligence checks.

3. Prevention of Fraudulent Activities

Central KYC registry in India plays an important role in preventing organised crimes such as money laundering and fraud. By registering with the CKYC registry, different types of entities, including companies and branch offices, can be officially identified and authenticated. This is especially valuable in identifying entities established in grey-listed jurisdictions, aligning with the Financial Action Task Force (FATF) requirements.

4. Reduction in Submission Hassles

One of the significant benefits of Central KYC registry in India is the reduction in document submission hassles. Customers need not repeatedly submit KYC documents to various institutions. Instead, their details are stored centrally in the CKYC repository. This simplifies the process for applicants, allowing them to engage with multiple financial entities without undergoing KYC registration each time, ultimately reducing the submission and documentation process.

5. Document Management and Updating

The Central KYC registry in India is highly integrated with various servers, enabling efficient document management, identification, search and updating services. It simplifies the process of handling customer documents, ensuring accuracy and security in document-related transactions.

6. Digital Electronic Modes

CKYC uses integrated systems for data synchronisation and digital implementation. All customer data is securely stored in electronic format, simplifying data processing and ensuring authentication. The digitally secure electronic format guarantees the safety of KYC data.

7. Advanced Search Capabilities

The CKYC registry offers advanced document search capabilities, allowing users to access documents from multiple entities. Even archived documents can be easily retrieved, enhancing information retrieval efficiency through the Central KYC registry use in the country.

8. Cost Reduction

By centralising the KYC process, Central KYC registry in India significantly reduces the overall cost of customer information verification. It saves time and resources for entities seeking customer information, eliminating the need for repetitive KYC checks that can be both time-consuming and costly.

9. Real-Time Notifications

CKYC ensures real-time notifications to all concerned institutions whenever there are changes in customer information. This feature keeps all entities updated through frequent notifications, facilitating timely updates and compliance with all the regulatory requirements.

So, the Central KYC Registry offers a comprehensive set of features that enhance the efficiency, security and cost-effectiveness of the KYC process, making it a significant component of India's financial sector.

Types of CKYC Accounts

The Central KYC Registry offers various types of accounts for different methods of identity verification and ease of use. These CKYC account types are as follows:

- Normal Account:

Normal accounts are established when individuals provide any of the following six official documents as proof of identity: PAN (Permanent Account Number), Aadhaar, Voter ID, Driving Licence, Passport or NREGA Job Card.

- Simplified Measures Account:

This type of CKYC account is created when individuals submit officially valid documents that are permitted as per the RBI circular RBI/2015-16/42. The KYC identifier for these accounts will be prefixed by 'L'.

- Small Account:

Small accounts are opened when individuals provide only personal details along with a photograph. The KYC identifier for these accounts will be prefixed with 'S'.

- OTP Based eKYC Account:

OTP (One-Time Password) Based eKYC accounts are established when individuals submit a photograph along with the Aadhaar PDF file downloaded from the UIDAI website, facilitated by an OTP. The KYC identifier for these accounts will be prefixed with 'O'.

These different types of CKYC accounts are for various methods of identity verification, allowing individuals to choose the option that best suits their preferences and convenience while adhering to regulatory guidelines.

Documents Required for Central KYC Registry for Financial Institutions

Given below are the necessary documents to be obtained for Central KYC registry for the financial institutions:

- Institution Registration Form (which is duly signed)

- Licence, Certificate, Notification from the Regulator

- PAN Card of the Financial Entity

- Corporate Identification Number (for those Institutions with Multiple Licences)

- Registration Certificate (for the Co-Operative Banks or Societies)

- Authorisation Letter for Admin Users (Must be signed by the Authorised Signatory/Director)

- Certified Copy of Photo Identity Card for User Administrator (Issued by the respective institution)

- Certified Copy of User Administrator's ID Proof

Note: Upon submission/upload of the required documents to the Central KYC servers, verification and registration are completed within two weeks. Once registered, an applicant investor can commence investing immediately. Central KYC simplifies document submission and provides an efficient experience for the investor.

Process for Financial Institutions to Register with Central KYC Registry

Given below is the process for Central KYC registry for the financial institutions:

- Access CKYC Form:

Financial institutions seeking registration with the Central KYC Registry should first obtain the Central KYC Registry Form. This form can typically be obtained from the respective Asset Management Company (AMC), Know Your Customer Registration Agency (KRA) website or registrar.

- Visit CKYC Official Website:

Visit the official website of the Central KYC Registry in India.

- Initiate FI Registration:

On the CKYC website, look for the option to register a new Financial Institution.

- Admin Details Entry:

Enter the details of the individuals responsible for managing the information on the website. These individuals will serve as administrators.

- FI Details Submission:

Provide comprehensive information about your financial institution, including its name and relevant particulars.

- Regulatory Body Information:

Specify the regulatory body under which your institution is registered.

- Digital Signatures Requirement:

Ensure that you possess at least two digital signatures, a mandatory requirement for commencing your operations within the CKYC system.

- Download and Submit FI Registration Form:

Download the filled FI registration form and gather all the required documents specified in the application.

- Temporary Reference Number:

Upon submission of the registration form and documents, the system will generate a temporary reference numberand send it to the designated nodal officer.

- Functionality Testing:

Test all the functionalities provided by the CKYC system in accordance with the prescribed checklist to ensure smooth operations.

- Application Verification by CERSAI:

The Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI) will proceed to verify your application. If all details are accurate and in order, your application will be approved.

- Notification of Discrepancies:

In case of discrepancies or missing information, CERSAI will notify you via email and may temporarily hold your application for rectification.

Following these steps diligently will enable financial institutions to successfully register with the Central KYC Registry, ensuring compliance with KYC regulations and facilitating secure customer data management.

Documents Required for Central KYC registry in India for Individuals

To complete the Central KYC registry in India for individuals, the following documents are needed:

- Proof of Identity (Any 1 of the following):

- Passport

- Voter ID card

- PAN card

- Driving Licence

- Other documents notified by the Central government

- Proof of Address (Any 1 of the following):

- Aadhaar Card

- Passport

- Voter ID card

- PAN card

- Driving Licence

Note: Submit copies supported by original documents for verification during submission.

- Additional Requirements:

Some additional requirements are:

- Self-attested copies of the documents mentioned above

- Signature on plain paper

- Web Camera with a smooth internet connection

- Contact details

- Details of the related person (e.g., Guardian of the Minor or Authorised representative)

Note:

If the identity proof does not contain the address or the address is not valid, address proof is required as an additional document. In case the applicant investor has multiple correspondence addresses, an Annexure is required to be submitted along with the Central KYC registry form.

- FATCA Declaration:

Investors must provide a declaration related to the Foreign Account Tax Compliance Act (FATCA) to prevent tax evasion.

- Unique KIN Generation:

Upon submission and verification of the provided information, a unique KYC Identification Number (KIN) is generated and communicated to the applicant via SMS/email.

Note: Both resident and non-resident individual investors are eligible to apply for Central KYC.

Procedure for Central KYC Registry Registration for Individuals

The process to register on CKYC involves the following steps for individuals:

- Visit CKYC Website

Go to the CKYC website.

- PAN Verification and KYC Check

Enter your PAN on the website for validation and to check if you are already KYC verified.

- Modification of KYC Details

If already KYC verified, you'll be prompted to modify your KYC details if needed. Proceed by clicking the continue button.

- Personal Information Entry

Provide your Name, Mobile Number, Email and Aadhaar (UID) Number.

- Communication Preference

Tick the checkbox to accept communication from the AMC and then click on submit.

- Additional Personal Details

Enter any further personal details required for Central KYC on the subsequent page.

- Attachment of Documents

Attach self-certified copies of your PAN card and Aadhaar card.

- Photo Upload

Capture and upload a photo using your device's camera.

- Signature Upload

Sign on a plain piece of paper and show it to the device camera for signature capture.

- In-Person Verification

Complete the in person verification through live video recording through your device's camera.

- Confirmation of Information

Finally, confirm that all the information that is submitted is true to the best of your knowledge.

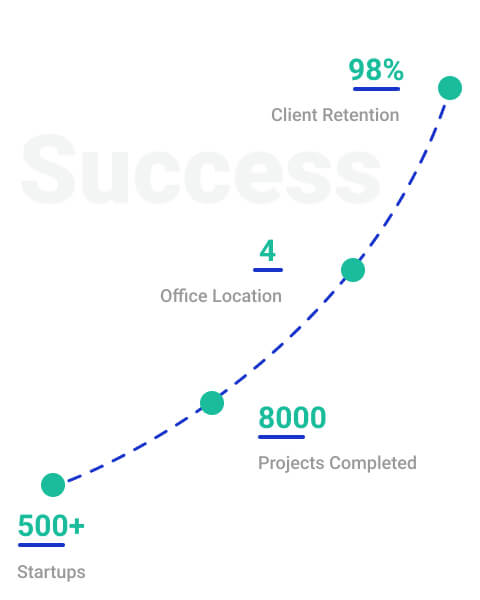

Why Choose StartupFino for Central KYC Registry in India?

The Central KYC registry in India serves a significant function by simplifying and expediting the KYC process for financial transactions in today’s fast world. This registry substantially enhances the experience for both investors and financial institutions, and it contributes to a safer and more efficient financial sector in the country.

StartupFino is a company that specialises in offering complete services for Central KYC Registry in India. We can help you with everything from providing advice in the initial phase to ensuring that you meet all the necessary requirements and compliances for Central KYC Registry in India.

Our Comprehensive services include:

- Comprehensive KYC Documentation Support

- Centralised KYC Registration.

- Due Diligence Compliance.

- Document Management Solutions.

- Digital Implementation.

- Cost-Efficiency.

- Real-Time Monitoring and Notifications.