Start-ups in India greatly benefit from financial consultancy services, which play a significantly important role in helping them through the ever-changing and complex financial environment. These services bring valuable expertise and guidance that contribute to the growth and success of businesses.

A wide range of benefits is offered by these services, including expert advice on important aspects like financial planning, preparation and analysis of essential financial statements like the profit and loss statement, balance sheet and cash flow statement. Our consultants at StartupFino provide valuable expertise and guidance, enabling businesses to make well-informed financial decisions, develop strong financial plans and enhance their capital structure and funding options.

What is a Profit & Loss Statement for Startups?

Within a specified period, be it a quarter or a year, a profit & loss statement offers a concise summary of a business's costs, revenues and also its expenses. Every indirect expense and income, including the gross profit or loss, is covered in this statement, ultimately showing the net profit or loss.

Its significance lies in its ability to effectively showcase a company's financial performance during the designated time frame. It empowers decision-makers with the necessary insights to make informed choices and continuously monitor operations of the startup.

Why is the Significance of the Profit & Loss Statement for Startups?

Companies utilise the Profit & Loss Statement, along with other tools for the following reasons:

- Assessing business profits and losses: The statement calculates and presents the profits or losses incurred by a business over a monthly or yearly duration.

- Fulfilling statutory requirements: In adherence to laws such as the Companies Act, Partnership Act or other relevant regulations, companies prepare the Profit & Loss Statement to meet legal obligations.

What are the Key Components of a Profit & Loss Statement for Startups?

A profit and loss statement contains the following major components:

1. Revenue/Income:

- From Primary Business Operations: Revenue generated from the core activities of the business.

- Other Income: Miscellaneous income derived from investments, such as interest or dividend income.

2. Cost of Goods that are Sold:

- Direct Cost: Expenses directly associated with purchasing or manufacturing goods, such as labour and raw material costs.

- Direct Overheads: Overhead costs specifically related to the production process.

3. Operating Expenses of the company:

- Administrative Expenses: Indirect costs incurred in running the business, including depreciation, employee expenses, marketing and distribution costs, research and development expenses, etc.

4. Operating Profit of the company:

- Gross Margin: Positive balance remaining after deducting the cost of goods sold from revenue.

- Operating Expenses Deduction: Indirect expenses subtracted from the gross margin to calculate operating profit.

- Demonstrates the profitability and solvency of the business.

5. Net Income:

- Total Profit: Net profit obtained after deducting all operating and non-operating expenses, interest and taxes.

- Shareholder Distribution: Profit available for distribution to shareholders.

- Earnings per Share: Calculation based on the net profit, reflecting the profitability per share of the business.

What is the Process for Preparing a Profit and Loss Statement for Startups?

The following is the procedure for preparing the Profit and Loss Statement:

- Prepare ledger accounts: To establish the closing balance, an account statement must be prepared for each ledger from the journal book.

- Make a trial balance: A trial balance is a summary of all the ledger accounts. It displays the closing balance from the individual ledger accounts statement for each ledger account.

- Preparing the trading and profit and loss statement: The Profit & Loss Statement includes all ledger accounts related to sales, purchases, indirect expenses, direct expenses and revenue.

How to Submit the Profit & Loss Account to the Registrar?

To submit the Profit & Loss Account to the Registrar, companies are required to file E-Form 23ACA, which serves as the official means of providing the necessary financial information.

As part of the filing process, a company must attach an audited copy of the Profit & Loss Account to the E-Form. This audited document ensures the accuracy and credibility of the financial data presented.

To complete the submission, the E-Form 23ACA needs to be digitally signed by a practicing Chartered Accountant, Cost and Management Accountant or Company Secretary who holds full-time practice. The signature certifies that the information provided in the form is accurate and that the audited Profit & Loss Account is properly attached.

What is Cash Flow Management for a Startup?

Cash flow management is the process of controlling the inflow and outflow of funds with the fundamental objective of ensuring that the outgoing flow of funds remains lower than the incoming flow, thereby preserving the profitability of the business. Cash flow management assumes a supplementary role in ensuring the proper investment or retention of surplus funds to yield optimal returns on the capital held.

The main purpose of cash flow management is to guarantee the uninterrupted availability of cash within the company. It is imperative that no company delays payments to its creditors, as punctuality in fulfilling financial obligations is paramount. By actively managing cash flow organisations can uphold their financial stability and maintain favourable relationships with creditors. It also must not have any long-standing debts on its files.

Companies must collect and analyse data from their general ledger, bank accounts and other sources organise it according to the cash flow statement sections, calculate the net cash flow for each section and then combine the sections to determine the period's total cash flow.

Cash flows are classified into two types:

Positive cash flow happens when the incoming flow of funds into your business through sales, etc. exceeds the outgoing flow of funds from your firm through monthly expenses, salaries and so on.

Negative cash flow happens when the outflow of cash exceeds the inflow of cash. Negative cash flow generally causes issues for firms, which can lead to insolvency.

What are the Benefits of Cash Flow Management for Startups?

Cash flow management for startups can be beneficial in many ways, including:

1. To Predict shortfalls:

- Ability to forecast cash shortfalls in advance, allowing time to devise alternative plans.

- Examples include delaying shipments to avoid customs duty, collecting outstanding bills.

2. For Reducing stress based on financial situation:

- Effective cash flow management alleviates stress by providing clarity and understanding of financial circumstances.

- Eliminates anxiety associated with uncertainty and ensures a better grasp of the situation.

3. Informed decision-making regarding investment:

- Enables informed decision-making regarding investment in business growth.

- Offers insight into available funds for expansion, separate from overall profitability.

4. Gain leverage with suppliers and financial institutions:

- Good cash flow management enhances credibility and increases leverage with banks and suppliers.

- Facilitates negotiation for credit extensions and favourable terms by demonstrating reliable repayment plans.

5. More accurate than initial plans/budgeting:

- Cash flow management provides a realistic view of financial operations, surpassing the limitations of budgeting.

- Offers insights into actual occurrences, even if they deviate from initial plans.

What is the Process of Preparing Cash Flow Statements for Startups?

There are two methods under which cash flow statements can be prepared for startups in India. These are:

Preparation Under Indirect Method:

- Indirect cash flow statement begins with net income, which is adjusted for non-cash items like depreciation, amortisation and gains/losses on investments.

- Adjustments are made to reflect changes in the balance sheet, like accounts receivable, inventory, prepaid expenses and accounts payable.

- Cash inflows and outflows from operating, investing and financing activities are combined to determine the overall change in cash.

Operating Activities:

- Cash flow from operating activities is calculated by determining the operating profit before changes in working capital.

- Changes in working capital (increase or decrease in current assets or liabilities) affect the overall effect on cash flows.

- Cash from operating activities is the operating profit before changes in working capital, plus reductions in current assets and increases in current liabilities, minus increases in current assets and decreases in current liabilities.

Investing Activities:

- Cash generated from investments includes money from asset sales and subtracting cash spent on acquiring new assets.

- Income from dividends, interest, capital gains and other sources contributes to the net cash generated.

- Investing activities involve purchases of fixed assets, investments in joint ventures, acquisitions of intangible assets and repayment of advances/loans to external parties.

Financing Activities:

- Cash inflows and outflows related to long-term debt and equity investments are considered financing activities.

- Cash generated from financing activities includes receipts from stock issuance, debentures, loans and similar securities.

- Repayment of borrowed amounts and distribution of profits to shareholders are examples of cash outflows from financing activities.

Preparation Under the Direct Method:

- The cash flow statement is also prepared using the Direct method.

- It begins with cash received from customers and cash paid to suppliers and employees.

- Changes in working capital and other cash flow items are adjusted to determine the net cash flow from operating activities.

- The presentation of the statement differs slightly from the Indirect method.

What is the Basic Purpose of a Balance Sheet for Startups?

A balance sheet is an important financial statement since it offers information on a start-up’s financial health. A balance sheet presents a variety of financial information, allowing an assessment of both financial stability and future success of the company for a particular financial year.

The balance sheet equation is essentially a report version in which the total number of assets equals total number of liabilities plus shareholder capital. All investors and creditors of the enterprise review its balance sheet to determine how efficiently it can use its resources and estimate the worth of all of its interests.

What is the Importance of Balance Sheets for Startups in India?

Balance sheets are important for startups in many ways. Some of these are:

- Financial Assessment: Investors, creditors and stakeholders use balance sheets to assess a company's performance, profitability and also its overall financial wellbeing.

- Fundraising Tool: Start-ups frequently seek outside investment to help them develop. Balance sheets play a significant role in this process as they are submitted to investment groups or banks when applying for business loans. Lenders and investors use the balance sheet to evaluate the start-up's financial stability and determine its creditworthiness.

- Performance Measurement: Balance sheets enable start-ups to measure their growth and progress over time. By comparing balance sheets from different years, entrepreneurs can assess the company's financial trajectory and identify areas of improvement. This analysis helps in making strategic decisions regarding business expansion and resource allocation.

- Investment Decision-Making: Start-ups seeking additional investments can use balance sheets to attract potential investors.

- Working Capital Management: Balance sheets help start-ups manage their working capital effectively. By analysing the balance sheet, companies can determine if they are funding their operations through profits or debts. This information is vital in maintaining financial stability and optimising cash flow.

What are the Essential Components of a Balance Sheet?

Given below are the necessary components that must be included in the balance sheet:

Assets:

- Includes all resources or things owned by the entity.

- Assets are categorised into non-current and current.

- Current assets: Resources to be used within a short period (ex., accounts receivable, inventory, cash, bonds, stocks, short-term investments).

- Non-current assets: Resources providing long-term benefits (ex., patents, equipment, buildings, land).

Liabilities:

- Debts owed by the entity to others.

- Liabilities are divided into current and noncurrent.

- Current liabilities: Debts to be cleared within a year (ex., annual taxes, short-term loans, accounts payable).

- Non-current liabilities: Debts with a due date after a year or more (ex., bond issues, long-term loans).

Capital or Owner's Equity:

- The amount invested by shareholders in the company.

- Also referred to as stockholder's equity.

- Examples include retained earnings, public or private stocks and capital invested by the owner.

What is the Process of Preparing Balance Sheets for Startups?

Balance sheets can be prepared using the steps given below:

1. Identify the date of the balance sheet:

- Determine the specific date for which the balance sheet will be prepared, typically the end of the month or quarter.

2. Gather financial information:

- Collect relevant financial data from the start-up's accounting records, including the general ledger, accounts payable and receivable and bank statements.

3. Organise the information into the given 3 sections:

- Assets: List the company's assets in order of liquidity, starting with current assets (ex., cash, accounts receivable) and followed by non-current assets (ex., property, plant and equipment).

- Liabilities: List the company's liabilities in order of maturity, beginning with current liabilities (ex., accounts payable, short-term loans) and followed by non-current liabilities (ex., long-term loans, bonds payable).

- Equity: Show the residual interest in the company's assets after deducting liabilities. Include capital stock, retained earnings and any other reserves.

4. Balance the balance sheet:

- Ensure that the balance sheet balances by verifying that the total sum of assets equals the total sum of liabilities and equity.

5. Review and present the balance sheet:

- Conduct a thorough review of the balance sheet to ensure accuracy and completeness.

- Present the balance sheet in a clear and concise manner, making it easily understandable to stakeholders and investors.

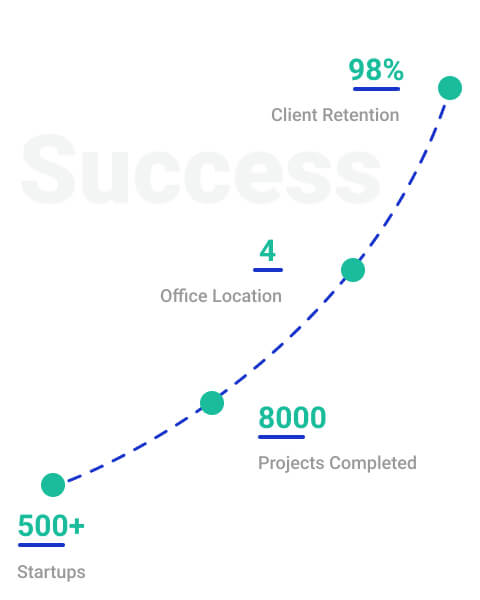

What are the Financial Consultancy Services Offered by Startupfino for Startups?

Financial consultants at StartupFino assist businesses in developing comprehensive financial plans and strategies tailored to their specific goals and circumstances, identifying and mitigating financial risks, evaluating funding needs and exploring various financing options and analysing financial performance through comprehensive financial reports and analysis.

Professional financial consultants function as trusted advisors in a fast growing and complex financial market like India, assisting customers in dealing with problems, optimising financial resources and achieving monetary goals.

Using the services of financial consultants like StartupFino can aid companies enhance their financial performance, mitigate risks and achieve sustainable growth in the highly competitive Indian market.

Our services include the below mentioned:

- Expert advice on financial planning, including profit and loss statement, balance sheet and cash flow statement.

- Strategies for effective cash flow management, including cash flow forecasting.

- Preparation of comprehensive financial reports to attract potential investors.

- Detailed analysis of profit and loss statements to assess business performance and profitability.

- Expert assistance in preparing accurate and comprehensive balance sheets for start-ups.

- Identification of strengths, weaknesses and areas for improvement in the company's financial position.

By availing our services, entrepreneurs can avoid the negative outcomes of non-followance of rules and compliances. StartupFino works hard to provide services that are prompt and effective, so you can manage your business without any issues and without facing penalties or problems.