A Microfinance Company is an entity established for providing financial assistance to rural populations, low-income groups, and the underprivileged sectors of society. The main aim of this is to extend banking facilities to all sections of society. In order to initiate a Microfinance Company in India, obtaining Microfinance Company Registration from the Reserve Bank of India is a must.

It is essential to recognise that a microfinance institution or company falls under the category of a Non-Deposit Taking Non-Banking Financial Company and is distinctly separate from a section 8 company. Moreover, the operations and conduct of a Microfinance Institution are subject to governance and regulation as per the provisions defined in the Reserve Bank of India Act of 1934, along with the directives issued in accordance with the said act.

Role of Microfinance Institutions

The role of microfinance institutions in India are as given below:

Financial Assistance to the Low Income Strata

One primary responsibility of a Microfinance Institution is to provide financial assistance to individuals within the low-income strata. This involves offering accessible and personalised financial solutions to empower those who may have limited access to traditional banking services in remote areas.

Banking Facilities in Rural, Semi-Rural, and Backward Areas

Another important role of a Microfinance Institution is to extend banking facilities to areas characterised by rural, semi-rural, and economically backward conditions. By doing so, these institutions contribute to financial inclusion and economic development in regions that may otherwise be underserved by mainstream financial institutions.

Benefits of Microfinance Company Registration in India

Given below are the major benefits of Microfinance Company registration in India:

- No Need for Collateral Security for Borrowing Funds

Microfinance Company Registration in India eliminates the requirement for collateral security when borrowing funds. This benefit particularly aids individuals and businesses with limited assets, promoting greater financial inclusivity.

- Facilitates Employment Generation

Microfinance Company registration plays an important role in promoting employment generation. By providing financial support to small enterprises and entrepreneurs, it contributes to the growth of businesses, subsequently creating job opportunities.

- Contributes in Rural Development

Microfinance Company Registration actively contributes to rural development initiatives. By extending financial services to rural areas, it helps in uplifting the economic status of these regions, promoting overall development.

- Renders Opportunity to Earn Income

Microfinance Company registration offers individuals the opportunity to earn income by providing them access to financial resources.

- No Need to Fulfil any Minimum Capital Requirement Criteria

One of the advantages of microfinance company registration is the absence of a mandatory minimum capital requirement. This reduces barriers to entry, allowing a more diverse range of entities to participate in the microfinance sector.

- Provides Better Interest Rate of Repayment

Microfinance companies often offer favourable interest rates on repayments, making it more accessible for borrowers. This enhances the affordability of loans and facilitates a higher rate of successful repayment.

- Aims to Make People Self-Sufficient

The main goal of microfinance company registration is to make people self-sufficient. By providing financial tools and resources, it empowers individuals and communities to break the cycle of poverty, promoting economic independence.

Regulations Governing the Model of Microfinance Institution

Given below are the main regulations that govern Microfinance company registration:

1.RBI Compliance

The regulatory framework governing the model of Microfinance Institutions is primarily defined by the Reserve Bank of India. "RBI Compliance" refers to the guidelines established to regulate the affairs and operations of Microfinance Companies. While Microfinance Companies are generally exempt from certain RBI requirements, they are still obligated to adhere to specific rules outlined by the RBI pertaining to their functioning.

2.Companies Act 2013

In addition to RBI regulations, Microfinance Companies must also comply with the legal provisions of the Companies Act 2013. When a Microfinance Company is established as a Section 8 Company, it becomes especially crucial to observe and comply with the requisites outlined in the Companies Act of 2013. This legal framework furnishes essential guidelines governing the governance and operations of Section 8 Companies, including those specifically involved in microfinance activities. Adhering to the provisions of the Companies Act 2013 ensures the lawful and proper functioning of such entities, emphasising the regulatory framework that must be followed by Section 8 Companies, including those operating within the microfinance sector.

Conditions for Obtaining Microfinance Company Registration in India

To obtain Microfinance Company registration in India, certain conditions must be met, including:

- Registration under the Companies Act 1956 and 2013:

The company seeking MFC registration must be duly registered under the provisions of the Companies Act, including both the Companies Act of 1956 and the Companies Act of 2013. This ensures the legal standing and compliance of the entity.

- Net Owned Funds of Rs 5 Crores:

The company is required to have a minimum Net Owned Funds of Rs 5 crores. This financial criterion is essential to demonstrate the financial stability and capacity of the microfinance institution.

- Eligibility to Offer Loans Between Rs 50 thousand to Rs 1.25 Lakh:

MFCs are eligible to provide loans within the range of Rs 50 thousand to Rs 1.25 lakhs. This restriction on loan amounts is specified as part of the eligibility criteria for obtaining MFC registration.

- Furnishing Details Concerning Promoters:

Entities seeking MFC registration need to provide detailed information about their promoters. This may include personal and financial details of such individuals or organisations.

- 85% of Total NOF as Qualifying Assets:

A significant portion of the Total Net Owned Funds, specifically 85%, must be maintained as Qualifying Assets. This ensures that the funds are appropriately utilised for qualifying activities within the microfinance sector.

- No Minimum Capital Requirement:

Unlike some other financial institutions, MFCs do not have a stipulated minimum capital requirement. This allows a diverse range of entities to participate in the microfinance sector without worrying for a specific capital threshold.

It is important for entities aspiring to obtain MFC registration to carefully adhere to these conditions and fulfil all the specified criteria to ensure compliance with regulatory standards in India.

Different Types of MFC Registration in India

Microfinance Companies in India can be registered under different categories. The various types of MFC registrations applicable in India are as given below:

1.RBI Registered MFIs:

To establish a Microfinance Company or Institution as a Non-Banking Financial Company, the applicant must first register the company as a Private Limited or Public Limited Company under the Companies Act of 2013. Subsequently, the applicant company must comply with all the necessary steps for obtaining microfinance company registration. This process includes meeting the minimum capital requirement and filing the application for registration at the regional office of the Reserve Bank of India.

2.Section 8 Registered MFIs:

For those looking to start a Microfinance Institution in India as a Section 8 company, the process involves several steps. The applicant company must first apply for obtaining Digital Signature Certificates and Directors Identification Numbers for all proposed directors. Following this, the company needs to submit an application for Name Approval using form INC – 1. Additionally, the drafting of the MOA and AOA for the company is required. The applicant then submits form INC – 12, along with the necessary documents, to obtain Microfinance Company Registration under Section 8 of the Companies Act.

These different types of MFC registrations involve diverse structures and regulatory frameworks, providing flexibility for entities to choose a suitable path based on their specific goals and operational models.

Types of Loans Provided by Microfinance Company

Microfinance Companies usually specialise in offering small loans to individuals in rural and backward sections of society. Although these loans are often unsecured, the company has the capacity to apply interest rates that align with regulatory guidelines and meet the financial needs of the target demographic.

Key Features of Loans Provided by Microfinance Company:

Some major features of the loans provided by these microfinance companies are:

- Loan Amounts for Rural and Backward Sections:

Microfinance Companies focus on providing small loans personalised to the financial requirements of individuals in rural and backward sections of society. These loans aim to support economic activities and enhance financial inclusion in underserved areas.

- Unsecured Nature of Loans:

While microfinance loans are generally unsecured, meaning they are not backed by collateral, the Microfinance Company relies on other criteria to assess creditworthiness and determine the borrower's ability to repay.

Microfinance companies are required to comply with distinct regulations governing interest rates. The interest imposed by these institutions must not surpass a specified threshold established by regulatory authorities. This safeguard ensures that borrowers, particularly those in economically precarious regions, are not subjected to exorbitant interest rates.

- Reasonable Interest Rates:

In addition to regulatory limits, Microfinance Institutions are expected to maintain interest rates of a reasonable nature. This ensures that the cost of borrowing remains fair and sustainable for the borrowers, promoting responsible lending practices.

- Compliance with Microfinance Company Requirements:

Loans or funds extended by Microfinance Companies must align with the precise requirements and guidelines stipulated by regulatory bodies overseeing Microfinance Institutions. This guarantees that the loans are structured in a way that promotes financial inclusion and fulfils the intended purpose of assisting individuals in underserved communities.

Eligibility for MFI Registration in India

Microfinance Institution registration in India is open to various entities engaged in specific sectors. The eligibility criteria include a diverse range of activities, including:

Entities involved in agricultural activities are eligible to acquire MFI registration. This includes individuals or organisations engaged in farming, cultivation, and related agricultural enterprises.

Artisan businesses, which involve skilled craftsmanship or the production of handmade goods, are eligible for MFI registration. This includes a wide range of traditional and contemporary artisanal activities.

- Professional & Transport Trade:

Professionals and businesses operating in the transport trade are eligible to obtain MFI registration. This category includes professionals such as doctors, lawyers, and others, as well as businesses involved in transportation services.

Small-scale businesses across various sectors are eligible for MFI registration. This includes enterprises that operate on a smaller scale in manufacturing, services, or trading activities.

It's important to note that the eligibility criteria may vary, and entities seeking MFI registration should comply with the specific requirements and guidelines set forth by regulatory authorities like RBI in India.

Documents Required for Microfinance Company Registration

To obtain Microfinance Company Registration, the applicant must submit a comprehensive set of documents. These documents include:

- Copy of Certificate of Incorporation:

A copy of the certificate that confirms incorporation of the company.

- Permanent Account Number Card Details:

PAN card details of the applicant entity.

- PAN Card Details of Proposed Directors:

PAN card details of all the directors proposed for the company.

- Digital Signature Certificates:

DSCs for all proposed directors.

- Director Identification Number:

DIN for all proposed directors.

- Passport-Sized Photographs:

Latest passport-sized photographs for all proposed directors.

- Address Proof for Registered Office:

Address proof for the premises being used as the registered office of the company.

- Lease Deed or Rental Agreement:

Copy of the duly stamped lease deed or rental agreement if the property is rented.

- Sale Deed or Ownership Certificate:

Copy of the sale deed or ownership certificate if the property is self-owned.

- Certified Copy of Memorandum of Association:

Certified copy of the MOA.

- Certified Copy of Articles of Association:

Certified copy of the AOA.

- Certified Banker’s Report:

Certified report from the bank.

- Duly Certified Copy of Board Resolution:

Copy of the board resolution, duly certified.

- Auditors Report Displaying Minimum Net Owned Funds:

Copy of the auditors' report displaying the minimum NOF.

- Compliance Certificate from Chartered Accountant:

Duly certified compliance certificate from a practicing chartered accountant.

- Structured Business Plan:

A detailed business plan for the applicant company.

- Latest Financial Report Concerning Directors:

Copy of the latest financial report concerning directors.

- Income Proof of Key Managerial Personnel and Proposed Directors:

Income proof for all key managerial personnel and proposed directors.

- No Objection Certificate from the Company:

NOC from the existing company.

- Bankers Certificate Regarding No Lien:

Certificate from the bank regarding no lien.

- Credit Statement of the Company:

Copy of the company's credit statement.

- Passport Copy (for Indian Nationals):

Passport copy for Indian nationals.

- Apostil or Notarised Passport Copy (for Foreign Nationals):

Apostil or notarised copies of passports for foreign nationals.

- Net Worth Certificate for Proposed Directors:

Net worth certificate for all proposed directors.

Additionally, it is important to note that all submitted documents must not be older than a period of 2 months.

Process for Obtaining Microfinance Company Registration in India

The process for obtaining Microfinance Company Registration in India involves several steps as given below:

1.Register a Company:

- Incorporate a company under the provisions of the Companies Act 2013.

- File a SPICe+ Form with the Ministry of Corporate Affairs.

2.SPICe Plus Service:

- Utilise the SPICe Plus Service for online registration.

- This service provides name reservation, Director Identification Number, Permanent Account Number, Tax Deduction & Collection Account Number, EPFO, ESIC, and other required registrations.

3.Compliances after Incorporation:

- Complete name reservation if the company is a new entity.

- Fulfil compliances related to EPFO, GST, Income Tax, PAN, TAN, Bank Account, and Professional Tax Registration (if required).

4.Application in SPICe Plus:

- Click on the SPICE Plus under relevant MCA services.

- Apply for a new application or click on an existing application if the company already exists.

- Specify the type of industrial activities and other details.

- Check for Name Approval:

- Auto-check for the availability of the company name.

- Submit details related to the name, location of the registered office, operations, registrations, etc.

- Perform a pre-scrutiny check and download forms including AGILE-Pro, SPICe+ MOA, SPICe+ AOA, URC-1, and INC 9.

- Affix Digital Signature Certificate for proposed directors.

- Upload linked forms online, generate a request number, make the required payment, and await processing.

6.Raise the Required Capital:

- Raise the specified capital amount, usually Rs 2 crores or 5 crores, as per the requirements.

7.Open a Current Bank Account:

- Directors open a current bank account and obtain a no-lien certificate.

8.Apply to RBI for Microfinance Company Registration:

- Furnish certified copies of documents to the regional office of the Reserve Bank of India.

- Required documents include copies of the Incorporation Certificate, MOA, AOA, Fixed Deposit Receipt, and a certificate from the bank regarding no liens on Net Owned Fund.

9.File an Online Application:

- File an online application with the RBI for Microfinance Company Registration.

- Receive a Company Application Reference Number (CARN) for future reference.

10.Furnish the Hard Copy:

- Submit hard copies of documents to the specified regional office of the RBI.

- RBI conducts scrutiny and due diligence to confirm compliance with all requirements.

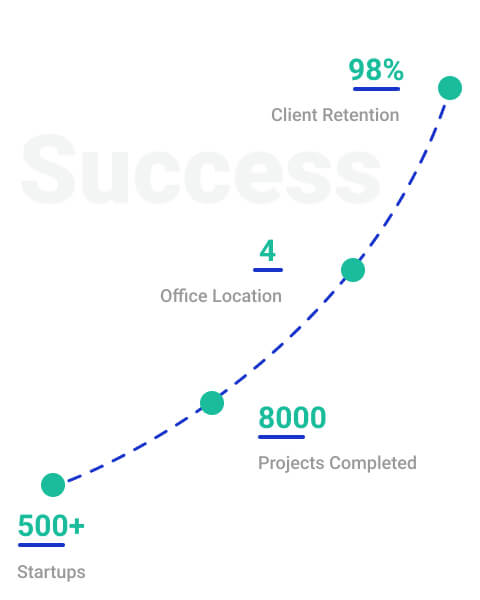

Why Choose StartupFino for Microfinance Company registration?

StartupFino is a company that specialises in offering complete Microfinance Company registration services. We can help you with everything right from providing advice in the initial phase to also ensuring that you meet all the necessary requirements and compliances after Microfinance Company registration.

The significance of microfinance companies lies in their vital role in empowering individuals and communities. These financial institutions grant access to essential resources, promoting entrepreneurial initiatives and contributing to economic development in the society and community at large.