There are more than 39,000 startups in India these days that can access several private equity & debt funding options. But obtaining funding is tough when the business is a concept or a beginning stage. Additionally, the Micro, Small and Medium Enterprises (MSME) segment of India has restricted ability to access proper credit and thus the Government of India introduced startup business loan programs for startups and MSMEs.

The Small Industries Development Bank of India (SIDBI) has also begun lending to entrepreneurs and MSMEs directly as opposed to banks. The rates for these kinds of loans tend to be nearly 300 basis points lower compared to those provided by banks.

Benefits of Business Financing for Startups

Some of the main benefits of Startup Business Loans are:

Tax relief for New entrepreneurs

New entrepreneurs get 3 years of Tax Relief to cushion their initial startup expenses.

Equity Preservation

Unlike money from venture capital, which may be costly and have high return expectations, bank loans do not involve Equity dilution. This means entrepreneurs keep 100% ownership & control over their business and also have access to money.

Accessibility & Ease of approach

In India there are numerous Banks and NBFCs (Non-Banking Financial Companies) where entrepreneurs can Approach local bankers & request money & credit facilities. This accessibility makes funding easier for startups.

Structured processing

Banks in India follow a prescribed procedure for Processing funding requests from entrepreneurs. This method means most loan applications are processed quickly with minimal documentation - decreasing bureaucratic obstacles for startups.

Independent business Management

Borrowers retain complete control of their Business profits & losses with bank loans. Unlike venture capital investors who may count on accountability and involvement in business decisions, entrepreneurs manage only their business finances.

Startup Business Loans Options in India

Given below are the main Startup Business Loan options for your startups:

|

Type

|

Description

|

Repayment Period

|

Collateral Required

|

|

Working Capital Loan

|

Provides money to small business startups without collateral. Short-term loans with repayment periods up to fifteen years.

|

Up to 15 years

|

No

|

|

Term Loan

|

For startups only, available in both long and short terms. Repayment varies from 12 months to 5-10 years.

|

12 months to 5-10 years

|

Varies

|

|

Overdraft Facility

|

Allows withdrawal from an account with zero balance. Requires collateral, generally a fixed deposit with the bank.

|

Varies

|

Yes

|

|

Letter of Credit

|

Guarantees funding for business suppliers in global trade, commonly used in trading businesses.

|

Varies

|

No

|

|

Government Loan Schemes

|

Various government schemes like Startup India, PMEGP, and Standup India provide financial support to startups.

|

Varies

|

Varies

|

|

Equipment Finance/Machinery Loan

|

Helps startups purchase machinery or equipment with tax advantages for qualifying companies.

|

Varies

|

Yes (Equipment)

|

|

Merchant Cash Advance

|

Lends money based on a percentage of everyday credit card income, with repayment tied to credit card payments.

|

Tied to credit card payments

|

No

|

|

Invoice Financing

|

Allows borrowing against outstanding customer invoices to fund expenses and business expansion.

|

Varies

|

Yes (Invoices)

|

Working Capital Loan

Working capital loans provide the money to small business startups without collateral. They're generally short-term loans with repayment periods up to fifteen years, based on the loan amount.

Term Loan

Term loans are typical for start ups and come in both long and short terms. Repayment terms for short term loans usually range from twelve months to five to 10 years.

Overdraft Facility

An overdraft facility lets business owners take money from an account with zero balance. This particular startup financing requires collateral - usually a fixed deposit with the bank account.

Letter of Credit

Commonly used in trading businesses, a letter of credit guarantees funding for business suppliers for global trade.

Government Loan Schemes

Many government loan schemes including Startup India, PMEGP and Standup India offer financial support to start ups.

Equipment Finance/Machinery Loan

This loan helps startups buy machinery or equipment with tax advantages to qualifying companies.

Merchant Cash Advance

Merchant cash advance institutions lend startups money based on a percentage of their everyday credit card income, with repayment tied to credit card payments.

Invoice Financing

Invoice financing allows startups borrow against outstanding customer invoices and fund crucial expenses and business expansion.

How To Figure Out How Much Business Funding You Need?

Startups must know what you need the money before you estimate just how much business finance you need. You may want to apply for more than you require - but then you owe back the cash. Instead, obtain a loan amount that covers your company's needs without you needing more cash.

Whenever you want the funds for a particular business expense or investment, doing the calculation is busy work. Remember to modify your business plan according to the business loan amount. It is particularly important for new - started businesses.

You might want to consider a business line of credit for startup in case you want money for ongoing expenses or your company has frequent business requirements. Having a line of credit for startup business, you receive a credit limit to work with if you want it. The available credit is replenished as you repay.

Top Govt. Start Up Loan Schemes In India

Given below are details of gov start up business loans during the past several years by the govt. of India:

|

Scheme Name

|

Description

|

Loan Amount

|

Eligibility

|

|

Startup India

|

Govt. initiative for startup growth, offering loans at attractive rates.

|

Varies

|

Startups

|

|

Standup India

|

Funds for SC/ST and women entrepreneurs, facilitating small business launches.

|

Rs. 10L - Rs. 1Cr per branch

|

SC/ST, Women Entrepreneurs

|

|

psbloansin59minutes.com

|

Website approving loans in 59 minutes, ranging from Rs. 10L to Rs. 5Cr at 8.50% p.a.

|

Rs. 10L - Rs. 5Cr

|

Businesses

|

|

MUDRA Loan

|

Collateral-free loans up to Rs. 10L, with attractive interest rates and flexible repayment.

|

Up to Rs. 10L

|

Individuals, Businesses

|

|

CGTMSE Scheme

|

Govt. initiative offering collateral-free loans for MSMEs, benefiting first-time entrepreneurs and startups.

|

Varies

|

MSMEs, First-time Entrepreneurs

|

|

SIDBI's Growth Capital

|

Startup funding from various banks and financial institutions, tailored to entrepreneurs' needs.

|

Varies

|

Startups

|

1) Startup India

Startup India Scheme is an Government of India initiative which gives immediate business loans to startups for growth and expansion. Other functions of Startup India are promotion of Startups, creation of wealth and employment generation. Startups can register for business loans with Startup India at attractive interest rates.

2) Standup India

Stand Up India Scheme offers funds to SC/ST category individuals & women entrepreneurs of the society. Stand-up India scheme was launched by Government of India for credit services mainly for SC/ST category people. Its objective is to assist banks by providing loans of Rs. 10 lakh & Rs. 1 crore per bank branch to more than one SC/ST applicant along with one women entrepreneur to launch a small business.

3) psbloansin59minutes.com

The Government of India has introduced a web site which approves business loan applications in 59 minutes from submission. Its minimum loan amount offered by this plan is Rs. Ten lakh plus the maximum is Rs. 5 crores. Banks/NBFCs providing interest rate under this scheme start from 8.50% p.a.

3) MUDRA Loan

Mudra Yojana within Pradhan Mantri Mudra Yojana (PMMY) - Loans up to Rs. Ten lakh without asking borrowers for collateral at attractive interest rates. Repayment tenure as much as 5 years and processing fee Nil to nominal. No minimum loan amount is needed for borrowing. The interest rates shall differ from bank to bank according to the profile and businesses of the applicant.

5) CGTMSE Scheme

Credit Guarantee Funds Trust for Micro and Small Enterprises (CGTMSE) is another Government initiative offering MSMEs funding through financial institutions like banks and NBFCs. First-time entrepreneurs & startup companies are benefited under this scheme. The loan offered under CGTMSE scheme is collateral-free.

6) SIDBI's Growth Capital and Equity Assistance Scheme

Entrepreneurs can now get this certain type of funding for their startup from the banks. Numerous banks and financial institutions provide loan schemes designed for startups and their requirements. Various banks might give these Startup Business Loans in different names.

Eligibility Criteria for New Startup Business Loans

Given below are the basic set of eligibility criteria for new Startup Business Loans:

Applicants must be between 21 and 65 years old at the time of loan maturity.

Applicants should be self-employed.

The startup must be established as a sole proprietorship, partnership firm, private or public limited company, or a limited liability partnership.

A good credit score is required.

Applicants with no previous loan defaults with any bank will be given preference.

The total annual turnover of the firm should not exceed Rs. 25 crore.

Documents Required for Startup Business Loan Application

Given below are the set of documents required for Startup Business Loans:

|

Document Type

|

Documents Required

|

|

Photographs

|

Two copies of passport-size photographs

|

|

Proof of Identity

|

Any of the following: PAN Card, Passport, Aadhaar Card, Voter's ID, Driving Licence

|

|

Address Proof

|

Any of the following: Passport, Driving License, Aadhaar Card, Postpaid Phone Bill, Voter's ID

|

|

Age Proof

|

Any of the following: Passport, PAN Card

|

|

Bank Statements

|

Statements from the last six months

|

|

Proof of Income

|

Any of the following: Income Tax Returns, Salary Slips

|

|

Signature Proof

|

Any of the following: Bank-verified signature, PAN Card, Passport

|

|

IFSC Code Proof

|

Any of the following: Cancelled or scanned cheque, Copy of the front page of passbook from the same bank account

|

The documents required in detail are:

- Application Form and Photographs:

Ensure that the application form is completely filled out and accompanied by recent passport-sized photographs.

Submit KYC documents for both the applicant and co-applicants. These may include:

- Passport

- Aadhar card

- Voter’s ID card

- Driving License

- PAN Card

- Utility Bills (Telephone & Electricity Bills)

- Last 12 months’ bank statement

- Last 1-year ITR

- Business Incorporation Certificate

- Business Address Proof

Be prepared to provide any other documents requested by the lender to complete the application process.

Process of Getting Startup Business Loans

Given below is the process for getting Startup Business Loans:

Step 1: Fill In Application Details

Complete all required fields, including :

- Desired loan amount.

- Employment status.

- Yearly gross sales or turnover.

- City of residence.

- Years in current business.

- Collateral type.

- Mobile number.

Step 2: Agree to terms

Check the box to accept Terms and move on to the next step.

Step 3: Give Additional Information.

Specify the following:

- Company type.

- Nature of business.

- Type of industry.

- Gross Annual Profit.

- Bank Account details.

- Existing EMI.

- Full name.

- Gender.

- Residence PIN code.

- PAN card number.

- Date of Birth.

- Email Address.

Step 4: Wait for Bank contact

A Bank representative is going to Contact you soon to complete loan formalities.

Step 5: Approval

The approved loan amount will be deposited directly into your specific account within specified working days.

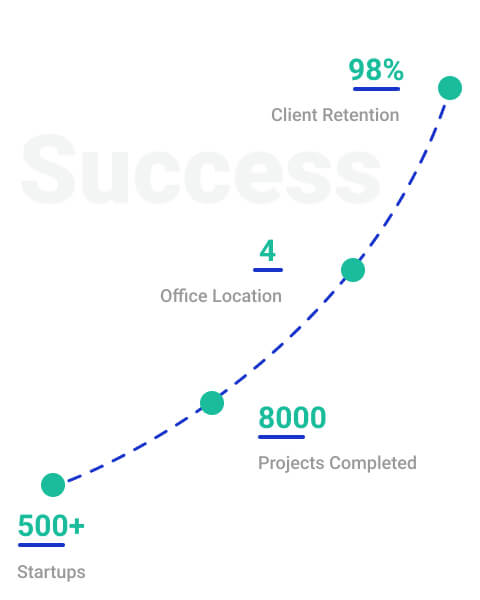

Why Choose StartupFino for Startup Business Loans and Grants?

StartupFino is the preferred option for startup business loans and grants because we understand India's complicated funding environment. With over 39,000 startups in India struggling to obtain credit, StartupFino helps with guidance and access to government-backed loan programs. Those programs include SIDBI and include competitive rates and simplified processes.

StartupFino focuses on providing loans which range from working capital loans to government schemes including Startup India and Standup India. Our simple yet efficient application process and network of partners guarantee fast funding access.

FAQs

Several banks and financial institutions lend to start-ups and MSMEs. You simply have to satisfy the eligibility criteria and send the documents. When your application is approved, you can borrow a substantial sum. You repay the loan over a fixed repayment tenure.

Age of applicant mustn't be under twenty one years and not over sixty five years. The applicant should be an Indian citizen. Interested applicants ought to have a business plan.

The beneficiary unit shall usually be a registered micro, medium or small enterprise as defined in MSMED and should hold a valid UAM or Udyam Registration. The manufacturing MSMEs might be a profitable entity preferably in the last 1 year of its operation, but PMAC might relax the criteria.

Startup India is a Government initiative launched on 16th Jan 2016 under which the Government of India intends to develop an environment for innovation and startups in India that will stimulate economic growth and large scale employment creation.

There are two types of business loans which lenders offer - term loans and working capital loans. Term loans may be used for expanding business, purchasing machinery or even beginning new jobs. These loans may be taken for 1 year to ten years. Working capital loans are short term loans due back within one year and could be utilised to pay rent, pay workers' salaries, stock up inventory, etcetera.

Several of the government initiated business Loan schemes provide loans without collateral/security, for instance Mudra loan under PMMY, Startup India, Standup India and CGTMSE.

The maximum and minimum loan amount is based on the financial lender and your requirement. There's no limitation on the minimum loan amount & max loan amount is Rs. 2 crores (collateral-free business loan).

Startup business loan is like the primary funding for a company you wish to start. The startup can be of anything and obtaining a loan to start a new business will only expand your company initially giving your Startup the machinery and equipment it needs.

Some Government based startup business loans in India include:

- Start up India Scheme

- Mudra Loan under PMMY

- Bank Credit Facilitation Scheme: CGTMSE

- Standup India

- Psbloansin59minutes.com etc.

Most of the private and public sector Banks, NBFCs and even Small Finance banks & Micro Finance Institutions provide business loans for start up business in India.