Dubai is an important financial centre in the Middle East, which is a major attraction for foreign investors with a diverse range of business opportunities. The city has strategically expanded its horizons, promoting an environment that perpetuates trade and business development. Notably, Dubai has successfully shifted gears in its economic sector, with oil production now constituting less than 1% of its overall economy, thus making it ideal for Company Incorporation in Dubai.

In a commendable stride toward diversification and sustainable growth, Dubai has been on a licencing spree. The first half of 2022 witnessed a substantial uptick, with 45,653 new business licences issued—an impressive 25% surge compared to the previous year's 36,647. The driving force behind this growth lies in the city's business-friendly policies, well-crafted programs, favourable tax regimes and strong infrastructure.

In light of these favourable conditions, it's evident that Dubai stands out as a prime destination to start a business venture. Company Incorporation in Dubai holds considerable advantages, particularly for foreign investors looking to capitalise on a thriving business sector.

Benefits of Company Incorporation in Dubai

The benefits of Company Incorporation in Dubai include:

1. Business-Friendly Regulatory Environment

Dubai boasts a business-friendly regulatory environment, marked by the rapid adoption of technology for streamlined company registration. The process is efficient, requiring minimal paperwork and completion within a few days. The straightforward steps for company incorporation in Dubai contribute to a hassle-free experience for entrepreneurs.

2. 100% Foreign Ownership

Recent amendments to the Commercial Companies Law of UAE in 2021 have opened doors for foreign investors, allowing them to enjoy 100% ownership of their businesses in the UAE. This significant change includes over half of Dubai's economic activities, granting foreign investors the freedom to hold complete ownership.

3. Availability of More Than 30 Free Zones

Entrepreneurs and investors in Dubai have the option to establish their companies in both the mainland area and various Free Zones. With over 30 Free Zones to choose from, investors can benefit from 100% ownership, repatriation of profits and collaboration opportunities within the same industry.

4. Tax Benefits Offered by the Government

A noteworthy advantage of company registration in Dubai is the absence of corporate or personal taxes. Dubai's business landscape is characterised by a tax-friendly environment, with only a few companies subject to a modest 5% GCC VAT on specific business activities in the city of Dubai.

5. Strategic and Advantageous Geographic Location

Dubai's strategic location at the crossroads connecting north, south, east and west positions it as one of the world's premier re-export hubs and suitable for company incorporation in Dubai. With highly active airports and seaports, along with efficient logistics infrastructure, Dubai stands out as a key global trade and tourism hub in the world.

6. Developed Infrastructure

Ranked among the most developed cities in Central Asia, Dubai offers world-class infrastructure that continually evolves. The city features top-notch public transportation, telecommunication networks, terminals and more. The hosting of Dubai Expo further accelerated advancements in Dubai's overall infrastructure, solidifying its status as a global business and tourism destination.

Regulatory Authority/Body for Company Incorporation in Dubai

In Dubai, the primary regulatory authority overseeing company formation is the Registrar of Companies. This authoritative body serves as the focal point for processing new applications for Company Incorporation in Dubai. The Registrar of Companies is responsible for receiving and managing the necessary documentation related to company formations, ensuring compliance with regulations and overseeing the registration process.

Key Functions of the Registrar of Companies in Company Incorporation in Dubai

The key functions of the Registrar of Companies in Company Incorporation in Dubai include the following:

- Receiving New Applications:

The Registrar of Companies is the designated entity for receiving applications from businesses seeking registration in Dubai.

- Processing Company Registrations:

All aspects of company registrations, from the submission of necessary documents to the approval of applications, fall under the jurisdiction of the Registrar of Companies.

- Compliance Oversight:

Companies registered in Dubai are required to adhere to various regulatory and compliance standards. The Registrar of Companies plays an important role in overseeing and enforcing these compliance measures.

- Maintaining Records:

The regulatory authority is responsible for maintaining accurate and up-to-date records of registered companies, ensuring transparency and accessibility of information.

- Facilitating Documentation:

The Registrar of Companies serves as a facilitator for companies submitting necessary documents for registration, making the process efficient and transparent.

Companies in Dubai interact with the Registrar of Companies throughout their lifecycle, from the initial application for registration to ongoing compliance and reporting requirements. This central regulatory authority plays a vital role in ensuring the integrity and legality of the business environment in Dubai.

Eligible Business Structures under Company Incorporation in Dubai

The list of available business structures under Company Incorporation in Dubai include:

Limited Liability Company:

A Limited Liability Company in Dubai offers shareholders limited liability, requiring sponsorship from a UAE national or a wholly owned UAE-owned company. While there is no minimum limit on capital, the generally accepted practice suggests AED 100,000. Income tax is not applicable unless the company engages in high economic activities. Physical office space is a requirement for registration and a minimum of one director/manager is necessary. Repatriation of funds is unconstrained, but the company must maintain a legal reserve of 10% of the LLC's net profits.

Branch Office:

A branch office in Dubai serves as an extension of the parent company, not constituting a separate legal entity. It can be set up both on the mainland and in most Free Zones across Dubai. This is also one of the significant options for company incorporation in Dubai as it is readily available across the free zones of UAE.

Joint Stock Company:

Joint Stock Companies in Dubai have capital divided into negotiable shares and a partner is liable only to the extent of their contribution to the company's share capital. There are two types: Private JSC and Public JSC. Private JSCs require a minimum share capital of AED 2,000,000 and a minimum of three founders. Public JSCs need a minimum share capital of AED 10,000,000 and a minimum of ten founders. A JSC should have a minimum of 2-15 directors, with the majority, including the chairman, being UAE nationals.

Free Zone Companies:

Free Zone Companies in Dubai operate under special laws distinct from mainland regulations.

There are two types: Free Zone Company/LLC (up to 5 shareholders) and Free Zone Establishment (single shareholder with limited liability).

Dual Licence Branch Office:

A dual licence branch office extends from a free zone company into the mainland area. These offices hold an additional licence, reducing the cost and duration to incorporate a separate company. They are not registered with the UAE Ministry of Labour and staff holds free zone resident visas.

Trade Representative Office:

A trade representative office functions as an extension of its parent company, not forming a separate entity. It is allowed to perform limited functions, such as collecting information and acting as Dubai's marketing and administrative centre. To establish a representative trade office, a UAE national agent must be appointed or a wholly-owned company of UAE nationals. The office cannot purchase any UAE property under its name and a non-refundable deposit of AED 50,000 must be made for its setup, which cannot be used as working capital.

Documents for Company Incorporation in Dubai

The documents needed for Company Incorporation in Dubai include:

For Initial Approval:

- Application Form for Name Reservation and Initial Licence Approval:

Completed form for reserving the company name and obtaining initial licence approval.

- Business Plan:

A well-drafted business plan outlining the company's objectives and operations.

- Existing Registration Certificate/Trade Licence:

Copy of the current registration certificate/trade licence if the company already exists.

For Freelancers:

- Application Form for Registration:

Completed application form for freelancer registration.

- Curriculum Vitae:

CV of the freelancer.

For Registration of the Company:

- Application Form for Company Registration:

Completed application form for company registration.

- Share Capital Information:

Details regarding the share capital.

For Licensing and Visa Processes:

- Lease Agreements:

Prepared lease agreements for the company.

- Trade Licence:

Issued trade licence.

Procedure for Company Incorporation in Dubai

The detailed process for Company Incorporation in Dubai includes the given steps:

1. Decision on Business Structure

Every applicant must carefully consider and decide on the appropriate business structure for company registration in Dubai. The available structures include Limited Liability Company, Branch Office, Joint Stock Company, Free Zone Company or Trade Representative Office. The choice depends on factors such as the number of shareholders, commercial activities and capital requirements.

2. Name Selection and Reservation

The next important step is choosing and reserving a name for the company. The applicant needs to ensure that the selected name aligns with legal requirements and is available for use. This involves confirming name availability with the Department of Economic Affairs of the UAE or the relevant Free Zone Authority. Several considerations must be taken into account when choosing a name:

- The name should not violate public morale or disturb public peace.

- It must adhere to the legal form of the company.

- The chosen name should not have been previously registered by another entity.

- It should be in line with the business activities of the company.

- The name must not include references to religion, governing authorities or external bodies.

- It should avoid being controversial, derogatory or insulting.

- If using the names of entrepreneurs as the trade name, it should reflect their full names rather than nicknames.

By carefully following these guidelines, the applicant ensures that the chosen name complies with the law and stands out uniquely in the business landscape. This approach helps in preventing conflicts and legal issues related to the company's identity and branding.

3. Applying for a Business Licence

After successfully choosing and reserving the company name with the relevant authority, the applicant proceeds to apply for a business licence that aligns with the intended business activities in Dubai. The business licence serves as the legal document permitting the company to engage in specific activities mentioned in the licence. Various types of licences are available:

- Commercial Licence: Essential for enterprises involved in trading activities.

- Industrial Licence: Required for businesses engaged in production and industrial operations.

- Professional Licence: Mandatory for professionals providing services, technicians and artisans.

4. Choosing the Jurisdiction/Location

The decision regarding the company's jurisdiction or location within Dubai is a critical aspect that can significantly impact the business. Entrepreneurs must carefully select the office space location, considering factors such as the nature of the chosen business activity, the number of employees and the allocated budget.

Entrepreneurs have the flexibility to either purchase office space or lease land. The choice of office space depends on the specific business requirements and financial considerations. Different free zones in Dubai offer varying office sizes, ranging from 20-30 sq. m. to 2000 sq.m. and beyond. This decision requires careful consideration, as the location can influence operational efficiency, accessibility and business visibility.

5. Compliance with Jurisdiction Laws

Operating within any jurisdiction entails a commitment to comply with the specific laws and regulations governing that region. To deal with these regulatory requirements, companies must initiate the process by seeking pre-approvals, completing business registration formalities and securing the requisite business licence from the relevant authorities. The documentation requirements for these procedures hinge on factors such as the nature of the business activities, the company's geographical location and its unique business structure. In essence, aligning with the legal framework ensures a smooth and lawful operation within the given jurisdiction.

6. Application Process for Approvals and Licences

Upon determining the required approvals, businesses submit the necessary documents to the concerned authorities. This process involves careful coordination and adherence to the regulatory framework governing the chosen business structure and activities. The authorities review the application, ensuring that it complies with legal standards before granting pre-approvals, business registration and the requisite business licence.

7. Establishing a Corporate Bank Account

Following the successful acquisition of registrations and approvals from authorities, the company proceeds to open a corporate bank account in its name. This account serves as an important financial hub for the company, facilitating the receipt and transmission of funds for business operations. The corporate bank account allows the company to manage its financial affairs efficiently and conduct transactions in line with its business objectives.

Most Progressive and Advanced Free Zones in the U.A.E

The most advanced free zones for Company Incorporation in Dubai include:

- Abu Dhabi Free Zone:

- Abu Dhabi Global Market Free Zone

- Khalifa Industrial Zone (KIZAD)

- Masdar City Free Zone

- Abu Dhabi Airport Free Zone (ADAFZ)

- Dubai Free Zone:

- Dubai Airport Free Zone

- Dubai Design District

- Dubai Humanitarian City

- Dubai Metal and Commodities Centre

- Dubai Investment Park (only through JAFZA)

- Dubai Silicon Oasis

- Jebel Ali Free Zone

- Dubai Internet City

- Dubai Media City

- Dubai Healthcare City

- Dubai World Central

- Dubai Studio City

- Ajman Free Zone:

- Ajman Media City Free Zone

- Ajman Free Zone

- Fujairah Free Zone:

- Fujairah Creative City Freezone

- Fujairah Free Zone

- Ras Al Khaimah Free Zone:

- Ras Al Khaimah Economic Zone (RAKEZ)

- Sharjah Free Zone:

- Hamriya Free Zone Authority

- Sharjah Media City Free Zone

- Sharjah International Free Zone

- Sharjah Research, Technology and Innovation Park

- Umm Al Quwain Free Zone:

- Umm Al Quwain Free Zone (UAQ)

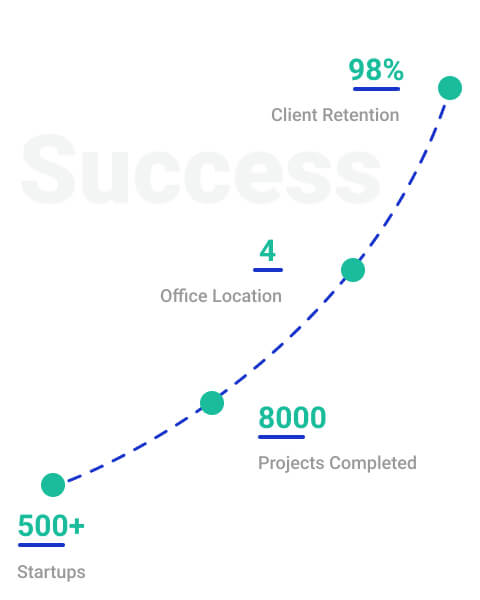

Why Choose StartupFino for Company Incorporation in Dubai?

StartupFino is a company that specialises in offering complete services on Company Incorporation in Dubai. We are dedicated to supporting you throughout the entire journey, from providing guidance in the early stages to ensuring you meet all the necessary requirements and adhere to regulations once your incorporation is finalised.

The free zones available in the UAE and Dubai offer diverse advantages for company incorporation in Dubai such as strategic locations, flexible legal frameworks, tax incentives, world-class infrastructure and excellent logistics facilities. Investors and entrepreneurs can benefit from these progressive and advanced free zones to establish and expand their businesses in the U.A.E. Each free zone has unique features and incentives, catering to various industries and business requirements.