Small and medium-sized enterprises frequently face challenges in obtaining loans from banks, primarily because they lack sufficient collateral and struggle to meet interest payments. Facilitating the growth of these businesses is important for overall economic progress, for which mudra loans become important.

Mudra Yojana is a financial initiative started with many-sided goals, which aims to address various aspects related to the financing and development of small and micro enterprises. As part of the Jan Dhan Yojana, the government introduced the MUDRA Bank (Micro Units Development and Refinance Agency) initiative on April 8, 2015.

Objectives of Mudra Yojana

Mudra Yojana, initiated with multifaceted goals, aims to address various aspects related to the financing and development of small and micro enterprises. The key objectives of Mudra Yojana include:

- Policy Guidelines for Small/Micro Enterprises Financing:

Establishing comprehensive policy guidelines to facilitate the financing of small and micro enterprises. This involves creating a framework that supports the financial needs of these businesses.

- Registration and Regulation of Microfinance Institutions:

Ensuring the registration and effective regulation of Microfinance Institutions (MFIs) and related entities. This step is important for bringing transparency and accountability to the microfinance sector.

- Facilitating Small Business Development:

Promoting an environment for development and growth of small businesses. Mudra Yojana aims to provide the required financial support and resources for the expansion of small enterprises.

- Empowering Lower Income Groups:

Assisting lower income groups in building and expanding their businesses. This objective is aligned with the broader goal of inclusive economic development by empowering individuals in the lower income strata.

- Enhancing Access to Finance for the Unbanked:

Creating easy access to finance for the unbanked population, thereby addressing financial inclusion challenges. Mudra Yojana seeks to reduce barriers to financial services for those who are traditionally underserved by the banking sector.

- Lowering Cost of Finance:

Contributing to the reduction of the cost of finance for small and micro enterprises. By facilitating access to affordable financing options, Mudra Yojana aims to alleviate the financial burden on these businesses.

- SC/ST Lending Preference:

Providing lending preference to individuals belonging to Scheduled Castes and Scheduled Tribes. This targeted approach aims to address historical disparities and promote economic opportunities for marginalized communities.

- Regulation of Microfinance Institutions in Trading, Manufacturing and Service:

Implementing regulatory measures for Microfinance Institutions engaged in trading, manufacturing, and service sectors. This ensures that these entities adhere to standardized practices, promoting a healthy and sustainable microfinance ecosystem.

Types of Mudra Loan

The Pradhan Mantri Mudra Yojana offers three distinct types of loans, each for meeting the varying financial needs of micro and small enterprises:

1. Shishu Loan:

Maximum Loan Amount: Rs.50,000.

Description: The Shishu loan is the foundational category, providing financial support to micro-enterprises with modest capital requirements. This loan can be utilised for diverse business purposes, including working capital and equipment purchase. Notably, no collateral is required for this category, making it accessible to a broad range of small businesses.

2. Kishor Loan:

Maximum Loan Amount: Rs.5 lakh.

Description: The Kishor loan category caters to small businesses that require a higher loan amount than what is offered under the Shishu category. Businesses can utilise this loan for expansion, purchasing equipment or meeting other financial needs. Collateral may be required based on the creditworthiness of the applicant, providing flexibility for slightly larger enterprises.

3. Tarun Loan:

Maximum Loan Amount: Rs.10 lakhs.

Description: The Tarun loan category targets medium-sized businesses with substantial financial requirements. This category allows businesses to access a higher loan amount compared to the Kishor category. Similar to the Kishor category, collateral requirements may be determined based on the creditworthiness of the applicant. The Tarun loan supports the growth and expansion of businesses with more significant capital needs.

These loan types, ranging from Shishu to Kishor and Tarun, represent a tiered approach to address the diverse funding needs of micro and small enterprises. The scheme's flexibility in loan categories and collateral requirements aligns with the government's vision of promoting financial inclusion and supporting the growth of small businesses across different scales.

Moreover, the Mudra Yojana involves the participation of a diverse set of financial institutions for loan disbursal. As of now, the selected institutions include:

- Public Sector Banks: 21

- Regional Rural Banks: 36

- Private Sector Banks: 18

- Non-Banking Financial Companies (NBFC): 35

- Micro Finance Institutions (MFI): 25

- NBFC-MFI: 47

- Co-operative Banks: 15

- Small Finance Banks: 6

The distribution of loans under the Mudra Scheme is strategically planned, with 60 percent of the loans allocated through the 'Shishu' category and the remaining 40 percent through the 'Kishore' and 'Tarun' schemes. This allocation strategy ensures a balanced approach to meeting the financial requirements of businesses at different stages of their development, promoting inclusive growth across various sectors of the economy.

Utilisation of Loans under Mudra Yojana

Mudra Yojana, in its endeavour to support a diverse range of businesses, extends its coverage to various sectors and services. The following list shows the business activities and services eligible for obtaining loans:

- Transportation Sector:

Entrepreneurs purchasing transport vehicles for goods and passenger transportation, including auto-rickshaws, three-wheelers, small goods transport vehicles, taxis, and e-rickshaws.

- Agricultural Machinery and Commercial Vehicles:

Tractors, power tillers, tractor trolleys, and two-wheelers used exclusively for commercial purposes are eligible for loans.

- Service Industries:

Businesses in service-oriented industries, such as salons, gymnasiums, beauty parlours, tailoring shops, boutiques, dry cleaning, medicine shops, cycle and motorcycle repair shops, courier agents, DTP and photocopying facilities, etc.

- Food and Catering Businesses:

Entrepreneurs engaged in food-related activities, including achaar making, papad making, sweet shops, jam/jelly making, small service food stalls, day-to-day catering or canteen services, ice-making and ice cream units, cold storages, bread and bun making, biscuit production, etc.

- Textile and Apparel Industry:

Businesses involved in handloom, khadi activities, power loom, traditional dyeing and printing, traditional embroidery and handwork, apparel design, computerised embroidery, cotton ginning, stitching, and other textile non-garment products like vehicle accessories, bags, furnishing accessories, etc.

- Agro-Processing and Allied Activities:

Activities allied to agriculture, including beekeeping, poultry, livestock-rearing, aggregation agro-industries, fishery, dairy, food and agro-processing, agri-clinics, agribusiness centres and other services supporting these ventures.

Features of Mudra Loan under PMMY 2023

- Loan Amount:

The Mudra scheme offers a flexible loan amount ranging from Rs.50,000 to Rs.10 lakh. This allows borrowers to access financial assistance tailored to their specific business requirements.

- Repayment Tenure:

Borrowers benefit from a reasonable repayment tenure, ranging from 12 to 60 months. This flexibility allows entrepreneurs to choose a repayment period that aligns with their business cash flow and financial capacity.

- Interest Rate:

The interest rate on the loans is determined by the lending institution, which is generally set at a competitive rate. These loans are an attractive option for business financing, with an emphasis on providing affordable credit to facilitate business growth.

- Collateral-Free Loans:

One of the features of these loans is that they are collateral-free, meaning that borrowers are not required to pledge any assets or provide security for the loan. This significantly reduces the barriers to accessing credit, especially for small and micro-businesses.

- Eligibility Criteria:

The Mudra scheme is open to all Indian citizens engaged in non-farm, non-corporate business activities. This inclusive eligibility criterion aims to reach a broad range of entrepreneurs, promoting economic growth across various sectors.

Eligibility Criteria for Mudra Loans

- Indian Citizenship:

The borrower must be a citizen of India. This criterion ensures that the benefits of the Mudra Yojana are extended to Indian entrepreneurs, promoting economic growth and self-employment within the country.

- Non-Farm, Non-Corporate Business Activity:

The borrower should be engaged in a non-farm, non-corporate business activity. This criterion reflects the focus of the Mudra Yojana on supporting small and micro-businesses across diverse sectors.

- Good Credit Score:

A good credit score is an essential eligibility criterion, and lending institutions may assess the credit history of the applicant to ensure that they have a reliable track record of managing credit.

- Viable Business Plan:

The borrower must also have a viable business plan as it is important for assessing the feasibility and sustainability of the proposed business. It helps lending institutions evaluate the potential success of the venture.

Documents Required to Apply for Mudra Loans

The documentation required for applying for these loans varies based on the specific loan category. Given below are the documents needed for different types of loans:

Vehicle Loans:

- A Duly filled Mudra application form.

- Vehicle loan application form.

- 2 passport size colour photographs.

- Identity proof such as Passport, Voter ID card, Driving Licence, PAN card, Aadhaar Card.

- Address proof such as Voter ID card, Utility bills, Passport, Aadhaar Card, Driving Licence, Rent agreement.

- Proof of income - last six months’ salary slip, last year’s ITR/sales Tax returns.

- Bank statement.

Business Instalment Loan:

- A Duly filled Mudra application form.

- Duly filled Business Instalment Loan application form.

- Photo Identity proof.

- Proof of address.

- Establishment proof.

- Bank statement.

- Ownership proof of residence/office/store.

- Proof regarding continuity of business.

- Qualification proof.

- Trade references.

- Documents of Income tax return of the last 2 years.

- CA certified financials.

Business Loans Group and Rural Business Credit:

- A Duly filled Mudra application form.

- Duly filled Business Instalment Loan application form.

- Duly filled rural business credit application form.

- Proof of address.

- Ownership proof of residence/office.

- Business vintage proof.

- Bank statement.

- Documents of Income tax return of the last 2 years.

These documents are essential to assess the eligibility and creditworthiness of the applicant. It's important for prospective borrowers to complete the application form and provide the necessary supporting documents as per the specific loan category they are applying for. Additionally, applicants may need to check with the lending institution for any additional documentation requirements or updates.

How to Apply for Pradhan Mantri Mudra Yojana 2023

To apply for a loan under the Pradhan Mantri Mudra Yojana in 2023, follow these steps:

- Confirm Your Eligibility:

Make sure you meet the specified eligibility criteria outlined above.

- Pick a Bank or Financial Institution:

Select a bank or financial institution participating in the PMMY scheme.

- Go to Official Website:

Thereafter, go to the official website of your chosen bank or financial institution.

- Complete the Online Application Form:

Fill out the online application form found on the website.

- Submit Supporting Documents:

Upload supporting documents, including KYC documents and your business proposal or project report.

- Application Processing:

Once your application is submitted, the bank or financial institution will process it.

- Loan Approval:

If your application is approved, you will be informed about the loan details, including the sanctioned amount and terms.

Changes in Lending Target Under the Mudra Yojana

In the Budget of 2016-2017, the finance minister unveiled a visionary plan to boost Micro, Small and Medium Enterprises through the Mudra Yojana. The initial lending target set during this period was a substantial INR 1.22 lakh crores, with the primary aim of providing significant financial support to revive and sustain the MSME sector.

Remarkably, the achieved results surpassed expectations, with the lending target not only met but also surpassed by a considerable margin. The success and positive impact of the Mudra Yojana on empowering small businesses prompted the Union Government to make a strategic decision.

In recognition of the program's effectiveness and its role in promoting economic growth, the government took a proactive step by doubling the lending target under the Mudra Yojana. Consequently, the revised target was set at a substantial INR 2.44 lakh crore. This ambitious goal reflects the government's commitment to further empower and support MSMEs, acknowledging their pivotal role in the economic landscape.

Emphasis on Specific Segments under Mudra Yojana

In a significant announcement, the finance minister underscored a targeted approach within the expanded lending framework of the Mudra Yojana. While elevating the lending target, the government places a strategic emphasis on specific segments of the population, acknowledging historical disparities and aiming to address financial inclusion challenges. The key target segments include:

- Women:

The Mudra Yojana places a special emphasis on providing financial opportunities to women entrepreneurs. This targeted approach recognises the pivotal role that women play in economic development and aims to bridge gender-based financial gaps.

- Backward Classes:

Individuals belonging to backward classes are identified as a priority segment for Mudra Yojana. This inclusive measure aims to provide financial assistance to those who may have faced historical barriers in accessing funds for their businesses.

- Minorities:

The Mudra Yojana extends its focus to minorities, ensuring that members of minority communities have equal opportunities to access financial resources. This targeted approach aligns with the broader goal of promoting diversity and inclusivity in economic activities.

- Dalits:

Dalits, historically marginalised communities, are specifically identified as a key target under the Mudra Yojana.

- Tribals:

The Mudra Yojana aims to create opportunities for Tribals to access financial resources for their entrepreneurial endeavours. This targeted approach is designed to promote economic empowerment in tribal areas.

Mudra Loans Interest Rates from Selected Banks

- State Bank of India (SBI):

Interest Rate: As per bank guidelines.

Loan Amount: Maximum Rs.10 lakh.

Tenure: 1 to 5 years.

- UCO Bank:

Interest Rate: 8.85% p.a. onwards.

Loan Amount: Maximum Rs.10 lakh.

Tenure: At the discretion of the bank.

- Bank of Baroda:

Interest Rate: 9.65% onwards.

Loan Amount: Maximum Rs.10 lakh.

Tenure: 1 to 5 years.

- Union Bank of India:

Interest Rate: 7.30% p.a. onwards.

Loan Amount: Maximum Rs.10 lakh.

Tenure: 1 to 7 years.

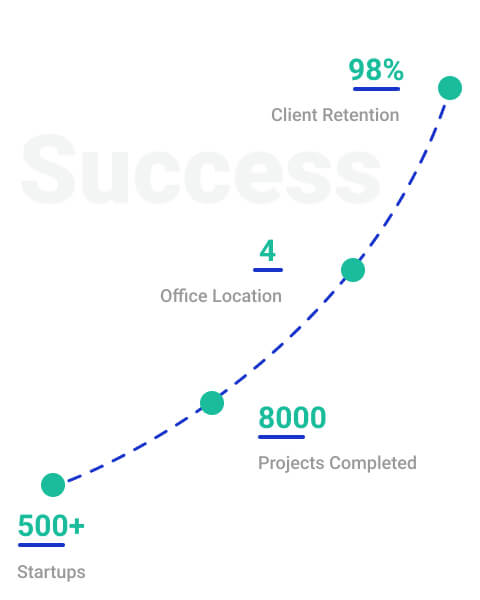

Why Choose StartupFino for Mudra Loans?

StartupFino is a company that specialises in offering complete services for Mudra loans. We offer comprehensive assistance, guiding you from initial advice to meeting all the essential requirements and compliance for your loan.

The flexibility in the utilisation of Mudra Yojana loans reflects the scheme's inclusive approach, for meeting the diverse needs of businesses across different sectors. By providing financial support for various purposes, the Mudra Yojana contributes to the overall development and growth of small and micro enterprises, promoting economic empowerment and entrepreneurship.