Account Aggregators serve as facilitators, acting as consent brokers to enable the seamless sharing of financial data across institutions in the financial sector. In essence, Account Aggregation after obtaining a NBFC Account Aggregator Licence involves consolidating a comprehensive range of financial data onto a unified platform, incorporating details from various accounts such as investments, banks, consumer records, business transactions and other pertinent financial sources.

These entities, the Account Aggregators, function as organised financial bodies that oversee the structured distribution of financial data from Financial Information Providers to Financial Information Users. The process involves seeking approval from users before transmitting this information. Importantly, the authority to grant or revoke consent rests with the users themselves and therefore getting an NBFC Account Aggregator Licence is important.

Understanding Role of NBFC Account Aggregator

NBFC Account Aggregator (NBFC-AA) is one significant financial entity that serves as the Account Aggregator specifically for customers of NBFCs. NBFC-AA plays an important role in accumulating and providing comprehensive information concerning multiple accounts held by customers across various NBFC entities. This organised and consolidated data reveals the financial engagements of customers across a range of NBFC products, including mutual funds and insurance. The concept of NBFC-AA was introduced by the Reserve Bank of India in 2015 and RBI has since issued master directions governing Non-Banking Finance Companies - Account Aggregators.

NBFC-AA's primary function revolves around furnishing data to NBFC clients regarding their accounts held within diverse NBFCs. This data is presented in a coherent and structured manner, shedding light on the customer's financial interactions across various NBFC products.

To gain a deeper understanding of NBFC Account Aggregator licence, it's essential to clarify two key terms:

Financial Information Provider (FIP):

Financial Information Providers are financial institutions that, upon request from individuals or organisations, grant access to user account information. They are regulated entities operating within the financial sector and play important role with regard to account aggregation.

Financial Information User (FIU):

Financial Information Users are entities, both individual and organisational, that require user information from FIPs for various purposes, including customer analysis and market evaluation. These entities are subject to regulation by financial sector regulators such as RBI, IRDA, SEBI and PFRDA.

Benefits of NBFC Account Aggregator Licence

NBFC Account Aggregator licence (NBFC-AA) offer several advantages, making them a valuable tool for both customers and the financial industry. These benefits include:

- Organised and Accessible Data:

NBFC-AA specialises in providing customers with organised, consolidated and easily retrievable financial data. This streamlines the process of accessing information about various accounts held by customers.

- Advanced Information Technology:

NBFC-AAs employ cutting-edge IT-oriented practices, ensuring that customers receive advanced and up-to-date data. This technological focus enhances the quality and timeliness of information provided to clients.

- Non-Monetary Resource Exchange:

Unlike traditional NBFCs, NBFC-AAs do not engage in financial transactions or monetary resource exchange with their clients. Instead, they focus solely on collecting and disseminating financial data.

- Investment Surplus Management:

Account aggregators are permitted to manage and convey investible surpluses in financial instruments but are prohibited from engaging in active trading. This allows clients to optimise their financial holdings without direct involvement in trading activities.

- Transparent Pricing:

NBFC-AAs establish their pricing policies through board-approved approaches. These pricing structures must be transparent and publicly accessible, ensuring that clients are informed about the cost of services.

- Regulatory Compliance:

NBFC-AAs are obligated to adhere to the rules and policies established by the Reserve Bank of India and other relevant authorities. This ensures that they operate within a well-defined regulatory framework, fostering trust and accountability.

- Client Protection:

NBFC-AAs are responsible for ensuring the suitability and understanding of agreements between the aggregator, clients and financial service providers. This includes safeguarding client interests, corporate governance, addressing complaints, data security, audit control and maintaining a strong risk management framework.

- Support from Financial Stability and Development Council:

NBFC-AAs play a vital role in the financial ecosystem and are supported by the Financial Stability and Development Council, which underscores their importance in promoting financial stability and development.

Components of Financial Information

Financial Information includes a wide range of data relevant to a customer's financial profile. It includes the following key elements:

- Deposits with NBFCs: Details about deposits made with Non-Banking Finance Companies (NBFCs), such as savings accounts, fixed deposits or recurring deposits.

- Structured Investment Product (SIP): Information pertaining to structured investment products, which are financial instruments with customised terms and conditions, often designed to meet specific investment objectives.

- Commercial Paper (CP): Data concerning commercial paper, which represents short-term promissory notes issued by corporations to raise funds.

- Certificates of Deposits (CD): Information about certificates of deposit, which are time deposits offered by banks and financial institutions with fixed maturity dates.

- Government Securities (Tradable): Details regarding government-issued securities that are tradable in the financial markets.

- Equity Shares: Information related to ownership stakes in companies, typically represented by shares or stocks.

- Bonds and Debentures Overview: Information regarding bonds and debentures, which are debt instruments utilised by entities to raise capital.

- Insights on Mutual Funds: Details about investments in mutual funds, including fund types, holdings and performance.

- Exchange Traded Funds: Information on Exchange Traded Funds, investment funds traded on stock exchanges, akin to stocks.

- Understanding Indian Depository Receipts: Detailed information about Indian Depository Receipts, representing shares of foreign companies traded on Indian stock exchanges.

- Insight into Collective Investment Scheme: Information regarding collective investment schemes, aggregating funds from multiple investors for investment in various securities and assets.

- Alternative Investment Fund Insights: Data about alternative investment funds, investing in non-traditional asset classes like private equity, real estate and hedge funds.

- Insightful Insurance Policies: Information including insurance policies, including coverage details, premium payments and policy terms.

Importance of NBFC Account Aggregator Licence

Getting a NBFC Account Aggregator licence plays an important role in the financial system, providing several important benefits to both customers and the financial industry. The significance of NBFC Account Aggregator licence can be understood through following factors:

1. Enhanced Financial Clarity:

Customers often have a limited understanding of their diverse financial holdings, including investments in mutual funds, insurance policies, fixed deposits, pensions and more. NBFC-AA serves as a valuable resource by offering customers detailed and consolidated information about their various assets, enhancing their financial awareness and clarity.

2. Uniform and Transparent Data:

NBFC-AAs present financial information in a standardised format on a common platform. This uniformity and transparency in data presentation make it easier for customers to understand their financial portfolios and track their investments effectively in their financial plans.

3. User-Centric Data Sharing:

The provision of financial information by NBFC Account Aggregators is contingent on the explicit consent of the user. Proper agreements exist between the customer, aggregator and financial service provider, ensuring that user data is shared only with their authorisation. This safeguards against unauthorised data access and abuse.

4. Reliable and Secure Information:

NBFC-AAs are bound by the terms and conditions of their licences, which include important aspects such as customer protection, corporate governance, risk management, data security, grievance redressal and audit control. As a result, the information provided by NBFC-AAs is reliable, secure and subject to regulatory oversight.

5. Specialised Role:

NBFC Account Aggregators specialise in the specific function of account aggregation. While they can manage investible surpluses in investments, this is subject to the stipulation that these investments are not intended for trading purposes. This focused role ensures that they provide a distinct and valuable service in the financial industry.

NBFC Account Aggregator licence bridges the information gap for customers, offering a clear and consolidated view of their financial assets. They operate within a secure and regulated framework, prioritising user consent and data protection. This makes NBFC-AA an essential component of modern financial services, contributing to greater financial literacy and transparency for users.

Duties and Responsibilities of NBFC Account Aggregator (NBFC-AA)

NBFC Account Aggregators (NBFC-AAs) have specific duties and responsibilities to ensure the secure and compliant handling of financial data. These responsibilities include:

- Customer Consent: NBFC-AAs must provide services to customers only with clear and explicit consent. This ensures that customers have control over the sharing of their financial information.

- Agreements/Authorisations: Non-Banking Financial Companies - Account Aggregators should establish proper agreements or authorisations among themselves, the customers and Financial Information Providers to substantiate the services they provide.

- Non-Transaction Role: NBFC-AAs are not authorised to support financial transactions for customers. Their primary function is to aggregate and provide information.

- Customer Documentation: The NBFC-AA must establish mechanisms to maintain proper documentation related to customers, ensuring transparency and compliance.

- Data Sharing: Financial information should only be shared with the customer who owns it or with any other Financial Information User as approved by the customer, as per the terms and conditions of the consent provided.

- Business Scope: NBFC-AAs are restricted from engaging in any business activities other than those related to account aggregation. However, they are allowed to invest surplus funds in avenues not meant for trading.

- Data Storage: Financial information accessed from FIPs shall not be retained by the NBFC-AA, ensuring data security and privacy.

- No Third-Party Services: NBFC-AAs cannot utilise third-party services to conduct account aggregation business, maintaining direct control over the process.

- Customer Rights Protection: They must have a Citizen's Charter in place that clearly outlines and protects customer rights. Customer data cannot be shared without their explicit consent.

- Data Discrepancies: In cases of discrepancies between the financial information generated by the Account Aggregator and the data in the books of the FIP, the information in the FIP's books shall prevail.

- Digital Data Sharing: NBFC-AAs facilitate digital sharing of financial information, replacing traditional paper statements. While this enhances efficiency, it also requires strong regulatory oversight to protect customer data and ensure data quality.

Eligibility Criteria for NBFC Account Aggregator (NBFC-AA) Licence

Promoters of an NBFC-AA must meet specific eligibility criteria to ensure their suitability and compliance with Reserve Bank of India regulations. The key aspects of the eligibility for promoters are:

- Promoter Suitability Assessment:

The company seeking to become an NBFC-AA and get an NBFC Account Aggregator licence must have a plan in place to assess the suitability of its promoters. This assessment should align with RBI rules and guidelines.

- Declaration from CEO/Managing Directors/Directors:

The company is required to obtain a declaration from the CEO, Managing Directors or Directors confirming their compliance with RBI directives and regulations.

- Annual Disclosure:

Promoters must provide an annual disclosure of any changes in the CEO, Directors or Managing Director positions. This disclosure should be properly accredited by Legislative Auditors and submitted within 15 days of the close of the financial year.

- Arrangement Deed:

Under RBI orders and guidelines, the company must have an arrangement deed in place that outlines the roles, responsibilities and compliance requirements of the Managing Directors, Directors or CEO.

Requirements for NBFC Account Aggregator Licence and Registration

Obtaining a NBFC Account Aggregator licence involves meeting specific criteria and adhering to regulations outlined by the RBI. The major requirements for NBFC Account Aggregator licence and registration are:

- Minimum Capital Requirement:

The applicant must have a minimum capital of Rs. 2 crores as a prerequisite for obtaining an NBFC Account Aggregator licence. This capital serves as a financial foundation for the aggregator's operations.

- Capital Raising Period:

After receiving the principle approval from RBI, the NBFC-AA is granted a 12-month period to raise the required capital. During this time, the aggregator can mobilise funds to meet the minimum capital requirement.

- Limited Scope of Services:

An NBFC-AA is restricted to providing account aggregation services exclusively. It cannot engage in fund-based activities like traditional NBFCs, making its focus solely on data collection and dissemination.

- Technological Setup:

Following regulatory approvals, the NBFC-AA is given a 12-month timeframe to establish and configure the necessary technologies and establish essential partnerships. These technological capabilities are vital for the execution of account aggregation services.

- Use of Customer Information:

NBFC Account Aggregators are strictly prohibited from utilising customer financial asset information for any purpose other than aggregation. This ensures the confidentiality and security of customer data.

- Exemption for Certain Entities:

Entities involved in aggregating accounts within specific financial sectors that are already regulated by other regulatory bodies may be exempt from obtaining RBI's separate approval. However, these exempt entities, including NBFC-AAs, are not authorised to engage in financial activities beyond aggregation as traditional NBFCs do.

It's important to note that the regulatory framework for NBFC Account Aggregator licence is designed to maintain the integrity of financial data and protect the interests of customers while allowing for the efficient aggregation of financial information. Compliance with these requirements is essential for entities seeking to operate as NBFC-AAs in India.

Process of Obtaining an NBFC Account Aggregator Licence in India

Obtaining an NBFC Account Aggregator licence in India involves a series of steps and compliance with specific requirements. Given below are the steps on how to secure NBFC Account Aggregator licence:

- Company Registration:

The first step is to register the company according to the Companies Act, 2013. This ensures that the entity is legally recognised and structured appropriately.

- Resource Assessment:

The organisation must possess the necessary resources and capabilities to offer account aggregation services. This includes having the required financial resources and technological infrastructure.

- Capital Structure:

Prepare a suitable capital structure plan that meets the minimum capital requirement. As mentioned, there is a minimum requirement of at least Rs. 2 crores in capital.

- Management Character:

Ensure that the management team has no biases that could compromise public interests. A neutral and impartial approach is essential.

- Application to RBI:

Submit an application to the RBI as an interested applicant. This application should include all necessary documentation and information required by the RBI.

- Minimum Capital Requirement:

As mentioned, ensure that the company meets the minimum capital requirement of at least Rs. 2 crores as part of the application process.

- IT and Data Infrastructure:

Have a strong Information Technology and data innovation framework in place to effectively conduct account aggregation services. This includes ensuring data security and privacy.

- Leverage Ratio:

Maintain a leverage ratio that does not exceed 7 times. This ensures financial stability and responsible risk management.

- Fit and Proper Promoters:

The promoters of the NBFC-AA must be fit and proper individuals or entities. This assessment typically involves evaluating their integrity, competence and financial standing.

Revocation of NBFC Account Aggregator Licence

The NBFC Account Aggregator licence may be cancelled if any of the following conditions are met:

- Cessation of Business: If the company ceases to operate as an Account Aggregator in India, the RBI-DNBR may revoke its NBFC Account Aggregator licence.

- Failure to Meet Conditions: The licence can be revoked if the company does not meet or comply with the conditions outlined during the granting of the Certificate of Registration as an Account Aggregator.

- Loss of Eligibility: If the RBI-DNBR becomes aware that the company is no longer qualified or eligible to hold the Certificate of Registration as an Account Aggregator, the NBFC Account Aggregator licence may be revoked.

- Violation of Mandatory Conditions: The NBFC Account Aggregator licence may be cancelled if the company violates any conditions that are mandatory to obtain or maintain the Certificate of Registration.

- Non-Compliance with RBI Directions: Failure to comply with relevant directions issued by the RBI can lead to NBFC Account Aggregator licence revocation. NBFC-AAs must adhere to RBI directives to operate within the regulatory framework.

- Failure to Maintain Accounts and Financial Information: If the company fails to maintain proper accounts, publish required information or disclose financial data as specified by the RBI or relevant laws, its NBFC Account Aggregator licence may be revoked.

- Refusal of Inspection: If the company refuses to submit its books of accounts or other relevant documents to the RBI for inspection when required, this may also result in NBFC Account Aggregator licence revocation.

Activities Required by NBFC Account Aggregator (NBFC-AA) During the In-Principle Approval Validity Period

During the in-principle approval validity period, NBFC Account Aggregators must undertake several important activities to prepare for full-scale operations while ensuring compliance with regulatory requirements. These activities include:

- Data Innovation Platform Preparation:

The company should work on establishing a strong data innovation platform. This platform is essential for the secure and efficient aggregation of financial data from various sources.

- Legal Documentation:

Ensure that all legal documentation required for conducting business activities is completed and in order. This includes contracts, agreements and compliance documentation.

- Eligibility and Suitability:

Continuously assess and demonstrate the eligibility and suitability of the NBFC-AA to hold a registration certificate. This includes maintaining the necessary capital, adhering to regulatory guidelines and upholding high ethical and professional standards.

- RBI Guidance:

Stay updated and compliant with any guidance or directives issued by the RBI pertaining to the operations and responsibilities of NBFC Account Aggregators.

- Financial Reporting:

Prepare and distribute financial statements as required by law and regulatory authorities. Transparency in financial reporting is important for maintaining regulatory compliance.

- Account Book Examination:

Allow for the inspection and examination of account books by relevant authorities to ensure the accuracy and integrity of financial data.

- Customer Data Protection:

Develop and implement measures to protect customer data, ensuring it is handled with the utmost care and in compliance with data privacy regulations.

- Training and Staff Development:

Invest in training and development programs for staff to ensure they are well-equipped to handle financial data and adhere to regulatory standards.

- Risk Management:

Continuously assess and manage risks associated with data aggregation and financial operations to prevent any potential breaches or financial losses.

Standards for Data Security in NBFC Account Aggregator Licence

Data security is paramount in the operations of NBFC Account Aggregators. These entities handle sensitive financial data from various customers, making it important to adhere to strict standards to protect the integrity and confidentiality of this information. The important data security standards for the NBFC Account Aggregator licence are:

- Strong IT Infrastructure:

NBFC-AAs must establish a secure and legally compliant IT system since they handle significant amounts of financial data from diverse customers. This includes secure storage and transmission of data from financial data providers to financial data customers.

- Protection of Customer Credentials:

Ensuring that customer credentials are not retrievable or stored within the system is essential for safeguarding user privacy and security.

- Protection Against Unauthorised Access:

NBFC-AAs should implement measures to prevent unauthorised access, modification, degradation, disclosure or distribution of records and data. This involves stringent access controls and encryption protocols.

- Utilising Advanced Technology:

Using advanced technology platforms is necessary for the preservation of financial data. This includes secure data storage and transmission protocols that adhere to industry best practices.

- Risk Management:

Implementing important risk management measures is essential for identifying, assessing and mitigating potential risks to data security. This proactive approach helps prevent data breaches and financial losses.

- External Data System Audit:

Regular data system audits by external auditors accredited by organisations ensure that the data security measures are effective and in compliance with regulatory standards.

- Regulatory Framework:

The RBI introduced regulations for NBFC Account Aggregators in 2016 to provide a comprehensive framework for their operations, including data security. These regulations aim to ensure that customer data is handled with the utmost care and protection.

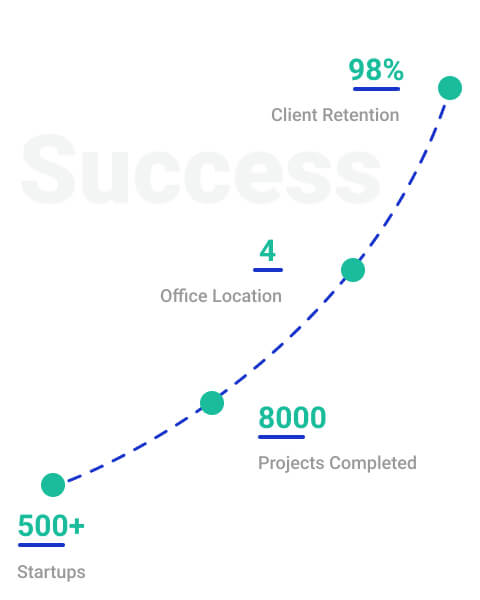

Why Choose StartupFino for NBFC Account Aggregator Licence in India?

NBFC Account Aggregator licence helps account aggregators offer their customers a valuable service by providing organised and easily accessible financial data while operating within a regulated and transparent framework. These entities help clients manage their financial resources more effectively and make informed decisions about their investments.

StartupFino is a company that specialises in offering complete services for NBFC Account Aggregator Licence. We can help you with everything from providing advice in the initial phase to ensuring that you meet all the necessary requirements and compliances for your NBFC Account Aggregator Licence and registration.