Fundraising Secretarial compliance is essential for companies to uphold accountability, transparency, and ethical practices. By adhering to the regulatory and legal requirements, the companies ensure that their fundraising activities are conducted in a responsible and lawful manner. It includes maintaining accurate financial records, registering with relevant authorities, and submitting regular reports. Secretarial compliance also involves protecting donor privacy, providing solicitation disclosures, and complying with anti-fraud and consumer protection laws.

By fulfilling these obligations, companies can gain trust and confidence among the customers, effectively manage risks, and maintain effective stakeholder communication. Ultimately, fundraising secretarial compliance enables companies to operate ethically, build a strong governance structure, and sustain their mission-driven initiatives for the benefit of the communities they serve.

Points to consider for Fundraising Secretarial Compliance

Here are some key considerations for fundraising secretarial compliance:

Registration and Licensing

Companies engaged in fundraising activities must require registering with government agencies or obtaining specific licences or permits before engaging in fundraising activities. It basically involves providing necessary documentation, submitting an application, and paying any required fees. The fundraising may include in specific events or campaigns. The registration and obtaining licensing process ensures that companies meet certain standards and are authorised to engage in fundraising.

Financial Reporting

Fundraising companies involved in fundraising are generally required to maintain accurate detailed financial records and submit regular reports to regulatory bodies. This includes financial statements, annual reports, and disclosure of fundraising expenses. This also includes keeping accurate records of all donations received and expenses incurred, and providing financial statements on an annual or periodic basis. Transparent financial reporting builds trust and demonstrates proper use of funds to donors and regulators.

Solicitation Disclosures

Fundraising companies are often required to provide certain disclosures when soliciting donations to potential donors. These disclosures include information about the company's mission, the intended use of funds, and any tax implications associated with donations or whether such donation is tax-deductible etc. Compliance with solicitation disclosure requirements becomes helpful for the donors to make informed decisions and prevents misleading or deceptive practices.

Donor Privacy and Data Protection

Companies must handle donor information with care and comply with privacy laws and regulations. There must be policies to protect donor privacy and not sharing donor details without obtaining the appropriate consent. This involves consent for data collection, storage, and use, as well as implementing security measures to protect donor information from unauthorised disclosure or access. Compliance with data protection laws ensures that donors' privacy rights are respected.

Governance and Board Oversight

Companies are often required to have a specific legal structure, such as being registered either as a private limited, non-profit corporation or charitable trust. They may also need to establish a governing board which can comply with governance guidelines. The registered company includes the board of directors or trustees responsible for overseeing fundraising activities and adherence to bylaws. These requirements help ensure compliance oversight, accountability, and transparency in fundraising decision-making activities.

Compliance with Anti-Fraud Laws

Fundraising activities must follow the anti-fraud laws and regulations to prevent deceptive or fraudulent practices and protect donors. This includes accurately representing the company’s mission, using funds for the intended purposes, and not making false or misleading statements to potential donors. Companies must also accurately represent their programs, services, and comply with consumer protection laws to ensure ethical fundraising practices. Companies must be aware of the relevant laws and regulations regarding fundraising practices to ensure compliance.

Compliance with Other Relevant Laws

The compliances depend on the nature of the fundraising activities, additional legal requirements may apply. For example, if the organisation engages in online fundraising or conducts raffles or lotteries, specific regulations may need to be followed. It is important to research and understand the laws and regulations before fundraising activities.

Objectives of Fundraising Secretarial Compliance

Overall, the objectives of fundraising secretarial compliance revolve around maintaining legal compliance, promoting good governance, ensuring financial integrity, building trust with donors, mitigating risks, and facilitating effective communication. These objectives collectively contribute to the company’s reputation, sustainability, and ability to fulfil its mission through successful fundraising activities such as:

Legal Compliance

The main objective of fundraising secretarial compliance is to ensure that the companies comply with all applicable laws, legal requirements and regulations. It further includes registration and licensing obligations, complying with anti-fraud, consumer protection laws, compliance with data protection, and privacy regulations, and also with the other relevant laws involved in the fundraising activities.

Strong Governance

Secretarial compliance helps establish a strong governance framework within the organisation. It ensures that there is proper oversight and accountability in fundraising activities through the involvement of the board of directors or trustees. This includes setting policies, procedures, and guidelines for fundraising, ensuring financial transparency, and maintaining proper documentation and records.

Trust and Confidence

Another objective is to build and maintain trust and confidence among donors and stakeholders. Secretarial compliance ensures that fundraising activities are conducted in an ethical and responsible manner, with clear solicitation disclosures, accurate representation of the organisation's mission and programs, and proper handling of donor information. By adhering to compliance requirements, organisations can demonstrate their commitment to integrity and accountability, thus fostering trust and encouraging continued donor support.

Financial Integrity and Reporting

Secretarial compliance aims to maintain the financial integrity of fundraising activities. The objective is to ensure that funds are used for the intended purposes and that particular financial information must be transparent and accessible to relevant parties. This includes proper management and utilisation of funds, accurate financial record-keeping, and timely reporting to regulatory bodies, donors, and stakeholders.

Risk Management

Secretarial compliance plays a role in mitigating legal, financial, and reputational risks associated with fundraising. By understanding and complying with applicable laws and regulations, organisations can minimise the risk of legal penalties, regulatory scrutiny, and damage to their reputation. Compliance measures help identify and address potential risks, ensuring that fundraising activities are conducted in a responsible and sustainable manner.

Effective Stakeholder Communication

Secretarial compliance facilitates effective communication with stakeholders, including donors, board members, regulatory authorities, and the public. By providing accurate and transparent information about fundraising activities, compliance measures help foster open and honest communication, ensuring that stakeholders are well-informed and engaged in the organisation's fundraising efforts.

Pre Funding Compliance

There is some important pre-funding compliance which is as follows:

- Compliance with the Registrar of Companies

- Conducting a Board Meeting

- Conducting an Extraordinary General Meeting

- Issuance of Offer Letters

Compliance with the Registrar of Companies

A private limited company can issue its shares to raise funds, as per the provisions of the Companies Act 2013, either within India or outside India. It is done by the process of a Preferential Allotment of shares to seed investors, angel investors and venture capitalists. The Preferential Allotment is done for an issue of shares issued by any listed or an unlisted company for selection of a group of investors. It is governed by the provisions of section 62(1)(c) of Companies Act, 2013 along with the Rule 13 of Companies (Issue of Share Capital and Debentures) Rules, 2014. It is one of the easiest ways of raising funds and also for increasing the share capital of the company.

How are shares allotted?

- The issuance of shares is authorised under the Articles of Association of the company.

- A special resolution should be made for such allotment of shares.

- A share price should be determined by the corporate valuation report of registered valuer.

Conducting a Board Meeting

A notice must be sent to all the board members at least 7 days prior to the conduct of the meeting. This board meeting is conducted for approving the subsequent points which are as follows:-

- Considering the Valuation Report: A valuation report has to be prepared by CA/Registrar valuer and the same has to be approved within board meeting.

- List of Allottees: The decision to be made regarding the list of allottees. All new shareholders have to be finalised

- Offer Period: The decision regarding the offer period is to be finalised

- Opening a checking account: Opening of the bank account in a Scheduled bank in order to receive the money or investment only.

- Finalising the draft offer letter: The offer letter issued to the shareholder has to be finalised

- EGM Finalisation: The date, day, venue and time of the (EGM) Extraordinary General Meeting is required to be fixed. It is required to finalise the notice for EGM and also the Explanatory Statement must be attached.

Conducting an Extraordinary General Meeting

The EGM is conducted with an objective of passing the Special Resolution in regard to Preferential Allotment. The Special Resolution has a validity period of 12 months. The MGT- 14 has to be filed and PAS – 4 containing the details of private placement offer is sent to all the allottees along with-

- A certified true copy of a Special Resolution.

- Explanatory Statement

Issuance of Offer Letters

Once approval is obtained, then the private placement offer letter cum application must be given to the proposed allottees within the time period of 30 days, in writing or by way of an electronic mode. A complete record of the preferential allotment has to be filed with the (ROC) Registrar of Companies. Once this is complete, the company will receive funds from the investors.

Post Funding Compliance

There is some important post-funding compliance which is as follows:

- Allotment of Shares

- Issuance of Share Certificate

Allotment of Shares

In case of an offer, the appliance money is often paid in cash, just in case of non-public placement the share money comes from the investment account of the corporation through the banking channels. After receiving money for application, the second meeting is held for the allotment and issuance of shares. Then within the time period of 60 days after receiving the funds with regard to the allotment of shares, then the securities have to be allotted to the allottees within the time period of 30 days of the securities after being allotted. Afterwards the Return of Allotment requires to be filed with the Registrar of Companies.

Issuance of Share Certificates

The issuing company is required to allot share certificates which are to be issued to all the allottees, hence officially making them the shareholders of a company. The share certificate required to be shared to the investors within 60 days from the date of allotment of shares. However, it is must be noted that in case of a foreign investor, the few additional compliances have to be fulfilled as per the guidelines mentioned by the Reserve Bank of India.

Additional Secretarial Compliances

- Advance Reporting form: This is filled with the Reserve Bank of India within the time period of 30 days of receiving funds. It contains the information of investors and their KYC.

- FC-GPR Form: It is required to be filled within the time period of 30 days from the date of issue of shares. Certifications regarding the procedure, compliance must be certified by the secretary. It is submitted to the CA along with the valuation certificate. These documents are required to fill form-FIRC and the same will be issued by the company’s bank and KYC issued by the investor’s bank.

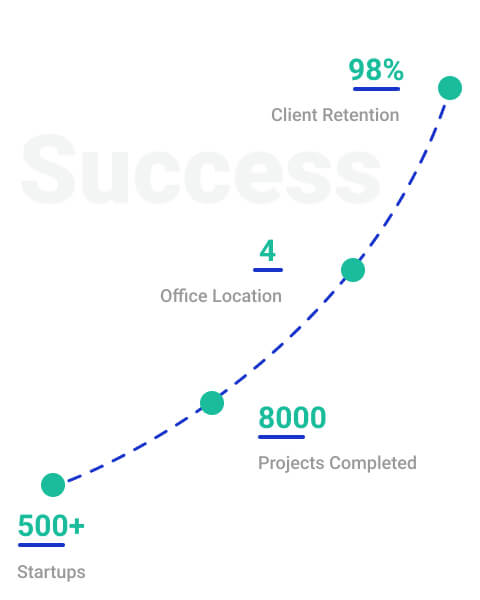

Why to choose Startupfino?

We understand the significance of transparency, accountability, and ethical practices in fundraising. That's why we prioritise fundraising secretarial compliance, ensuring that every aspect of our fundraising activities meets legal and regulatory requirements. With our commitment to financial integrity and reporting, we diligently fulfil our reporting obligations. By strictly adhering to laws, we guarantee that every contribution is handled ethically and responsibly.