The government of India made a plan called ESI for Indian workers. ESI means Employee State Insurance, and it's run by an organisation called ESIC. ESIC is an autonomous body under the Ministry of Labour and Employment in India.

The ESI plan helps workers stay safe and supported. Employers and workers put some money from the worker's paycheck into ESI each month. This helps workers get lots of different benefits, like medical help and financial help, if they're part of the ESI plan.

Establishments Under the ESI Act

The ESI Act says an establishment can be any organised place where people work, like shops or stores. If a place hires 10 workers or 20 in some states, and they earn up to Rs. 21,000 each month (or Rs. 25,000 if they have disabilities), they need to join the ESI scheme.

ESIC Registration Eligibility

Given below is the ESIC new registration eligibility criteria:

|

Eligibility Criteria

|

Description

|

|

Establishment Type

|

Any non-seasonal factory or establishment

|

|

Number of Employees

|

More than 10 employees (in some states it is 20 employees)

|

|

Maximum Basic Wages/Salary

|

Rs. 21,000 per month (Rs. 25,000 per month for persons with disability)

|

|

Registration Requirement

|

Mandatory registration with the ESIC within 15 days from the date of its applicability

|

|

Employer Contribution

|

3.25% of the total monthly wage payable to the employee

|

|

Employee Contribution

|

0.75% of the monthly wage

|

|

Employee Contribution Exemption

|

Employees with daily wages less than Rs. 176/per day are exempt from contributing

|

Entities Covered Under ESIC

The following entities are eligible to be covered under ESIC registration and ESIC compliances:

Cinemas and Movie Theatres

Cinemas and movie theatres are also included in the scope of ESIC compliances. These entertainment establishments need to comply with the prescribed employee threshold to qualify for ESI coverage.

Hotels and Restaurants

Hotels and restaurants offering services without any manufacturing functions can apply for ESI registration and ESIC compliances.

Newspaper Establishments

Newspaper establishments are covered under ESIC compliances. As with other entities, the employee count requirements apply.

Private Educational Institutions

Private educational institutions, such as schools and colleges, are considered eligible entities for ESIC compliances. However, it's important to verify the specific regulations governing such institutions in each state.

Roadside Motor Transport Establishments

Roadside motor transport establishments are included in the entities covered under ESIC compliances. These establishments also need to meet the specified employee count to be eligible for ESI benefits.

It should be noted that for hotels and restaurants, it is mandatory to only offer services and not have any manufacturing functions. In some states, medical and educational institutes are not included in the ESI coverage and newspaper establishments are not covered under the Factory Act.

Given below are the the entities covered under ESIC:

|

Entities Covered Under ESIC

|

Covered under State Government

|

Covered under Central Government

|

Minimum Employees for Registration

|

|

Shops

|

Yes

|

Yes

|

10

|

|

Restaurants or hotels

|

Yes

|

Yes

|

10

|

|

Cinemas including preview theatres

|

Yes

|

Yes

|

10

|

|

Road motor transport establishments

|

Yes

|

Yes

|

10

|

|

Newspaper establishments

|

Yes (not covered under the Factory Act)

|

Yes

|

10

|

|

Private medical institutions

|

Yes

|

No

|

10

|

|

Private educational institutions

|

Yes

|

No

|

10

|

|

Casual employees of Municipal Corporation or Municipal Bodies

|

Yes

|

No

|

10

|

|

Insurance business

|

No

|

Yes

|

20

|

|

Non-Banking Financial Companies (NBFCs)

|

No

|

Yes

|

20

|

|

Port trust

|

No

|

Yes

|

20

|

|

Airport authorities

|

No

|

Yes

|

20

|

|

Warehousing

|

No

|

Yes

|

20

|

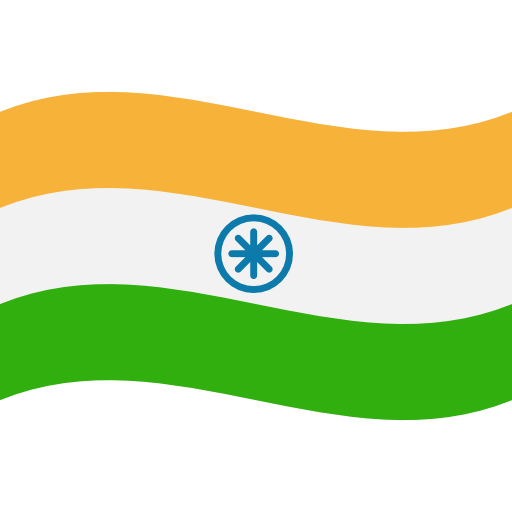

Advantages of ESIC Registration

ESI registration online brings these benefits:

- Sickness Benefits: Get 70% of your pay for up to 91 days if you're sick.

- Extended Sickness Benefits: If you have certain serious illnesses, you can get 80% of your pay for up to two years.

- Full Pay for Sterilisation: If you undergo sterilisation for family planning, like Vasectomy or Tubectomy, you can get your full pay for 7 or 14 days.

- Medical Benefits: You and your family get medical help.

- Retirement Medical Benefits: After retirement, you and your spouse can get medical benefits by paying Rs.120 annually.

- Maternity Benefit: If you're pregnant, you can get your full pay for 26 weeks, extendable by a month.

- Death Benefits: If you die because of work-related injury, your dependents get 90% of your pay monthly.

- Temporary Disablement Benefits: If you're hurt at work, you get 90% of your pay till you recover.

- Permanent Disablement Benefits: If you're permanently disabled due to work, you get 90% of your pay based on how much you can earn.

Funeral Expenses: Dependents or whoever does the last rites get Rs.15,000.

Purpose of ESIC Employee Registration Online

The primary goal of the Indian government's ESI programme is to protect the employee class from specific health-related hazards that might affect their capacity to work. Illness, workplace injury-related fatality, occupational disease and permanent or temporary impairment are examples of these dangers. The initiative helps workers reduce the financial load caused by such disastrous situations by providing financial aid.

The ESIC compliances protect workers by guaranteeing they obtain necessary medical care for themselves and their dependents.

ESI Contribution Rates 2024

The ESI contribution is set at 4% of the gross salary for FY 2023-2024 and is divided as follows:

- 3.25% contributed by the employer.

- 0.75% contributed by the employee.

Also, employees earning up to Rs. 137 per day on average are not eligible for contribution.

Documents Required for ESI Registration

Given below are the documents required for ESI registration online:

|

Document Required

|

Description

|

|

Registration Certificate

|

Obtained under either the Factories Act or Shops and Establishment Act.

|

|

Certificate of Incorporation

|

Certificate of Company Registration (for a company).

|

| |

Partnership deed (for a partnership firm).

|

|

GST Certificate

|

Certificate of Goods and Services Tax registration.

|

|

Memorandum of Association and Articles of Association

|

For a company.

|

|

Address Proof

|

Utility bills (Electricity, gas, or telephone bill of the establishment not exceeding three months).

|

| |

Rental agreement of the land.

|

| |

Property tax receipts of the land.

|

|

List of Employees

|

A comprehensive list of all employees working in the establishment.

|

|

PAN Card

|

PAN Card of the business establishment.

|

| |

PAN Card of all employees working in the establishment.

|

|

Compensation Details

|

Details of compensation for all employees.

|

|

Cancelled Cheque

|

Bank account proof for the company.

|

|

List of Directors

|

List of individuals holding director positions in the company.

|

|

List of Shareholders

|

List of individuals holding shares in the company.

|

|

Attendance Register

|

A register containing attendance records of the employees.

|

ESI Registration Procedure

The ESI registration procedure for employers includes these steps:

Step 1: Log in to ESIC portal

- Click on 'Employer Login'

- Sign up and fill details

Step 2: Confirmation Mail

- Receive confirmation mail with username and password

Step 3: Employer Registration Form-1

- Log in again, select 'New Employer Registration'

- Fill Form-1 with unit, employer, establishment, and employee details

Step 4: Payment for Registration

- Submit Form-1, pay initial contribution online

Step 5: Registration Letter

- Receive Registration Letter (C-11) via email with a 17-digit Registration Number.

Recent Amendments in ESI Rules and ESIC Registration

ESIC regulations in India have recently been changed. The new rules influence who is eligible for benefits, how much companies must pay and what benefits are offered. Employees earning up to Rs. 21,000 per month can now qualify for benefits and companies must pay more money. There have also been introduced some new perks, such as work-related disease insurance and money if you lose your job.

The ESIC has now changed the employee contribution @ 0.75% of wages and the employer contribution rate @ 3.25% of wages for year of 2023-2024.

What are the ESIC Compliances?

Given below in the table are the main ESIC compliances to be followed after ESIC registration online:

|

Compliances/Returns

|

Description

|

|

ESI Registration Status

|

Upon successful registration under the Employees' State Insurance Act of 1948, the company's ESI registration status becomes active.

|

|

Dormant Registration Option

|

Companies not immediately subject to the ESI Act can opt to make their registration number dormant within 6 months to avoid penalties for non-compliance.

|

|

Extension of Dormant Status

|

To prolong dormant status, companies must log in to the ESI website before 180 days elapse from the start of the dormant period.

|

|

Employee Attendance Register

|

Maintaining and submitting a record of employee attendance is mandatory as part of the ESI returns.

|

|

Form 6 Register

|

Form 6 register, containing details of the company's employees, must be prepared and submitted accordingly.

|

|

Wages Register

|

A register detailing employee wages and salary information must be filed along with the returns.

|

|

Accidents Register

|

An accidents register must be maintained to document any incidents or accidents occurring on the business premises.

|

|

Monthly Returns and Challans

|

Accurate preparation and filing of monthly returns and challans related to ESI contributions are essential ESI registration compliances.

|

Other Miscellaneous ESIC Compliances

Some other ESIC Compliances include:

|

Compliance

|

Description

|

|

Attendance Register

|

Maintain a record of employees' attendance.

|

|

Register of Wages

|

Maintain a complete record of wages paid to workers.

|

|

Inspection Book

|

Keep a record of inspections conducted on the premises.

|

|

Monthly Return and Challan

|

Submit monthly returns and challans by the 15th of the following month.

|

Why Choose StartupFino for ESIC Registration?

StartupFino is a company that specialises in offering complete services for ESIC registration and compliances. We can aid with everything from providing advice in the beginning phase to ensuring that you meet all the necessary requirements and also keeping your organisation in good legal standing.