The term Payment Gateway denotes a financial service provided through an e-commerce application service provider.However, to initiate a Payment Gateway service in India, one must acquire a Payment Gateway Licence from the Reserve Bank of India.

In addition to facilitating shopping, this digital platform expedites the payment of bills and recharges. Over time, these transactions have transitioned to be online. It is noteworthy that whenever an individual engages in online shopping or settles a bill, upon selecting the 'Pay Now' option, they are directed to a distinct webpage. This webpage, termed the Payment Gateway Website, is instrumental in effecting payments for the acquired goods and services.

Understanding The Concept of Payment Gateway

The Payment Gateway serves as an intermediary, facilitating communication between a transaction-enabled website and banks. Essentially, it gathers transaction information from the buyer's bank and transmits this data to the receiving bank. Subsequently, it records the transaction's status, indicating whether it has been approved or declined.

In the context of commencing a Payment Gateway business in India, the regulatory framework given in Section 4 of the Payment and Settlement System Act 2007 stipulates that exclusive authorisation is granted to the Reserve Bank of India for operating or initiating payment mechanisms. Should an individual or business entity wish to initiate such an enterprise, they are mandated to submit an application for authorisation to the apex bank, as specified by the provisions outlined in Section 5 of the PSS Act 2007.

Laws Governing Payment Gateway Licence in India

The following laws govern payment gateway licence in India:

Payment and Settlement System Act, 2007

The Payment and Settlement System Act, 2007 was established with the primary objective of regulating and supervising payment systems and mechanisms in India. The Reserve Bank of India serves as the principal regulatory authority under this Act, overseeing all matters falling within its purview.

Board for Regulation & Supervision of Payment & Settlements System Regulations 2008

Under the framework of the PSS Act, the Reserve Bank of India has implemented the "Board for Regulation & Supervision of Payment & Settlements System Regulations 2008." This set of regulations focuses on the constitution and composition of the Board for Regulation & Supervision of the Payment and Settlement System. Additionally, it addresses the establishment of a committee within the RBI's Central Board of Directors, which plays a vital role in the oversight of payment and settlement systems.

Payment & Settlements System Regulations 2008

The "Payment & Settlements System Regulations 2008" is another key component of the regulatory framework outlined in the PSS Act. These regulations include the application process for authorisation to initiate a payment system, the issuance of such authorisation, standards to be upheld in payment systems and the timely submission of relevant documents and financial information as well.

Benefits of Obtaining a Payment Gateway Licence

Obtaining a Payment Gateway Licence in India offers several advantages, enhancing security and convenience for users while reducing the risk of fraud. These benefits include:

1. PCI – DSS Wallet Compliance

Enhanced Security: Payment Gateway Licence ensures compliance with PCI – DSS Wallet standards, which prioritise the security of users' personal data stored in the portal or gateway. This protection is particularly important for recurring payments.

Safe User Experience: Users can securely save their bank account details on platforms like Amazon, knowing that the payment gateway safeguards their sensitive information against cyber threats.

2. White Label Wallet

Simplified Transactions: Some payment gateways enable customers to conduct digital transactions through mobile wallet applications. This trend simplifies financial operations by allowing users to manage various transactions from a single location.

Funds Transfer Convenience: Users can easily transfer funds from their bank accounts to their mobile wallet applications, using these funds for payments on other mobile applications or websites, enhancing flexibility and convenience.

3. Fraud Screening Tools

Risk Reduction: Payment gateways often offer Fraud Screening Tools to minimise the risk of data breaches and fraudulent transactions.

Comprehensive Verification: FST components such as CCV or Card Code Value, AVS or Address Verification Service and CVV or Card Verification Value help verify the legitimacy of transactions, ensuring a secure payment environment.

Preventing Fraud: These tools play an important role in confirming the absence of fraudulent activities during transactions, safeguarding users from potential financial losses.

4. Enhanced Credibility and Expanded Customer Base

A payment gateway licence serves as a testament to a business's credibility, signalling to clients that the business is reliable, trustworthy and reputable. This enhanced trust can elevate customer confidence, leading to an increase in sales and overall revenue.

By offering electronic payment options, businesses can attract a broader spectrum of clients from around the globe, thus expanding their customer base. This broader reach can result in increased potential sales and higher earnings.

5. Simplified Payment Processing and Improved Cash Flow

Possession of a payment gateway licence empowers companies to swiftly, securely and efficiently process electronic payments. The automation of payment processing reduces processing times and minimises error rates by eliminating manual interventions.

The expeditious handling of electronic payments facilitated by a payment gateway licence enables businesses to access funds swiftly, subsequently enhancing cash flow and improving financial management.

6. Regulation Compliance

Acquiring a payment gateway licence ensures that businesses adhere to all relevant rules and regulations, minimising the risk of penalties and other adverse consequences. This compliance is essential for maintaining a trustworthy business image.

A payment gateway licence also incorporates fraud prevention features, effectively mitigating the risk of unauthorised transactions and chargebacks.

Kinds of Payment Gateway

There are 2 types of payment gateway in India, which are:

1. Second-Party Providers

- Licencing Requirement: Second-party providers are typically required to obtain a Payment Gateway Licence.

- System Setup Cost: The setup cost to become a second-party provider is relatively high.

- Transaction Discount Rate: Second-party providers often offer lower TDR rates, which are part of the payment gateway charges. This makes them an attractive choice for businesses looking to minimise transaction costs.

2. Third-Party Providers

- Licencing Requirement: Third-party providers may not necessarily require a Payment Gateway Licence, depending on the specific regulatory framework and business model.

- System Setup Cost: Becoming a third-party provider generally involves lower system setup costs compared to second-party providers.

- Transaction Discount Rate: Third-party providers typically charge a higher TDR, ranging from 2 to 4 percent.

Operation of a Payment Gateway in India

A Payment Gateway plays an important role in facilitating online transactions in India. The process of how a Payment Gateway operates is as given below:

1. Encryption and Authorisation Request Process:

- When a customer initiates an order on an online platform, their browser encrypts the information before it’s sending it to the vendor's server.

- After encryption, the Payment Gateway proceeds to send the encrypted transaction data to the designated payment processor.

- Subsequently, the payment processor transmits this encrypted information to the relevant card association.

2. Bank Approval Process:

- At this stage, the bank that issued the payment card linked to the customer's transaction becomes actively involved.

- The bank reviews the transaction details, determining whether to grant approval or decline the transaction.

- Based on the bank's decision, the transaction is either accepted, proceeding further or denied, halting the process accordingly.

3. Filing of the Order

- If the customer's bank approves the transaction, the authorisation for the transaction, involving both the customer and the merchant, is then sent to the primary processor of the Payment Gateway.

- The main processor processes this authorisation and generates a response.

4. Payment Processing

- Upon receiving the response from the main processor, the Payment Gateway transmits this information back to the online portal where the customer made the purchase.

- The payment is then processed based on the response received from the main processor.

5. Transaction Completion

- The entirety of this process, commencing from the moment the customer places an order to the seamless processing of the payment, usually happens within a few seconds.

- Upon successful processing of the payment the process is deemed complete and the vendor proceeds to fulfil the customer's order promptly.

Additional Facilities Offered by Payment Gateways

Payment Gateways in India offer various additional facilities beyond quick payments to enhance security and efficiency in online transactions. These supplementary features include:

- Delivery Address Verification

Payment Gateways often provide the capability to verify the delivery address provided by the customer. This ensures that the purchased goods or services are sent to the correct location, reducing the chances of delivery errors.

- Advanced Visual System Checks

Advanced Visual System Checks involve additional validation methods, such as matching the visual elements of payment cards, like holograms and security features, to ensure the authenticity of the card being used for the transaction.

- Computer Fingerprinting Technology

Payment Gateways may employ computer fingerprinting technology to recognise and authenticate the device used by the customer for the transaction. This helps detect and prevent fraudulent activities associated with device impersonation.

- Velocity Pattern Analysis

Velocity Pattern Analysis involves monitoring the speed and frequency of transactions. If a series of transactions occurs within a short period or shows unusual patterns, the Payment Gateway may trigger alerts or additional security checks to mitigate potential fraud.

- Identity Morphing Detection

Identity Morphing Detection is a security measure used to identify instances where one person attempts to use multiple identities or accounts for fraudulent purposes. Payment Gateways may employ algorithms and checks to detect such identity manipulation.

- Calculation of Tax for Authorisation Requests

Some Payment Gateways can calculate and include tax amounts in the authorisation requests sent to the respective payment processors. This ensures that the correct tax amount is authorised and charged during the transaction.

Major Components of a Payment Gateway

A Payment Gateway comprises several key components that collectively facilitate secure online transactions. These major components include:

1. Merchant Agreement

A Merchant Agreement is a contractual arrangement between the business and the payment service provider. It outlines the roles, responsibilities and rules governing online transactions.

The agreement specifies the terms related to payment acceptance, authorisation, processing and settlement, ensuring that both parties understand their obligations in the payment process.

2. Secured Electronic Transaction

Secured Electronic Transaction is a security protocol provided by major payment providers like Visa and MasterCard. SET technology helps protect customers by implementing advanced security measures in the payment process.

SET enhances the security of online transactions by allowing merchants to verify payment information without directly viewing sensitive card details. Payment card information is securely transmitted to the card issuer for verification, reducing the risk of data exposure during online transactions.

Eligibility Criteria for a Payment Gateway Licence in India

Obtaining a Payment Gateway Licence in India involves meeting specific eligibility criteria. The basic requirements for securing such a licence include:

- Incorporation Under the Companies Act:

The entity or company seeking the Licence must be incorporated in accordance with the provisions of either the Companies Act, 2013 or the Companies Act,1956.

- Minimum Membership Requirement:

The entity is mandated to have a minimum of two members, which may include shareholders or partners, depending on the company's legal structure.

- Mandatory Directorship:

At least two directors must be appointed to the company's board. These directors play a pivotal role in overseeing operational activities and ensuring compliance within the payment gateway.

- Verification of Business Address:

Valid address proof for the business is a requirement, including documents like utility bills, lease agreements or property ownership documents. This verification validates the physical location of the company.

- Comprehensive 5-Year Business Plan:

A detailed business plan outlining the company's objectives, strategies and financial projections for the coming five years is a vital requirement. This plan is important for regulators to evaluate the payment gateway's sustainability and viability.

- PAN of the Company:

The Permanent Account Number of the company is necessary for tax-related purposes and legal compliance.

- Current Bank Account Details:

Providing details of the company's current bank account is essential for conducting financial transactions and complying with monetary regulations.

- System Flow & Code Testing Report:

A report from a certified software testing agency is required to ensure the reliability and security of the payment gateway's system flow and code. This report demonstrates that the gateway can handle transactions securely.

- Compliance with PCI DSS:

Compliance with the Payment Card Industry Data Security Standard is also essential to ensure the security of cardholder data and other important things.

- Service tax registration no.:

Along with all the above details, a service tax registration no. wherever applicable is also needed.

Capital Requirements for Payment Gateway Licence in India

The capital requirements for obtaining the Licence vary based on the type of entity and the nature of prepaid payment instruments. Given below are the capital requirements:

1. Non-Banking Financial Companies and Scheduled Banks:

Non-Banking Financial Companies and scheduled banks who want to function as payment gateways in India have to mandatorily adhere to the Capital Adequacy Requirements established by the Reserve Bank of India. Only NBFCs and scheduled banks that meet the RBI's capital adequacy requirements will be permitted to issue prepaid payment instruments.

2. Entities Authorised under FEMA:

Entities authorised under the provisions of the Foreign Exchange Management Act, 1999, to issue foreign exchange Prepaid Payment Instruments, are exempt from the scope of RBI guidelines regarding capital requirements for payment gateways.

These foreign exchange PPIs are typically limited to permissible current account dealings and transactions, subject to the restrictions outlined in the Foreign Exchange Management Current Account Transactions Rules 2000. The use of these instruments is regulated by FEMA rules and compliance with FEMA guidelines is necessary for entities issuing foreign exchange PPIs.

Documents Required for Obtaining a Payment Gateway Licence in India

When applying for a Payment Gateway Licence in India, you must provide specific documents, which include:

- Certificate of Incorporation:

A copy of the CoI issued by RoC is required to verify the legal registration of the company.

- PAN Card of Directors:

Personal Account Number cards of all directors of the company need to be submitted as part of the application process.

- Address Proof of Directors:

Address proof documents, such as Aadhaar cards, passports or utility bills, for all directors are essential to verify their residential addresses.

- Digital Signature Certificate of Directors:

Digital signatures of directors are necessary for digitally signing and submitting application documents electronically.

- Director Identification Number:

DINs of directors are required for identification and regulatory purposes.

- Registered Office's Address Proof:

Proof of the registered office's address, such as utility bills or rental agreements, is needed to establish the physical location of the company.

- Bank Account Information:

Detailed particulars regarding the company's current bank account, inclusive of bank statements and account specifications, are essential for financial verification and seamless transaction processing.

- Business Planning for the Next Five Fiscal Years:

A comprehensive business plan of the company's goals, strategic approaches and financial forecasts for the subsequent five fiscal years is vital.

- Testing Code Report by a Software Agency:

A report regarding the testing of the payment gateway's code by a certified software agency is essential to ensure the reliability and security of the system.

Procedure for Obtaining Payment Gateway Licence in India

The process of obtaining payment gateway licence in India is as given below:

Step 1: File Application for Registration

Initiate the authorisation process by submitting an application, utilising the prescribed Form A. as per section 5(1) of the Payment and Settlement System Act.

Address this application to the Chief General Manager of the Department of Payment & Settlement Systems, which is at the Central Offices of RBI in Mumbai or at other RBI offices specifically designated for this purpose.

Step 2: RBI Checks Authenticity

The RBI, based on the discretionary powers granted by section 6 of the PSS Act, assesses and approves the application for authorisation.

RBI may conduct inquiries and verification processes to ensure the authenticity of the information provided by the applicant and the credentials of all involved participants.

Step 3: Compliance of Conditions for Authorisation

Before issuing authorisation, the RBI considers various conditions, including:

- a) The necessity for the proposed payment mechanism or services.

- b) Technical standards for the payment mechanism or system.

- c) Terms and conditions, including security procedures.

- d) Payment system operation procedures.

- e) Payment instruction acquisition methods.

- f) The applicant's financial status, experience and integrity.

- g) Customer-provider relationship terms.

- h) Credit and monetary policies.

- i) Authorisation timeframe.

Step 4: Issuance of Authorisation Certificate

If the RBI is satisfied that all requirements as per section 7(1) are met, it issues an Authorisation Certificate in Form 'B' to the applicant.

The authorisation then only takes effect from the date determined by the RBI and is subject to the conditions imposed by the RBI.

Step 5: Authorisation within 6 Months

As given under section 4 of the PSS Act, the RBI has to process applications with maximum processing time of six months only from the date of application submission. This is an important step in the registration procedure as it ensures timely processing of applications.

Validity of Payment Gateway Licence in India

In terms of validity and renewal, the licence has a one-year duration. Failure to follow the regulations in the validity period may lead to fines or other legal repercussions. Therefore, timely renewal and strict adherence to regulatory requirements are essential for maintaining a valid licence.

IT Requirements for Obtaining Payment Gateway Licence in India

Obtaining the Licence involves meeting specific IT requirements to ensure the security and reliability of the payment gateway system. Given below are the different IT requirements:

Security-Related Recommendations for Payment Gateway Licence Holders

The Reserve Bank of India has issued several important security-related recommendations that licenced Payment Gateway Systems must adhere to in order to maintain the security and integrity of their operations. These recommendations include:

1. Information Security Governance:

PGS should conduct comprehensive security risk assessments covering areas such as people, IT and business processes. This assessment helps identify risk exposures and defines remedial measures as well as residual risks.

Security checks can be carried out through internal security audits conducted annually by independent security auditors or by CERT-In impanelled auditors. Reports on risk assessment, security compliance, security audits and security incidents should be presented to the Board.

2. Data Security Standards:

PGS should implement the best data security standards and practices, including compliance with standards like PCI-DSS i.e., Payment Card Industry Data Security Standard, PA-DSSand the use of the latest encryption standards and transport channel security.3. Security Incident Reporting:

PGS must promptly report any security incidents or cardholder data breaches to the RBI within the stipulated timeframe.

Monthly cybersecurity incident reports, along with root cause analysis and preventive actions taken, should be submitted to the RBI.

4. Merchant Onboarding:

During the merchant onboarding process, PGS should conduct thorough security assessments to ensure that merchants comply with minimum baseline security controls.

5. Cyber Security Audit and Reports:

PGS must conduct and submit the following reports to the IT Committee:

- Quarterly internal and annual external audit reports.

- Bi-annual Vulnerability Assessment reports.

- PCI-DSS compliance reports, including Attestation of Compliance and Report of Compliance reports.

- Any observations, corrective actions and preventive actions planned, along with action closure dates.

6. Information Security:

PGS should review the board-approved information security policy annually. This policy should cover various aspects, including objectives, scope, ownership, responsibilities, organisational structure, roles, asset inventory, data classification, authorisation, knowledge and skills, training, compliance review and penal measures for non-compliance.

7. IT Governance:

Establish IT policies for the effective management of IT functions and ensure detailed documentation of procedures and guidelines is in place.

Also, review the strategic plan and policy annually.

Board-Level IT Governance Framework

The establishment of an efficient IT governance framework at the board level is important for the effective management and oversight of IT-related matters within a Payment Licence system. Given below are key components of a board-level IT governance framework:

Involvement of Board:

The Board or top management of the Payment Licence system plays an important role by:

- Approving information security policies that provide the foundation for IT security measures.

- Establishing the necessary organisational processes or functions for information security, ensuring that security is integrated into the company's operations.

- Providing the necessary resources, both financial and human, to support IT governance initiatives.

IT Steering Committee:

The Payment Licence system should form an IT Steering Committee comprising representatives from various business functions as appropriate.

This committee's role is to assist the Executive Management in implementing the IT strategy approved by the Board.

Enterprise Information Model:

The Payment Licence system must establish and maintain an enterprise information model.

This model supports application development and decision-supporting activities consistent with the IT strategy approved by the Board.

Cyber Crisis Management Plan:

The Payment Licence system should develop a comprehensive Cyber Crisis Management Plan that is approved by the IT strategy committee.

This plan should include components such as:

- Detection: Strategies and mechanisms for detecting cyber threats and incidents in a timely manner.

- Containment: Actions to limit the impact of a cyber crisis and prevent its escalation.

- Response: Procedures for responding effectively to cyber incidents, including communication and coordination.

- Recovery: Strategies for recovering from a cyber crisis, restoring services and mitigating future risks.

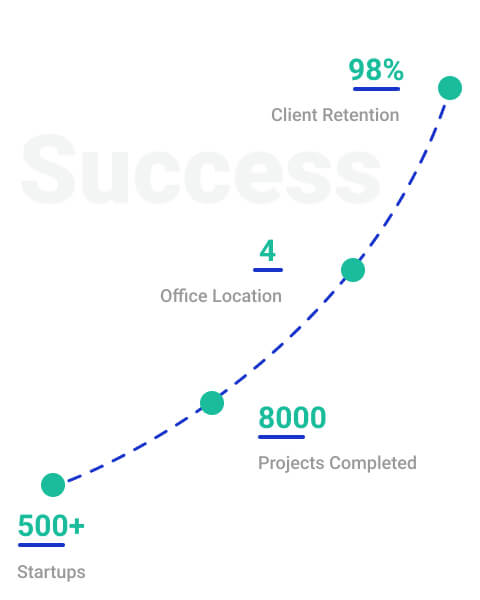

Why Choose StartupFino for Payment Gateway Licence in India?

A Payment gateway licence in India operates by allowing secure transmission of encrypted customer transaction data to payment processors, banks and card associations. The process involves many layers of authentication and authorisation to ensure the security and integrity of online transactions, ultimately providing an efficient payment experience for both customers and merchants.

StartupFino is a company that specialises in offering complete services for Payment gateway Licence. We can help you with everything from providing advice in the initial phase to ensuring that you meet all the necessary requirements and compliances for your licence and registration.