Starting a new business requires adherence to local accounting rules, regulations and timely reporting in Haryana.

Due to the rapid changes in tax and accounting laws in Haryana, startups may find it challenging to keep track of legislative updates and their application in tax filing and compliance.

Benefits of Tax Consultancy and Compliance Services for Start-ups in Haryana

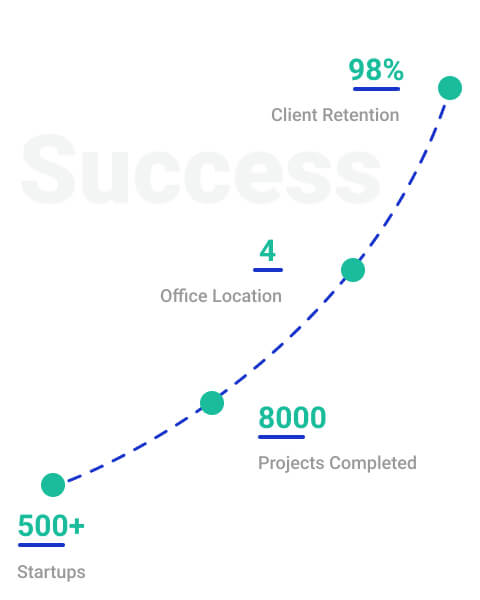

The benefits of availing tax consultancy services for Startups from StartupFino are the following:

Expert Guidance and Long-term Support:

- Engaging tax consultancy and compliance services from StartupFino provides start-ups in Haryana with access to experienced professionals who understand the complexities of India's tax laws.

Minimising Tax Liabilities:

- Tax consultants at StartupFino can identify legitimate deductions, credits and incentives that start-ups may not be aware of.

Avoiding Missing out on Updates:

- We at StartupFino ensure that the start-up's financial transactions and reporting adhere to the latest regulations, reducing the risk of costly mistakes or non-compliance penalties.

Comprehensive Risk Management:

- Our experts at StartupFino not only handle compliance but also provide risk management strategies.

GST Registration and Advisory Services in Haryana

The Goods and Services Tax as a unified taxation system includes all Indian service providers, traders and manufacturers. The GST consolidates central taxes like Service Tax, Excise Duty and CST, along with state taxes such as Entertainment Tax, Luxury Tax, Octroi and VAT.

In addition to this, taxpayers with a turnover of less than 1.5 crore rupees have the option to choose a composition scheme. This allows them to evade lengthy GST procedures and pay GST at a fixed rate based on their turnover.

Eligibility criteria for GST registration

The following entities are eligible for GST registration in Haryana:

- Business entities with an aggregate turnover exceeding Rs 40 lakhs (Rs 20 lakhs for special category states) in a financial year (dealing in goods) and for services, Rs 20 lakhs (and Rs. 10 lakhs for special category states), except for those dealing exclusively in GST-exempt goods/services.

- Entities previously registered under Excise, VAT, Service Tax, etc., need to register under GST.

- Entities engaged in inter-state supply of goods.

- Casual taxable persons.

- Taxpayers under the reverse charge mechanism.

- Input service distributors and their agents.

- E-commerce operators or aggregators.

- Non-resident taxable persons.

- Agents of a supplier.

- Persons supplying through e-commerce aggregators.

- Entities providing online information or acquiring databases from outside India to a person in India, other than a registered taxable person.

GST Return Filing Services in Haryana

The mechanism of providing the government with data on sales, purchases and taxes collected and paid by a registered taxpayer is known as GST return filing. In Haryana, all registered taxpayers under GST, irrespective of their sales or purchase activities during the period, are required to file GST returns.

Procedure for GST Return Filing

The procedure to file GST returns in Haryana for startups is as follows:

Step 1: Collecting the Documents and Invoices:

- All registered taxpayers gather the necessary documents and invoices for GST Return Filing.

Step 2: Filing the Application with the Necessary Documents:

- Applicants file the GST return with all required information and documents.

Step 3: Major Pre-Compliances before Filing the GST Return:

- Review GST filing and records before submission.

- Confirm the accuracy of records, invoices and documents.

Step 4: Completing the GST Return Filing:

- After cross-checking all the documents, the applicant completes the GST return filing.

Professional Tax Registration in Haryana

In every state, working professionals, including chartered accountants, lawyers and doctors, are subject to a professional tax imposed by state governments. This tax is based on the individual's occupation, trade or profession. The tax rates vary depending on the state, with a maximum cap of Rs. 2,500 per year.

Eligibility for Professional Tax Registration in Haryana

The eligibility for professional tax registration is as following:

- Individuals

- Public/Private/One Person Companies

- Partnership firms

- Co-operative Societies

- Association of Persons

- HUF (Hindu Undivided Family)

Comprehensive Process for Professional Tax Registration

The professional tax registration process involves the following steps:

Step 1: Provide Director/Partner/Proprietor Information

Step 2: Furnish Employee Details

Step 3: Fill the Application Form

Step 4: Submission by Experts

- Our experts at StartupFino will submit the application form to the concerned authorities on your behalf.

Step 5: Acknowledgement

- Within 5 to 7 working days, you will receive a basic acknowledgement from us.

Step 6: Registration Hard Copy issues in 10 days.

- In major cities, the registration hard copy will be issued within 10 days.

TDS Return Filing in Haryana

Tax Deducted at Source or TDS is a system used by the Government of India to collect taxes at the point of transaction occurrence. In this situation, the tax is taken when the payee's account is credited or when payment is made, depending on which occurrence comes first.

The company making the payment is required to deposit the deducted tax amount with the Income Tax Department. TDS is useful as it allows for the direct payment of a portion of the tax to the Income Tax Department.

Documents Required for Online TDS Return Filing

The list of documents needed for online TDS return filing are:

- TAN details

- PAN details

- Last TDS filing details, if applicable

- Period for TDS filing

- Date of business incorporation

- Number of transactions for TDS returns

Procedure for TDS Return Filing

The process for TDS return filing is as follows:

Step 1: Preparation of TDS Return Form

Step 2: Submission of Form and Documents

Step 3: Verification and Corrections

Step 4: Receipt of Acknowledgment

Step 5: Payment of TDS Amount (If Applicable)

Step 6: Issuance of TDS Certificate

Step 7: Regular Compliance and Reporting

Income Tax Return Filing in Haryana

Every responsible Indian citizen is required by law to file income taxes with the government. You may quickly file your income tax online using today's technologies. This procedure is quick and precise, with no time limits.

However, filing an income tax return in India via the official website necessitates the completion of ITR forms. Individuals must complete a different ITR form than salaried employees. This is an important responsibility because the income tax department has a variety of forms, each with a defined function and belonging to a distinct category. StartupFino’s team of experts can help you in understanding and filing the complex ITR forms in a hassle-free manner in no time.

How to File Your Income Tax Return in Haryana?

The overview of the process for filing ITR in Haryana is given below:

Step 1: Gather Required Documents

Step 2: Submit Documents to Experts

- Submit all required documents to our experts at StartupFino for ITR filing online.

Step 3: Expert Assistance for Online Filing

Step 4: Information and Exemptions

- Experts will select the appropriate ITR filing form and fill in all required information.

Step 5: Review Tax Payable Amount

- Our experts will inform you about the tax payable amount, if any, after considering all exemptions.

What are the Tax Consultancy Services Offered by Startupfino for Startups in Haryana?

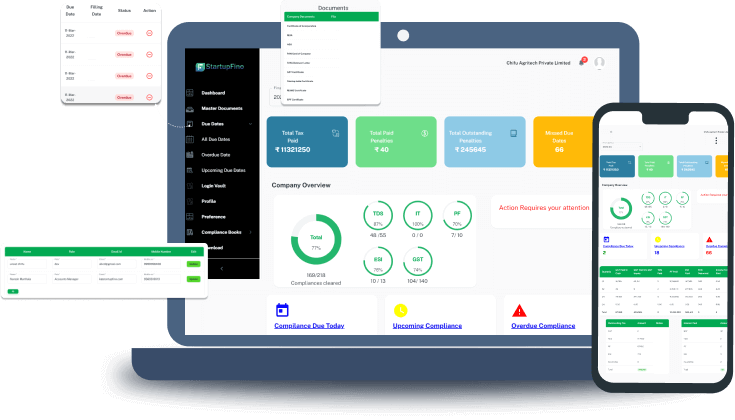

StartupFino offers tax and regulatory compliance services in addition to preparing and submitting company tax returns, computing advanced tax and all related taxation services. We assist enterprises in efficiently running their business operations in Haryana by completing a full health check-up of the business operations in order to become eligible for the greatest tax incentives benefits, deduct any deductions where possible and improve tax compliance.

Our professional team of specialists saves your time by managing the majority of Tax and Regulatory Compliance areas, including local tax queries, disclosure and documentation requirements.

Our services include the below mentioned:

- Accessing experienced professionals who understand India's tax laws and receive personalised advice for your start-up's specific needs.

- Identifying legitimate deductions and incentives to minimise tax burdens, enabling your start-up to retain more earnings for growth.

- Staying updated with changing tax laws and regulations to avoid costly errors and penalties in tax filing and compliance.

- Projecting potential tax obligations to avoid cash flow disruptions caused by unforeseen tax liabilities or penalties.

- Ensuring compliance and implementing risk management strategies to safeguard your start-up from potential tax-related risks.

- Advising on the most tax-efficient business structure, impacting tax liabilities and operational flexibility.

By availing our services, entrepreneurs can avoid the negative outcomes of non-followance of rules and compliances. StartupFino works hard to provide services that are prompt and effective, so you can manage your business in Haryana without any issues and without facing penalties or problems.