A Nidhi company refers to those entities in the non-banking finance sector that are recognised under Section 406 of the Companies Act 2013. These Nidhi Companies operating as NBFC in India are also governed by the Nidhi Rules, 2014. The primary business is borrowing and lending funds. To have Nidhi Company registration, a minimum of seven members are required. They are regarded as Benefit funds, permanent funds, Mutual benefits and Mutual Benefit Funds companies.

The (MCA) Ministry of Corporate Affairs governs the Nidhi companies in India and it also reserves the right to issue any directions related to deposit acceptance activities. The main objective of these companies is to reserve funds amongst its serving members. Unlike other NBFCs, Nidhi Companies are limited in their operations restricted to borrowing and lending activities among their individual members only. They cannot accept deposits from the general public or engage in other financial activities. Although exempted from RBI registration, Nidhi Companies must adhere to specific regulations provided by the Ministry of Corporate Affairs (MCA) in India.

Important Eligibility for Nidhi Company Registration

The consent of the RBI is not required to incorporate a Nidhi company in India. Therefore, its incorporation is very easy.

- Nidhi Companies are registered as Public Companies.

- They must affix "Nidhi Limited" at the company name's end.

- Nidhi Companies' undertakings are somewhat similar to NBFCs, and so they fall under the ambit and rules of the RBI.

- Nidhi Company's main objective is in-house lending and borrowing activities without any third-party intervention.

- Nidhi Rules of 2014 permits renting locker facilities to its members. The rental income must not surpass 20% of the Company's overall income during one the financial year.

Conditions for Incorporation of Nidhi Companies in India

The Governing Authority have the following Conditions for Incorporation of Nidhi Company in India:

- A minimum of seven (7) members are needed to start a Nidhi company

- There must 3 members who should be the designated directors

- A minimum equity share capital is to be Rs. 10 lakhs

- Within a year of Nidhi registration the Net Owned Funds (NOF) must increase to ₹20 lakhs

- Must have the company status under Company Act, 2013

- Mandatory inclusion of the Company's object in the MOA that reflects its intention and savings among the members.

- Unencumbered term deposits must make up at least 10% of the total amount of the company's existing deposits.

- 1 to 20% is the suggested Net Owned Funds (NOF) to deposit ratio. It includes equity share capital and free reserves. It excludes accumulated losses and intangible assets.

- At least 10% of the total deposits must be held in the fixed deposit account of a nationalized bank.

Benefits of Nidhi Company Registration in India

The benefits of the Nidhi Company Registration in India are as follows:

Affordable Borrowing

Nidhi company allows individuals to borrow money at a lower rate as compared to banks. These provide a significant advantage during times of financial need, as different members may require funds at various points in time.

Promotes Saving

Nidhi companies encourage all the members to save money and cultivate a frugal lifestyle. By fostering a mutual benefit society, Nidhi registration enables members to lend or borrow money and receive financial assistance among them.

Simplified Process

Nidhi company has a much simpler process as compared to the banks or unauthorized lenders. Due to the well-organized incorporation processes, members of a Nidhi company can optimize the potential of their financial resources and have access to lower interest rates when they require cash for their own requirements.

Minimum requirements

The Nidhi company registration has very few requirements for its formation. Some of important things to be kept in mind before the formation are listed below:

- Minimum of 7 members is required.

- Among these 3 are appointed as directors of Nidhi company.

- Simple documentation process

- Easy-to-do registration

- Even being a different type of NBFCs, the Nidhi company registration process is comparatively easy

No Compliance with RBI

Nidhi companies are not mandated to comply with the RBI regulations. The non-compliance gives the company freedom to inculcate better and different rules for its functioning. Complying with RBI's rules would have made it difficult for the Nidhi companies to formulate their own rules and regulations, it is a major point which differentiates them from other NBFCs.

Less Risk

Since all lending and depositing transactions are performed by members of the company, this lowers the financial risk taken by the company. In the Nidhi companies, only its members are involved with the financial transactions, making it safe and easy to track the depositing or borrowing funds from the company.

Economical Registration

Nidhi company registration is easy on the directors' pockets. The registration cost is very less for Nidhi companies than other NBFCs. Also the formation of Nidhi companies is much more simpler than other types of NBFCs. It acts as a major benefit for the directors for saving money on registration. Hence it makes it possible for directors to invest money in various business-related activities. It will also help the Nidhi companies to get business loans when required for growth of the company.

Certainty on Savings

The objective of Nidhi companies is to promote the culture of savings. Nidhi companies also ensure that they will never jeopardize the savings of their members' savings wherever it is invested. Savings are important to be inculcated in the individuals of all age groups of the society.

Net-owned Funding system

Nidhi companies follow the net-owned funding system. Net-owned funding refers to any transaction where an owner invests a particular amount in the business to raise funds for the same. However, in Nidhi companies the ratio of net-owned funding is 1:20. This makes Nidhi companies cost effective for owners to invest in the new business ventures and grow the company with more capital and diversify in the business.

Required Documents for Nidhi Company Registration

The list of Documents required for a Nidhi Company registration in India are as follows:

- Directors Identification Number, i.e., DIN and Digital Signature i.e. DSC

- Passport sized Photographs of the proposed directors and members

- Memorandum of Association of the company (MoA)

- Articles of Association of the company (AoA)

- Registered place of business proof such as lease or rent agreement

- No Objection Certificate (NOC) provided by the landlord

- Ownership proof of place of business in case the premises are owned

- PAN number: This is necessary for filing the financial transactions made by the company. A PAN card is also necessary for the taxation process of the company. PAN number of the proposed directors and members

- Address Proof: Bank Statement, Residence Card, Driving License, or any other Government issued identity proof having the address

- Residential Proof: Telephone Bill, Mobile Bill, Electricity Bill and Bank Statement

- Passport: Passports are only for companies whose directors are foreign nationals. Passport is not a mandatory document for Indian directors of Nidhi companies

- Registered Office Proof: Registered office proof for Nidhi company registration as to take government supported schemes and loans

Procedure of Nidhi Company Registration in India

The following are the steps for the procedure of incorporating Nidhi Company registration:

Step-1 Obtain DSC and DIN from MCA

The first required step is to get the DSC (Digital Signature Certificate) and also DIN (Directors Identification Number) for all the directors from the MCA. There are standard fees for such services and seek basic documentation for the same. However, the DSC is used to authenticate the document electronically. It is the most secure and legit way of signing the e-form and other documents.

Step-2 Name selection

A Nidhi Limited Company's name must be distinctive and one that aptly conveys its brand and business objective. Additionally, a set of conditions required to meet while naming a Nidhi company have been laid out in the Company (Incorporation) Rules, the Trademark Act etc. The name of a Nidhi Company cannot be the same as or similar to that of an already-existing company, LLP, an applied or registered trademark.

Step-3 Name Approval

One needs to suggest the 3 best names for the Nidhi Company to the MCA, and one of these names will be accepted by the MCA. As when you decide on the legit name for the Nidhi company, you must reserve it with the ROC in order to stop other companies from using it without your permission. All you have to do is get the name approval and reservation services, after which we must check the eligibility of the names and submit an application to reserve it, either in a RUN (Reserve Unique Name) or PART A of SPICe+ application.

Step-4 Application for Registration

After approving the name of the Nidhi Limited Company, one can proceed with its incorporation. To apply for a Nidhi company, one must fill out an online SPICe+ application available on the official website of MCA. The application is divided into two parts: that is in PART A- it is for the name reservation and PART B it is for NIDHI company incorporation. The application that is filled out and signed by any of the directors, and submitted to the ROC along with a prescribed set of documents attached alongwith it.

Step-5 Certificate of Incorporation

After receiving an application for Nidhi Company incorporation, the ROC will verify all the details and documents furnished in it. Only once ROC is satisfied with an authenticity of such details and documents, he will be registered as the Nidhi Limited Company, and issue the Certificate of Incorporation to the Nidhi company as the proof of its registration. Additionally, the ROC provides the Corporate Identification Number as the unique identity of a Nidhi Company. It takes 15-20 days to grant a certificate for incorporation of a Nidhi Company. The certificate also contains the Company's Company Identification Number (CIN).

Step-6 Obtain Nidhi Company license

Post-incorporation, a company must apply for the Nidhi Company license after fulfilling the set of conditions regarding its number of members, net funds, etc, as per the Companies Act, 2013. The application requires to be filed in form NDH 4 within 4 months from the date of incorporation or or within such extension period as permitted by the Regional Director of the Nidhi Limited Company to the Central govt. After being satisfied that the company has fulfilled all the prescribed conditions, the Government will grant the NIDHI Company license to the company and notify the same in the official gazette.

Restricted undertakings for Nidhi Company

Nidhi Companies are Not Permitted to get engage with the Following Undertakings:

- Business of Chit fund, hires purchase finance, lease finance, & acquisition of securities issued by any other corporate.

- Issuance of the preference shares, debentures, or debt instruments by any name

- Opening Current account with the serving members

- Acquisition of other entities via the purchase of securities or control of composition of BODs of any other company.

- Entering in a legal arrangement for altering the management in the absence of a board approved special resolution and without the consent of the Regional Director functioning in the respective jurisdiction.

- Conducting activities which deviate from the object of the Company.

- Accepting or lending deposits to the non-members.

- Pledging member's assets as security

- Taking any deposits or any granting funds to anybody from corporate

- Entering in any type of partnership arrangement for borrowing or lending activities

- Leveraging any form of advertisement for the soliciting deposit

- Paying incentives, mobilizing deposits from serving members, fund deployment, or issuing loans.

- In these new rules, it has been stated that the Nidhi Company must not raise loans from the banks, any financial institutions, or any other source to advance the loans for its members.

- Another prohibition is on acquiring or purchasing securities or controlling the composition of the Board of Directors of any other company or any other form entering into an arrangement for the change of its management.

Nidhi Company (Amendment) Rules of 2022

The followings are the amendments related to the registration of Nidhi Company specified under the Nidhi Company (Amendment) Rules, 2022:

No company will raise the deposit for any other member or gives a loan to any of its members in case of the following circumstances:

- if it does not comply with the rules or requirements mentioned under the Nidhi Company New Rules,

- if in case, the central government has rejected an application in Form NDH -4,

However, if anything not written under these rules must also apply to the Company incorporated on or after a commencement of these Nidhi Company New Rules.

Any of the public companies which want to be declared as a Nidhi company must have to apply in Form NDH-4 within a specified period of 120 days from the date of its incorporation for declaration as a Nidhi company. However these following conditions must be fulfilled:

- it has not less than 200 members;

- it has Net owned Funds is equal to or more than Rs. 20 lakhs

After examining an application, the central government will make its decisionwithin 45 days and convey the same to a Nidhi Company. In case it fails to do so within the given time period of 45 days, it must be deemed as to be approved as Nidhi Company Registration. However, the Company must commence its business only in the case if the central government approves the given application. The Company must also attach a declaration in regard to the fulfillment of fit and proper terms by all of its directors and promoters along with the Form NDH-4.

The following criteria must be determined that any promoter or Director is a fit and proper person:

(a) Must have an integrity, honesty, ethical behavior, fairness, reputation and character

(b) Must not have any of the following disqualifications:

- No complaint filed under section 154 of CrPC or any other pending case against him

- No chargesheet filed against him in the matter of economic offenses

- No Restraining, prohibition or department order has been passed against him in any matter in relation to company laws, securities law or financial market in force

- No Conviction order passed against him involving moral turpitude

- Not Declared involvement or any other charge

- Not Unsound mind

- Not Wilful defaulter

- No Fugitive economic offender

- Must not be a Director in five or more companies

- Must not be a promoter in three or more Nidhi Companies

Nidhi companies which are already existing must comply with all the requirements within the time period of 18 months from the date of enforcement of Nidhi Company New Rules. In this amendment the minimum paid-up share capital has been raised from Rs 5 lakhs to Rs 10 lakhs. The requirement of filing the application in Form NDH 1 within 90 days from the Company's incorporation must not be applicable to the companies incorporated on or after the enforcement of Nidhi Company New Rules. Also the requirement of Net owned funds for Nidhi Company has been changed from Rs. 10 lakhs to 20 lakhs.

In the Annexure, an amendment has been made under the Forms, (NDH 2 Form): heading, serial no. 4, serial no. 6, in (Form NDH 3) and also, Form NDH 4, another Form of NDH 5 is also inserted)

Nidhi (Amendment) Rules, 2023

The Nidhi (Amendment) Rules, 2023 were introduced by the Ministry of Corporate Affairs (MCA) on 20 January 2023. These rules specifically focus on modifying the forms associated with Nidhi companies, as originally specified in the Nidhi Rules of 2014. According to these new guidelines, Forms NDH-1, NDH-2, NDH-3, and Form NDH-4 have all been revised. The Nidhi (Amendment) Rules, 2023's Annexure contains the amended versions of these forms.

Can a Nidhi Company have branches?

Yes, a Nidhi Company is allowed to have branches as per the new amendment. In case a Nidhi company wants to open more than 3 branches outside the district or any branch outside the district, then it must have to apply in Form NDH 2 along with the fee as required under the Companies (Registration Offices and Fee) Rules, 2014. It must intimate such an opening to the Registrar within 30 days from the opening. However, in order to be eligible to open branches, the company should follow the following prescribed provisions:

- The Nidhi Company will be allowed to open branches only if it has earned the net profits after deducting tax, for the preceding 3 financial years continuously.

- The Nidhi Company has to file its financial statement or annual return to the Registrar.

- A Nidhi Company is allowed to open up to 3 branches only. All these branches have to be opened within the same district. It must not open its Branch outside the state where its registered office is situated.

- A Nidhi Company has to seek and obtain prior permission from the Regional Director in case it wants to open more than 3 branches. These branches can be within the same district or in a separate district.

- The registrar has to be intimated within 30 days of opening every branch.

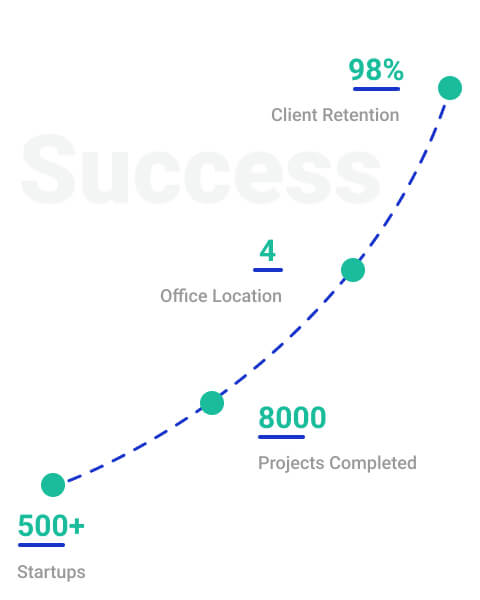

Why do you require the Startupfino Assistance?

When it comes to starting a Nidhi Company in India, choosing the right partner for your registration process is crucial. Startupfino stands as the leading choice for entrepreneurs and businesses across the nation for several compelling reasons:

- Expertise and Experience: With a proven track record of successfully registering numerous Nidhi Companies, Startupfino boasts a team of professionals who understand the nuances of the process.

- Comprehensive Services: From obtaining Digital Signatures to filing necessary documents, from securing approvals to acquiring your Nidhi Company Certificate, Startupfino offers an end-to-end solution. We handle all the details, so you can focus on your business.

- Prompt Support: We understand that time is of the essence when starting a Nidhi Company. Our team is readily available to answer the queries and assist you throughout the Nidhi company registration process.