Payroll processing is the full lifecycle management of employee compensation, from policy development to pay stipendiary and compliance with law. It makes timely and accurate payments to employees subject to regulatory requirements in addition to organisational guidelines.

Understanding the Payroll Process

The payroll process contains the calculation and distribution of payment to workers for work completed during a certain pay pd. It might include determining gross wages, net pay and deductions for every worker based on salary, hours worked and associated benefits or taxes. The exact record keeping of worker pay, taxes and deductions is a financial and legal obligation.

A HR and payroll management system handles employee compensation along with related tasks accurately, legally and efficiently by managing each step of the payroll process.

Payroll and HR management generally includes:

|

Aspect

|

Description

|

|

Processing Payroll

|

Calculation and distribution of employee salaries promptly and accurately.

|

|

Managing Staff Salaries

|

Tracking staff salaries, including adjustments and changes over time.

|

|

Tracking Deductions and Payment Info

|

Monitoring deductions for taxes, benefits, and other payment data.

|

|

Employee Record-keeping

|

Maintaining basic employee records such as contact details, employment history, and banking info.

|

|

Statutory Compliance

|

Filing IT returns, depositing TDS, PF contributions, and other statutory dues as required by law.

|

Different Ways of Payroll Processing

Effectively managing payroll is important for companies to make sure accurate compensation of workers and regulatory compliance. Two common payroll processing techniques are:

1. Excel Based Payroll Management

Excel-based payroll processing uses spreadsheet applications like Microsoft Excel to compute payroll.

Process:

- Payroll calculations are done manually from templates with built-in formulas.

- Data entry contains employee details, wages, attendance records, deductions and taxes.

- Payroll officers enter data into Excel sheets and compute salaries using formulas established.

Challenges:

- High risk of clerical and mathematical errors from manual data entry.

- Difficulty adding or even eliminating personnel from payroll list without interfering with calculations.

- Duplicate data entry and omissions Potential.

- Constant monitoring of Tax updates and statutory changes (Provident Fund (PF) along with Professional tax (PT) regulations.

2. Outsourcing Payroll

Outsourcing payroll means having outside organisations or service providers like StartupFino handle payroll on its behalf.

2. Outsourcing Payroll

Outsourcing payroll means having outside organisations or service providers like StartupFino handle payroll on its behalf.

Process:

- External payroll service providers gather employee data including attendance, leaves and reimbursement details.

- They compute payroll (salary computation, deductions & taxes) from the data supplied.

- Payroll service providers assure statutory compliance with tax regulations along with other legal requirements.

Benefits:

- Removes the organisation of the burden of payroll processing and compliance management.

- Access specialised expertise and resources for timely payroll processing.

- Outsourcing meets statutory requirements, avoiding legal issues and penalties.

Finding a great payroll service provider with experience like StartupFino is important to secure and accurate payroll processing.

Essential Features of Payroll Management

Efficient HRMS and payroll management systems provide features to simplify procedures, ensure compliance and support strategic decision making. The basic features of hrms & payroll management are given below:

|

Sr No.

|

Key Feature

|

Description

|

|

1

|

Fast Turnaround

|

Quick processing of payroll tasks including salary calculation, deductions, and payment disbursement.

|

|

2

|

Complete Lifecycle Support

|

Supports the entire employment lifecycle from onboarding to offboarding, including changes in status, benefits, etc.

|

|

3

|

Simplified Payroll Procedures

|

Automation and integration capabilities simplify payroll processes, reducing manual effort and boosting productivity.

|

|

4

|

Minimal IT Infrastructure Investment

|

Cloud-based or web-based solutions require minimal IT infrastructure investment, offering growth for all sizes.

|

|

5

|

Resource Allocation Optimisation

|

Efficiently utilises personnel, financial resources, and technology to manage payroll operations and support objectives.

|

|

6

|

Compliance & Statutory Requirements

|

Ensures compliance with tax laws, employment laws, and reporting obligations, lowering compliance risks and meeting standards.

|

|

7

|

Error Free Documentation & Reporting

|

Accurate documentation and reporting reduce payroll processing mistakes and improve compliance audits.

|

|

8

|

Risk Mitigation

|

Strict compliance and internal controls reduce the risk of fines, penalties, or legal action for non-compliance.

|

|

9

|

Employee Issue Resolution

|

Facilitates the resolution of employee inquiries or conflicts related to payroll matters, enhancing satisfaction.

|

Payroll Process Stages

The payroll process has many stages, each needed to handle employee compensation and meet regulatory requirements. The primary duties of a payroll and HR management system are as have been listed below:

1. Structured Compensation

This stage includes creating a structured compensation system - employee salaries, wages, bonuses along with other compensation. Clear guidelines specify how compensation is figured out according to job role, experience and performance.

2. Determining Deductions & Leaves

At this particular point, deductions from worker wages (such as taxes, retirement contributions, insurance premiums, etcetera. Leaves such as vacations, sick leave and unpaid leave are also included into the payroll calculation.

3. Salary Calculating & Processing

After compensation and deductions are determined, then net pay per employee is calculated. This includes hours worked, overtime, commissions along with other earnings or adjustments. Salaries are processed promptly and correctly.

4. Control of Payroll Taxes

Compliance with payroll tax regulations is important. This particular stage computes and withholds payroll taxes from employee wages (income tax, and any other taxes). Withheld payroll taxes must be remitted by the appropriate tax authorities by the established deadlines.

5. Submitting Returns

Payroll systems prepare and submit various tax returns and reports to governments. These returns consist of a no. of forms and returns. Timely and accurate submission of these returns is vital to avoid penalties and maintain compliance.

6. Generating Reports & Pay Slips

Lastly, payroll process generates reports on payroll data, tax obligations, and worker earnings. Pay slips or statements are given to workers describing gross pay, deductions, net pay along with other pay period details.

Payroll Management Methods

Given below are the main payroll mgmt methods:

|

Payroll Method

|

Description

|

|

Manual Payroll Processing and Management

|

A manual technique involving records and calculations, suitable for very small businesses.

|

|

Payroll Software

|

Automates payroll processes, saving time and reducing errors. Specialists assist in software selection.

|

|

Outsourced Payroll

|

Payroll functions are outsourced, allowing businesses to focus on core operations.

|

|

Cloud Payroll Management

|

Provides access to payroll system from any location at any time; installation and maintenance included.

|

|

Integrated Payroll Processing and Management

|

Combines payroll with other HR operations like benefits and time tracking.

|

Selecting a Payroll Processing and Management System

Selecting the best payroll management system for your business calls for considering no. of elements to make certain it fits your unique requirements and assists with payroll processing. The following are main considerations:

|

Criteria

|

Description

|

|

Size of Your Business

|

Determine the complexity and scale of your business operations. Smaller companies may be okay with manual or simpler software solutions, while larger firms may require more intricate or integrated systems capable of handling increased transactions and employee data.

|

|

Cost

|

Consider budget constraints and total cost of ownership, including initial purchase or subscription fees, ongoing maintenance costs, and additional expenses such as personnel hiring for system management. Choose a solution that fits within your financial means and offers space for future growth.

|

|

Usability

|

Prioritise intuitive, user-friendly payroll systems that simplify tasks, eliminate duplicate setups, and accommodate updates or changes easily. A simple interface enhances efficiency and reduces the risk of errors in payroll processing.

|

|

Customer Support

|

Select a payroll service provider with excellent customer support, offering timely assistance from competent staff for troubleshooting technical issues, addressing queries, and maintaining payroll operations. Choose StartupFino for availing these features.

|

|

Protection

|

Choose a payroll management system prioritising confidentiality and data security. Verify the presence of adequate protection measures against unauthorised access, data breaches, and cyber risks to safeguard company and employee information.

|

Payroll Management Process

Payroll process includes the tasks of paying workers a wage i.e. employee's payroll management system and complying with legal and organisational policies. This includes:

|

Step.

|

Task

|

Description

|

|

1.

|

Employee Compensation

|

Payroll is the procedure of keeping a list of workers paid by the organisation for their services. This includes determining the total amount paid to workers - wages, salaries, bonuses along with other benefits.

|

|

2.

|

Making Pay Policy

|

Pay policy development is a component of payroll management. This policy shows how the organisation compensates workers, including flexible benefits, leave encashment policies along with other allowances.

|

|

3.

|

Payslip Components

|

Payslips show basic salary in addition variable pay, House Rent Allowance (HRA), Leave Travel Allowance (LTA) along with other allowances paid to workers. These components are computed based on some basic criteria and employee agreements.

|

|

4.

|

Payroll Inputs

|

Payroll processing also consists of other inputs that impact payroll calculations. This might include information from outside vendors such as food supply solutions which contribute to employee benefits or deductions.

|

|

5.

|

Salary Disbursement & Dues Deposits

|

Payroll and HR management involves releasing workers' salaries on the established schedule. Additionally, it entails timely payment of statutory dues like Tax Deducted at Source (TDS), Provident Fund (PF) along with other contributions to the concerned authorities.

|

|

6.

|

Filing Returns

|

Compliance with tax and labour regulations requires filing returns punctually and accurately. Payroll processing includes the creation and submission of necessary documents to meet regulatory compliance and legal obligations.

|

|

7.

|

Net Pay Calculation

|

The final step of payroll processing is identifying net salary for every worker after income tax, deductions, along with other withholdings are taken into account. This ensures employees receive the correct compensation after deductions.

|

Payroll Processing In India

Payroll processing in India is divided into pre payroll and post payroll activities.

Pre-Payroll Activities

Effective payroll processing in India involves careful pre-payroll activities like policy definition, input gathering & validation and finally payroll calculation.Pre payroll activities involve:

|

Step

|

Description

|

|

Defining Payroll Policy

|

The very first step is creating payroll policies, with management approving guidelines for payroll procedures. This includes defining policies like Pay Policy, Attendance Policy, Leave and Benefits Policy, etc. to standardise payroll operations.

|

|

Gathering Inputs

|

Different departments inputs are collected to compute payroll.

Examples of data sources and corresponding data include:

- Employees: Income tax declarations, availed facilities etc.

- HR Team: Salary structure/benefit eligibility, etc.

- Finance Team: Recovery deductions, adjustment of cash, etcetera.

- Leave & Attendance Systems: Attendance reports, present working hours, etcetera.

- General Service Providers: Information from vendors such as canteen facilities or transport services.

|

|

Input Validation

|

Validation of gathered data is an important obligation for accuracy and compliance. Steps include:

- Verifying active employee records and deleting inactive ones.

- Checking data conformity with company policies and formats.

- Ensure data accuracy & completeness.

|

|

Payroll Calculation

|

The validated input data is processed by the payroll system to create net pay after taxes and deductions.

The key steps consist of :

- Entering validated information into payroll.

- Calculating gross pay, taxes and deductions.

- Creating payslips with net pay details.

- Conducting reconciliation to confirm accuracy and find discrepancies.

|

Post-Payroll Activities

Post-payroll activities i.e. after processing payroll - are necessary for compliance, accounting and reporting. The main steps here are:

|

Step

|

Description

|

|

Statutory Compliance

|

The payroll administrator should follow statutory compliance regulations. This includes statutory payments to Employee Provident Fund (EPF), Tax Deducted at Source (TDS), and Employee State Insurance (ESI) coming from the workforce. These deductions are then returned to the authorities or government bodies within the specified time.

|

|

Payroll Accounting

|

Every organisation needs accurate payroll accounting records. The salaries paid are a major entry in the organisation's books of accounts. Proper accounting practices result in transparency and compliance with financial reporting standards.

|

|

Payout

|

After statutory deductions and accounting entries are processed, salaries are credited to employees. Payments may be in cash, cheques, or bank transfers. Having salary accounts for employees makes it simple and secure to pay.

|

|

Reporting

|

The final step in payroll is preparing comprehensive reports. These reports include department-wise or location-wise employee expenses, tax obligations, and compliance status. Accurate reporting reveals payroll expenses and supports strategic decision-making.

|

Challenges With Payroll Process

Managing payroll presents a no. of hurdles for businesses to resolve to ensure accuracy, efficiency, and compliance. Common issues with payroll process are:

|

Concern

|

Description

|

|

Changing Laws

|

Keeping up with changing tax regulations, employment laws, and compliance needs can be tough. Following these changes in legislation entails regular monitoring and knowledge of new requirements, which is time-and resource-intensive.

|

|

Time consuming

|

Management of payroll includes calculating wages, taxing, and submitting reports. This might take up considerable resources and time and divert attention from other important business activities and strategic initiatives.

|

|

Mistakes

|

Even little errors in payroll processing systems like incorrect calculation or even missed deductions can be costly. Inaccurate payroll records can cause angry workers, legal disputes, and penalties from regulatory authorities, all of which undermine credibility and trust.

|

|

Protection

|

Protect very sensitive payroll data from unauthorised access, data leaks, or identity theft. Encryption protocols, regular audits, and access controls are required to safeguard employee information and privacy.

|

|

Cost

|

Businesses spend a lot of money on hrm payroll systems, software, and skilled staff. The cost of payroll & hr management versus benefits and value it delivers requires careful consideration to attain cost-effectiveness and optimum resource allocation.

|

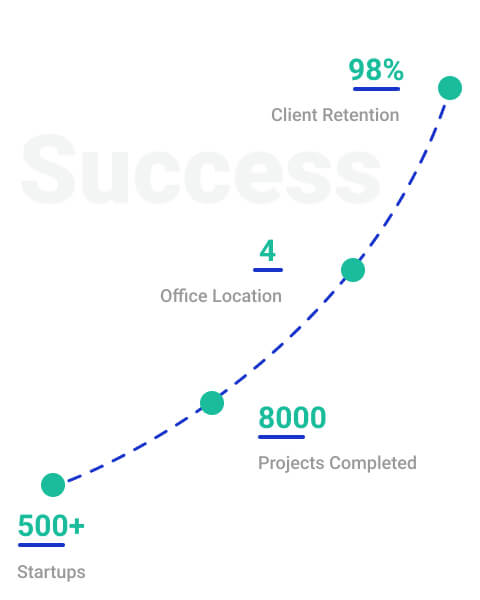

Why Choose StartupFino for Payroll Management Services?

Choose StartupFino for payroll processing and management solutions for quick payroll processing. Our experienced team calculates salaries, deductions and taxes according to statutory regulations. With StartupFino, you get access to the latest payroll technology to simplify payroll and minimise errors.

We offer customised solutions to suit your business requirements - whether you're a start up or an established business. Our commitment to client satisfaction includes clear and open communication and resolution of any payroll related queries quickly. Trust StartupFino to handle your payroll so you can concentrate on your business growth and innovation.