In recent years, a new trend has come up in the world of retail i.e., Direct-to-Consumer (D2C) e-commerce services. These services have transformed the way businesses reach and engage with their customers, bypassing traditional retail channels and establishing direct connections with consumers. StartupFino aims to provide expert accounting solutions for D2C & e-commerce startups in India.

What are D2C & E-commerce Startups?

A Direct-to-Consumer (D2C) eCommerce startup is a business venture that enables manufacturers or producers to sell their products directly to consumers through online channels, avoiding traditional retail intermediaries. These platforms serve as the backbone of D2C businesses, providing the necessary tools and functionalities to create, manage, and optimise online stores.

Key Features of D2C & E-commerce Startups

Some of the key features of these D2C & e-commerce startups are mentioned below:

- User-friendly Interface: D2C e-commerce platforms are designed to provide a smooth shopping experience for consumers. Intuitive interface, clear product descriptions, and easy checkout processes are essential features of these platforms.

- Secure Payment Options: Ensuring the security of online transactions is vital for D2C e-commerce platforms. Implementing strong payment security measures, such as encryption and fraud detection systems, helps build trust with consumers and protects their financial information.

- Integrated Marketing Tools: D2C e-commerce platforms often include built-in marketing tools to help businesses promote their products and reach their target audience. Features such as email marketing, social media integration, and SEO optimisation are commonly offered.

- Order Management System: Efficient order management is essential for D2C e-commerce platforms to ensure timely delivery and customer satisfaction. Advanced order management systems help businesses track orders, manage inventory, and process returns efficiently.

- Analytics and Reporting: D2C e-commerce platforms provide businesses with valuable insights into their sales performance, customer behaviour, and marketing effectiveness. Advanced analytics tools enable companies to track key metrics and make data-driven decisions.

Accounting Services for D2C & E-commerce Startups

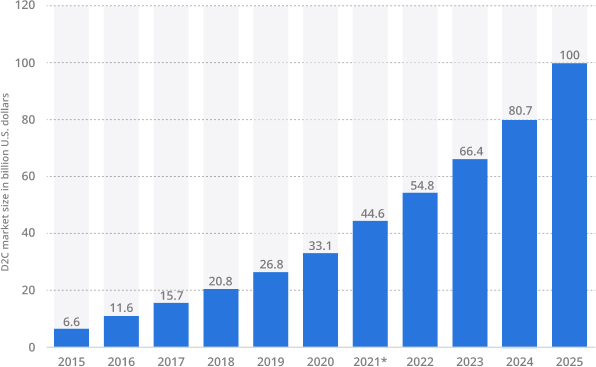

In the fast-growing digital commerce industry in our country and also globally, D2C and e-commerce startups are witnessing record growth. With the ease of online transactions and the global reach of the internet, entrepreneurs are finding exciting opportunities to bring their products directly to consumers' doorsteps. However, within that excitement of launching a new venture, one key aspect often overlooked is accounting.

Effective accounting services are the strength of any business, and for D2C and e-commerce startups, they play an even more critical role. From managing inventory to tracking sales, understanding cash flow, and staying compliant with tax regulations, sound accounting practices are essential for long-term success.

Types of Accounting Services in E-commerce

In D2C & e-commerce startups, many types of accounting services help in different aspects of financial management and compliance. The main types are:

- E-commerce Cost Accounting: Focuses on tracking production expenses, including labour and materials, to analyse costs and optimise profitability.

- E-commerce Financial Accounting: Involves recording and reporting financial transactions for stakeholders' decision-making and performance evaluation.

- E-commerce Management Accounting: Utilises financial data for internal decision-making, strategic planning, and performance evaluation.

- E-commerce Tax Accounting: Addresses specific tax obligations, ensuring compliance with tax laws and optimising tax strategies.

- E-commerce Forensic Accounting: Investigates financial fraud and embezzlement, ensuring integrity within the business and supporting legal proceedings.

Understanding the Importance of Accounting Services for D2C & E-commerce Startups

For D2C and e-commerce startups, effective accounting services are required for several reasons:

- Financial Visibility: Clear and accurate financial records provide startups with insights into their revenue, expenses, and overall financial health. This visibility enables informed decision-making and strategic planning.

- Compliance: D2C and e-commerce startups are subject to various tax regulations, including sales tax, income tax, and international tax laws. Professional accounting services ensure compliance with these regulations, minimising the risk of penalties and legal issues.

- Cash Flow Management: Managing cash flow is fundamental for startups to sustain operations and fuel growth. Accounting services help monitor cash inflows and outflows, identify cash flow patterns, and implement strategies to optimise liquidity.

- Inventory Management: Inventory management is a key challenge for e-commerce startups. Accounting services track inventory levels, monitor stock turnover rates, and optimise inventory purchasing to prevent stockouts and excess inventory costs.

- Business Growth: Accurate financial reporting and analysis provided by accounting services facilitate business growth. Startups can identify profitable product lines, assess market trends, and make data-driven decisions to expand their operations.

Accounting Challenges Faced by D2C & E-commerce Startups

Due to the busy nature of work in startups, many accounting challenges are faced by them. Some of these challenges are:

- Cybersecurity: Ensuring security and privacy of data are significant challenges for e-commerce businesses. With a large amount of sensitive information involved in online transactions, any security breach can have severe consequences, including loss of customer trust and legal liabilities.

- Customer Experience: Providing a uniform and personalised experience is essential for e-commerce businesses to retain customers and drive repeat purchases. However, maintaining consistency across various touchpoints, including website navigation, product recommendations, and customer support, can be challenging.

- Competitive Analysis with Rising Competition: In a saturated market, standing out from competitors is increasingly challenging for e-commerce businesses. Conducting thorough competitive analysis, identifying unique selling propositions, and differentiating the brand are necessary for success.

- Product Return and Refund Policies: Dealing with product returns and refund requests is an inevitable aspect of e-commerce business. Implementing clear and customer-friendly return and refund policies while minimising return rates can be challenging for startups.

- Choosing the Right Technology: Selecting the right technology solutions, including e-commerce platforms, payment gateways, and analytics tools, is essential for the success of e-commerce businesses. However, dealing with the vast range of options and ensuring compatibility and scalability can be tough.

Process of E-commerce Accounting

Effective e-commerce accounting is essential for ensuring the financial health and success of online businesses. The process involves several important steps to accurately manage financial records and provide valuable insights for decision-making. These include:

- Understanding Client Requirements: The first step is to know the specific needs and expectations of the client. This includes understanding the business model, transaction volume, and inventory management requirements.

- Records Analysis: StartupFino’s accounting experts access and analyse the client's financial records, including sales transactions, expenses, and inventory movements. In this step, we try and identify any discrepancies or errors that need correction.

- Updating Account Books: Once discrepancies are identified, the account books are updated to ensure accuracy. Past mistakes or errors are rectified to maintain the integrity of the financial data.

- Maintaining Records: Ongoing maintenance of financial records ensures that they remain up-to-date. This includes recording transactions as they occur to provide real-time insights into the financial performance of the business.

- Delivery of Financial Statements: Finally, all necessary financial statements are delivered to the client. These statements are presented in a summarised format, accompanied by explanations of key performance indicators for improvement. This step provides valuable insights into the financial health of the business and supports informed decision-making.

How StartupFino's Accounting Solutions Can Help D2C & E-commerce Startups?

StartupFino offers accounting services designed to address the unique needs of D2C and e-commerce startups, providing comprehensive support across various aspects of payment reconciliation.

StartupFino’s accounting solutions for D2C & e-commerce include the following important services:

Accounting in e-commerce:

With expertise in e-commerce accounting, StartupFino helps startups to deal with the complexities of financial management in the digital marketplace. From reconciling sales revenue with bank deposits to managing refunds and chargebacks, our accounting services ensure accurate financial records and compliance with tax regulations.

Vendor Reconciliation:

StartupFino assists startups in reconciling vendor payments by simplifying communication with vendors, verifying invoices against purchase orders, and reconciling payments. By ensuring accuracy and transparency in vendor transactions, startups can effectively manage vendor relationships and financial oversight.

Portal Reconciliation:

StartupFino aids startups in reconciling transactions across platforms and marketplaces, facilitating consistency and accuracy in financial reporting. Through automated tools and integrations, we simplify portal reconciliation processes, enabling startups to efficiently manage sales data from different sources.

Payment Reconciliation:

StartupFino supports startups in reconciling payment gateway transactions with bank statements and sales data, ensuring reconciliation accuracy and fraud detection. By reconciling payment gateway settlements, transaction fees, and chargebacks, we enhance financial transparency and risk mitigation for startups.

With a focus on automation, integration, and continuous improvement, StartupFino empowers D2C and e-commerce startups to update payment reconciliation processes, optimise financial management, and drive sustainable growth.

Our dedicated team of accounting professionals uses the best of industry expertise and leading technologies to provide startups with the financial insights and support they need to succeed in the competitive digital marketplace.

Why Choose StartupFino for Accounting of D2C & E-commerce Startups?

Accounting services are essential for the success of D2C and e-commerce startups, helping them deal with financial challenges, ensure compliance, and achieve long-term growth. By understanding the importance of accounting, addressing common challenges, and implementing effective accounting processes, startups can establish a strong financial foundation and grow in the competitive e-commerce sector.