Charitable trusts, societies and Section 8 Companies that receive donations or contributions from foreign sources are required to apply for FCRA Registration. FCRA or the Foreign Contribution Regulation Act, 2010, governs this process and ensures regulation of foreign contributions and activities to maintain a balance and protect national interests.

The objectives of the FCRA include:

- Balancing the acceptance and appropriate utilisation of foreign contributions or foreign hospitality by established individuals, associations or companies.

- Restricting the acceptance and utilisation of foreign hospitality or foreign contributions for activities adverse to national interest or related matters.

To adhere to the law, entities must obtain FCRA Registration before receiving any foreign contributions or grants. The registration certificate is issued by the government authority and is a mandatory prerequisite for any registered trust, social institution or NGO looking to acquire or accept foreign contributions.

Benefits of FCRA Registration

The benefits of Foreign Contribution Regulation Act registration can be understood by below mentioned factors:

- Legal Receipt of Foreign Contributions:

FCRA registration enables eligible organisations to legally receive foreign contributions and government aids. This is particularly beneficial for NGOs, charitable trusts and other entities engaged in social work and public welfare activities.

Foreign Contribution Regulation Act registration adds credibility to an organisation's operations, as it signifies compliance with stringent regulatory standards. Donors, both domestic and foreign, often prefer to contribute to registered entities, as it ensures transparency and accountability in the utilisation of funds.

- Continuity of Foreign Funding:

Registration under FCRA helps ensure the continuity of foreign funding, as non-registered entities may face challenges in receiving and utilising foreign contributions legally.

- Compliance and Accountability:

Foreign Contribution Regulation Act registration requires organisations to maintain proper financial records and submit regular reports to the government. This promotes transparency, accountability and responsible use of foreign funds.

FCRA-registered organisations are better positioned to establish partnerships and collaborations with international NGOs, institutions and governments, promoting the exchange of knowledge, resources and expertise.

Eligibility for FCRA Registration

The following are eligible for Foreign Contribution Regulation Act registration in India:

- Section 8 Companies: Section 8 companies registered under the Companies Act are eligible for FCRA registration. These companies are typically formed for promoting charitable or not-for-profit objectives.

- Trusts: Trusts registered under the Indian Trust Act can apply for Foreign Contribution Regulation Act registration. These trusts must have charitable objectives aligned with promoting the welfare of society.

- Societies: Societies registered under the Indian Society Registration Act are eligible for FCRA registration. These societies must have charitable purposes focused on the betterment of society.

- Compliance with FCRA Provisions: Entities seeking FCRA registration must ensure they are not barred in any manner under conditions of FCRA. Adherence to FCRA regulations is an essential prerequisite for both obtaining and upholding FCRA registration.

- Safety and Offense Prevention: Foreign contributions accepted by the organisation must not pose any risk to the life or safety of any individual and they should not result in any criminal offence.

- Charitable Objectives: The non-profit organisation seeking FCRA registration must have charitable objectives aimed at serving society. These objectives may include promoting health, education, economic development, art, culture, religion, sports and other activities that contribute to the welfare of the community.

Documents required for FCRA Registration

The documents required for FCRA registration include:

Self-attested Copy of Incorporation Certificate or Trust Deed: This document verifies the legal status and formation of the non-profit organisation. It can be an incorporation certificate, trust deed or any other relevant certificate held by the entity.

Particulars of Non-Profit Organisation and PAN: Details about the organisation, including its name, address, objectives and PAN are required for identification and verification.

Copy of Memorandum of Association and Articles of Association: These documents outline the objectives, rules and regulations of the organisation. Providing copies of the MOA and AOA helps establish the organisation's structure and purpose.

Impression of the Chief Functionary: A scanned or digital impression (photograph or signature) of the chief functionary or head of the NPO is often required in JPG format for authentication purposes.

Detailed Report on Activities of the Preceding 3 Years: This report should provide a comprehensive overview of the NPO's activities, projects and initiatives conducted in the three years preceding the FCRA registration application. It demonstrates the organisation's track record.

Audited Financial Statements: Certified copies of audited financial statements for the preceding three years, including the Profit and Loss (P&L) account, Income-Expenditure details and cash flow statement, are essential. These financial records offer insights into the organisation's financial stability and transparency.

Certified True Copies of Governing Body Resolutions: Copies of resolutions passed by the governing body of the NPO, authorising its application for FCRA registration, must be provided. These resolutions demonstrate the organisation's commitment to complying with FCRA regulations.

Certificate Obtained Under Section 12AB of Income Tax Act: This certificate signifies that the NPO is registered under Section 12AB of the Income Tax Act, which grants tax exemption to charitable organisations. It's an important document to demonstrate the organisation's eligibility for FCRA registration.

Criteria for Grant of FCRA Registration in India

The grant of FCRA (Foreign Contribution Regulation Act) Registration is subject to strict criteria and checks to ensure that the recipient entity or person meets the necessary requirements and adheres to legal and ethical standards. These criteria include:

Legitimate Identity: The applicant must be a genuine and legally recognised entity or person. Fictitious or benami entities are not eligible for FCRA registration.

Non-Engagement in Conversion Activities: The applicant should not have been prosecuted or convicted for engaging in activities aimed at converting individuals from one religious faith to another, either through inducement or force, directly or indirectly.

Absence of Communal Tension: The applicant should not have been prosecuted and convicted for communal tension/ disharmony in any district or other part of the country.

Proper Fund Utilisation: The applicant should not have been found guilty of diverting or misutilising funds received from foreign contributions.

Non-Advocacy of Sedition or Violence: The applicant should not engage or be likely to engage in propagating sedition or advocating violent methods to achieve its objectives.

Non-Utilisation for Personal Gains or Improper Ends: The applicant must not demonstrate intent to utilise foreign contributions for personal benefit or divert them towards inappropriate objectives.

Absence of Prohibition on Foreign Contribution Acceptance: The applicant must not face any prohibition preventing them from accepting foreign contributions.

For Individuals:

Absence of Criminal Convictions: For individual applicants, it is essential that they have not been convicted under any law during the application process and there should be no ongoing prosecutions for any offense against them.

For Organisations (Other Than Individuals):

Clean Record of Directors or Office Bearers: For organisational applicants, it is essential that none of its directors or office bearers have a record of convictions under any law during the application process and there should be no ongoing prosecutions for any offense against them.

Avoidance of Adverse Impact: Accepting foreign contributions should not have a detrimental effect on India's sovereignty, integrity, national security, strategic interests, scientific progress, economic well-being, public interest, electoral fairness, diplomatic relations with foreign states or harmony among diverse groups, communities or castes.

Prevention of Offenses and Physical Safety: The acceptance of foreign contribution should not lead to incitement of an offense or endanger the life or physical safety of any person.

Procedure for FCRA Registration in India

The online Foreign Contribution Regulation Act registration process involves the following steps:

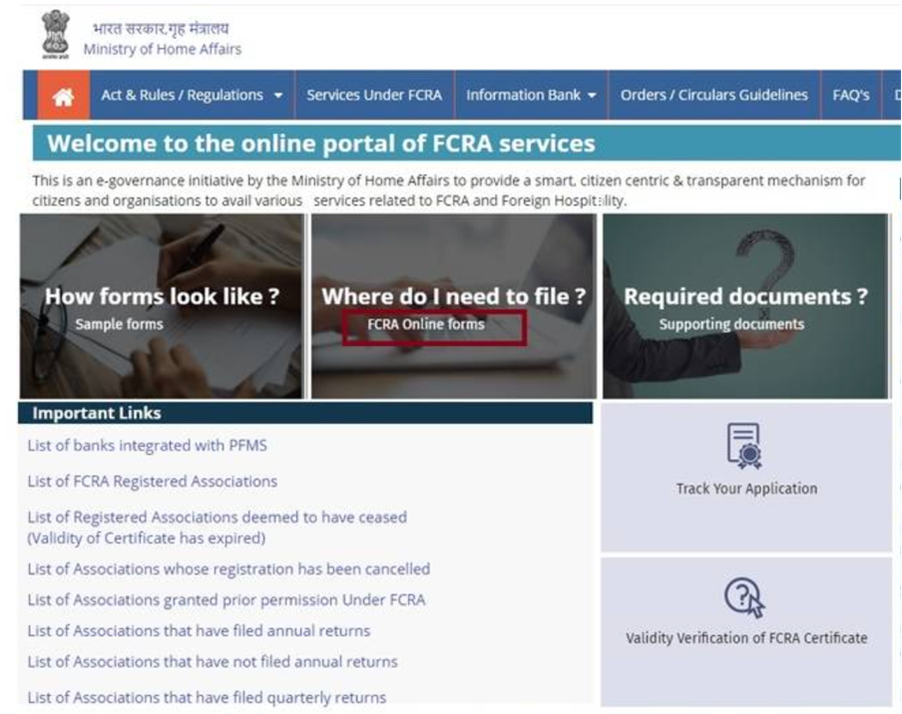

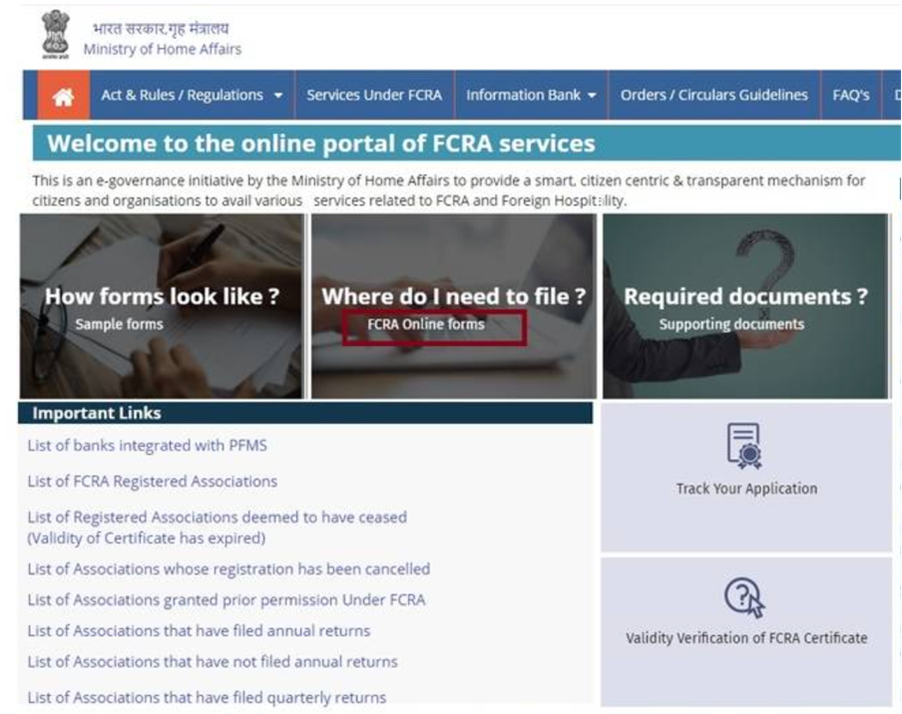

Step 1: Visit the FCRA online portal.

Step 2: Click on 'FCRA online forms' to access the FCRA registration forms.

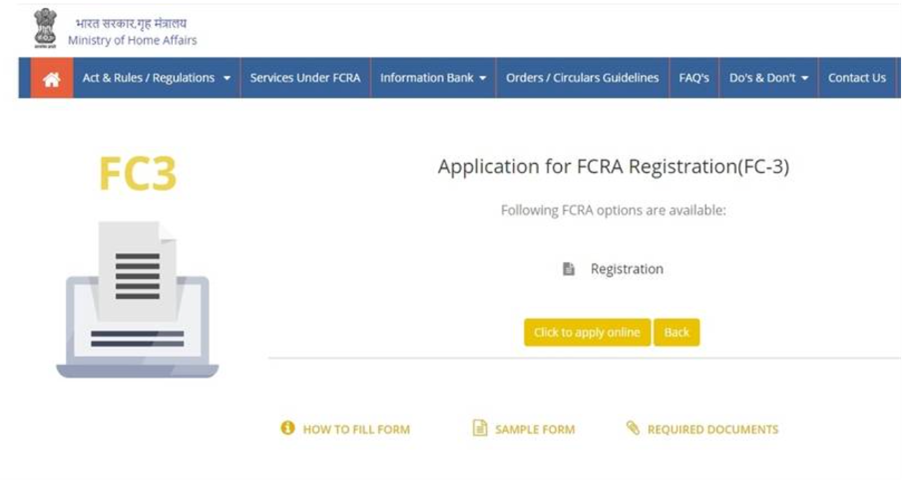

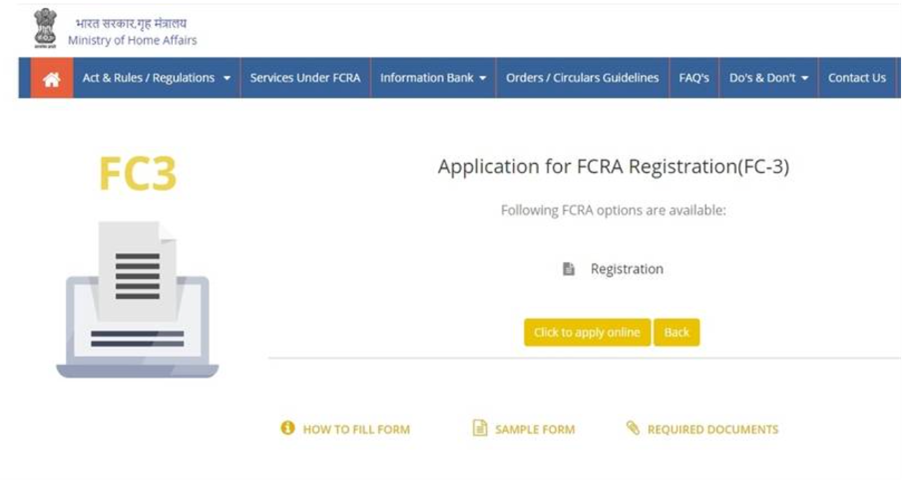

Step 3: Select the application for FCRA registration link, which will redirect you to the next page.

Step 4: Click on 'Click to apply online' to apply for FC3 (Registration).

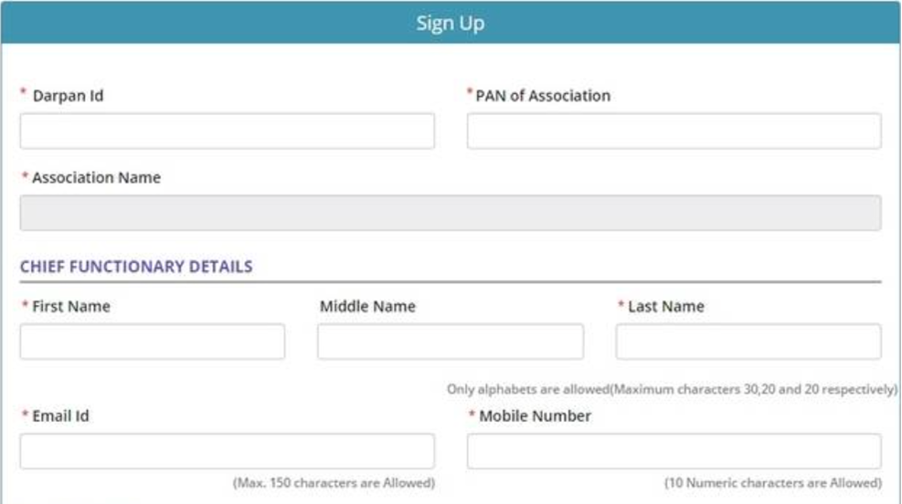

Sign up for FCRA Account:

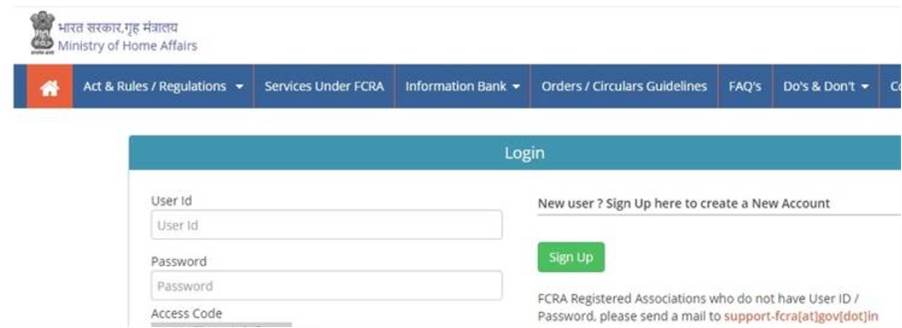

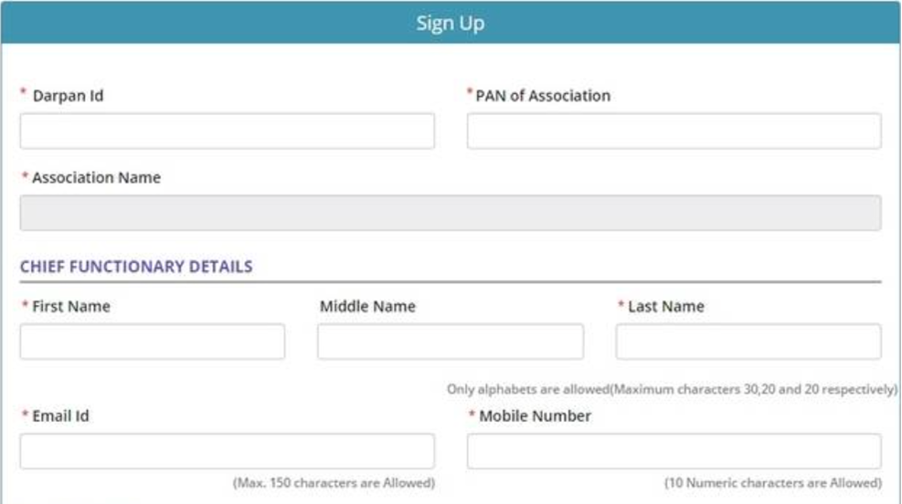

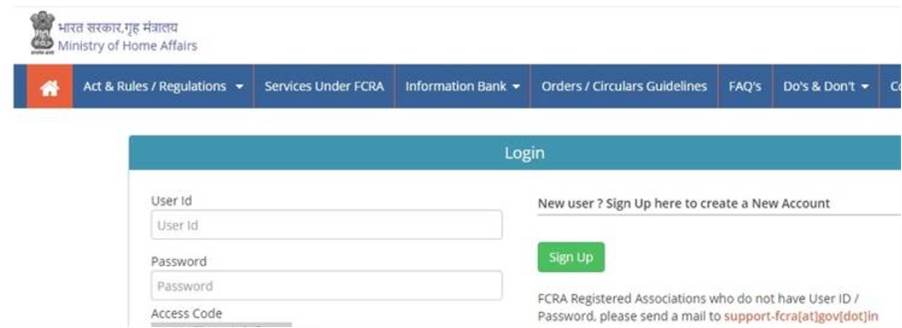

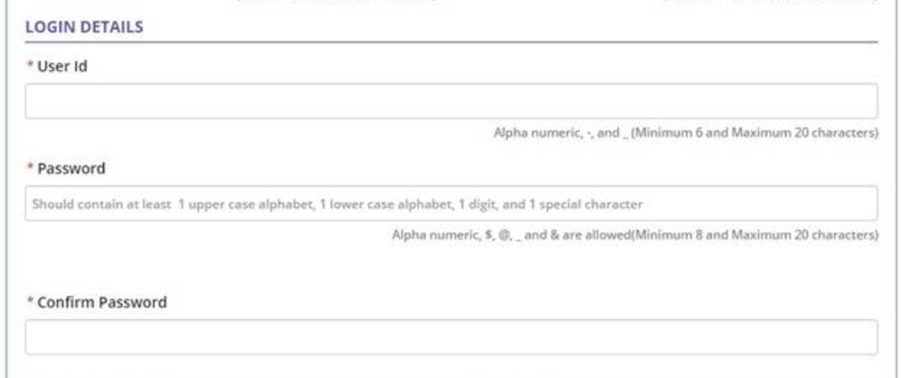

Step 5: Sign up for an FCRA account by selecting the sign-up option.

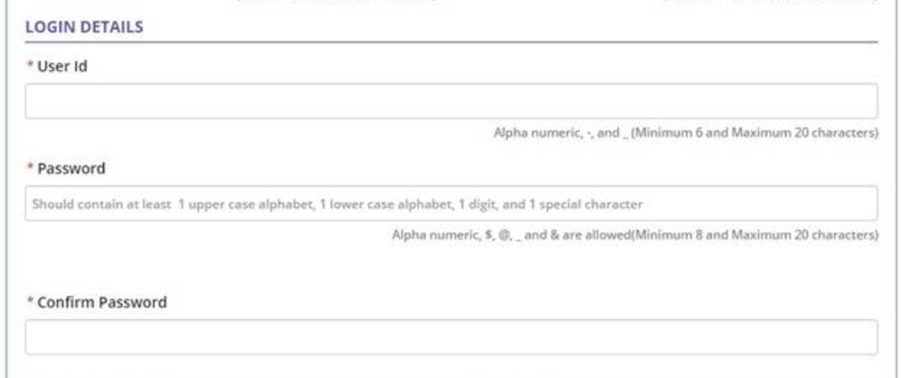

Step 6: Enter all of the mandatory details and click on save.

Step 7: A message will then be displayed on the screen indicating 'User ID successfully created and Your user ID is:'

Login to FCRA:

Step 8: Log on to the portal using the User ID and password that was just created.

Step 9: Select 'I am applying for' and choose Foreign Contribution Regulation Act registration from the menu. Click on 'Apply online.'

Step 10: To proceed with the registration, click on 'click here to Proceed New Registration.'

Step 11: Access the FC3 menu in the title bar for step-by-step registration.

Association Details:

Step 12: Select 'Association Details' from the menu. Enter all mandatory details, including Darpan ID, Address of Association, Registration no., Place of registration, Date of registration, Nature of association, as well as the main aim of the association.

Step 13: Click on submit button to save the data.

Executive Committee Form:

Step 14: Go to the Executive Committee Form by clicking on the Executive Committee option from the menu bar.

Step 16: Enter all details about the Executive Committee.

Step 17: Go and select 'Add details of Key Functionary,' and you can edit/delete/add Details of Information of the Executive Committee.

Step 18: For adding further foreigner details, select the checkbox of the record you want and click on 'Add/View button.'

Step 19: A new screen will be displayed, allowing you to add related foreigner details. You can edit/delete a record by clicking on the appropriate option.

EC Detail and Others:

Step 20: Fill in EC details and other information by selecting that option from the menu.

Step 21: Then click on 'save' after entering all mandatory details of the Executive Committee.

Bank Details:

Step 22: Provide your bank details, including Bank Name, IFSC code, Account Number and the Address of the bank, in this section.

Other Details Section:

Step 23: Click on 'Other Details' from the menu to provide all other relevant information.

Upload Documents:

Step 24: Upload all relevant documents in PDF format.

Final Submission:

Step 25: Click on the 'final submission' option from the menu bar. Declare the application form, enter the place and date and click on 'final submit.'

Step 26: After the final submission, a pop-up window will appear; click on 'OK.' Note that after the final submission, you can't modify application details.

Online Payment:

Step 27: Click on 'Make Online Payment' from the menu bar. The payment screen will be displayed.

Step 28: Click on 'Continue for Payment' in this screen. A pop-up screen will appear. Select the payment gateway and click on 'payment.'

Following these steps will guide you through the online Foreign Contribution Regulation Act registration process. It's important to ensure that you provide accurate information and upload the required documents during the process.

Renewal of the FCRA Registration

Renewing Foreign Contribution Regulation Act registration is important to ensure the continued validity of your registration, as it is granted for a period of five years,which you can initiate six months prior to the date of expiry. The steps to renew Foreign Contribution Regulation Act registration are:

Step 1: Select the option 'Application for Renewal of FCRA Registration' from FCRA Online Forms.

Step 2: Click on this option to proceed to the following page. Then, select 'Click to apply online.'

Step 3: Provide your User ID and password to access the FCRA portal.

Step 4: Opt for 'I am applying for' and choose 'FCRA renewal' from the drop-down menu. Follow the steps from 10 to 28 as detailed earlier for the process of renewing the registration.

Penalties for the Violation of FCRA

Violations of the FCRA can result in severe penalties to ensure compliance with the law. Some of the penalties for FCRA violations include:

- Seizure and Forfeiture of Foreign Contribution Receipts if in violation of FCRA provisions,

- Penalty of Up to Five Times the Value of Misused Foreign Contributions.

- Examination and Confiscation of Accounts and Records.

Types of Registrations as per FCRA 2010

Under the Foreign Contribution Regulation Act (FCRA) 2010 organisations and entities can obtain registration through two main routes:

To qualify for regular registration under FCRA 2010, the applicant needs to meet the subsequent conditions:

- Registered under the Societies Registration Act of 1860 or

- Registered under the Indian Trusts Act, 1882 or

- Incorporated as Section 8 Co. under the Companies Act, 2013 or any other Act as specified.

The applicant should possess a proven history of contributing by engaging in activities within their chosen domain for the betterment of society. Additionally, the organisation must have expended a minimum of Rs. 15 lakhs in the past three years towards fulfilling its objectives. Furthermore, submission of audited financial statements for the preceding three years, duly examined by qualified Chartered Accountants, is mandatory.

-

Pre-Approval Registration:

Pre-Approval Registration is intended for recently established institutions anticipating foreign contributions. In this category organisations must be registered under the Societies Registration Act, 1860, the Indian Trusts Act, 1882 or incorporated as a Section 8 Company under the Companies Act, 2013 or as stipulated by relevant Acts.

Organisations seeking Pre-Approval must furnish a specific commitment letter from the foreign donor to the Ministry of Home Affairs, indicating the contribution's amount and the intended purpose.

In cases where the Indian recipient organisation and the foreign donor organisation have common members, specific conditions must be met:

- The Chief Functionary of the said Indian entity can’t be part of the contributor entity.

- At least 51% of the office-bearers or members of the governing body of the Indian recipient shouldn’t be employees or the members of the foreign contributor entity.

If the foreign contributor is an individual:

- That individual can’t be Chief Functionary of the Indian organisation.

- At least 51% of the office bearers or the members of the governing body of the recipient entity should not be family members or close relatives of the donor.

Organisations and entities seeking Foreign Contribution Regulation Act registration should carefully consider these criteria and choose the appropriate registration route based on their eligibility and circumstances.

Suspension/ Cancellation of FCRA Registration

The cancellation or suspension of Foreign Contribution Regulation Act registration is a serious matter. Given below are some of the reasons that can lead to the cancellation or suspension of a registration:

- Non-Compliance with FCRA Provisions.

- Failure to Submit Annual Returns.

- Inquiry and Proven Allegations.

- Misuse of Contributions.

Changes Made by FCRA Amendment Rules 2020

The Foreign Contribution (Regulation) Amendment Rules, 2020, introduced several key changes to the existing Foreign Contribution (Regulation) Rules, 2011. Given below are some of the revised conditions and amendments brought about by the FCRA Amendment Rules in 2020:

-

Three-Year Existence Requirement:

One of the significant changes is the requirement that an institution seeking Foreign Contribution Regulation Act registration should have been in existence for at least three years. This condition ensures that newly formed organisations are not eligible for registration until they have a track record of three years.

-

Minimum Spending on Core Activities:

To be eligible for Foreign Contribution Regulation Act registration, an institution must demonstrate its commitment to social welfare by spending a minimum of Rs. 15 lakhs on its core activities and that too for the benefit of society in last three financial years. This financial commitment serves as evidence of the organisation's dedication to its mission.

-

Criteria for Prior Permission:

The FCRA Amendment Rules specify criteria for individuals or entities seeking prior permission for receiving a specific amount from specific donor for carrying out specific activities or projects. These criteria help ensure transparency and accountability in the utilisation of foreign contributions.

-

Validity of Registration Certificates:

In cases where an application for the renewal of registration is either not submitted or lacks the necessary fee before the expiration of the registration certificate's validity, the certificate will be deemed to have lapsed from the completion date of the initial five-yearperiod since its issuance. Any foreign contributions that remain unused in the FCRA account will be transferred to the designated authority in such instances.

The Ministry of Home Affairs extended the validity of Foreign Contribution Regulation Act registration certificates that were set to expire between September 29, 2020 and May 31, 2021, up to May 31, 2021. This extension aligns with the provisions of the Act, 2010, which stipulates a standard five-year validity for registration certificates.

-

Mandatory FCRA Registration:

The registration is compulsory for organisations receiving funding from foreign sources. Strict penalties, including cancellation of registration, can be imposed on NGOs found guilty of violating FCRA norms.

These amendments and revised conditions aim to enhance transparency, accountability and the efficient utilisation of foreign contributions by registered organisations under the Foreign Contribution (Regulation) Act, 2010.

Why Choose StartupFino for FCRA Registration?

Foreign Contribution Regulation Act registration offers many advantages to organisations engaged in social and charitable work by facilitating legal receipt of foreign contributions, expanding funding sources, enhancing credibility and enabling collaboration with international donors and partners.

StartupFino is a company that specialises in offering complete FCRA registration services. We can help you with everything from providing advice in the initial phase to ensuring that you meet all the necessary requirements and compliances post FCRA registration.