TDS or Tax Deducted at Source, is the amount of tax deducted from money paid at the time of making specified payments such as rent, commission, professional fees, salary, interest and so on.

TDS is deducted when a salary or life insurance policy is paid. The TDS sum is then submitted with the Income Tax department. TDS is a method of automatically paying a portion of the tax to the Income Tax department. As a result, TDS is regarded as a method of reducing tax avoidance.

Why is it necessary to submit TDS returns?

Filing TDS returns is a significant requirement under Indian tax regulations and failing to do so can result in penalties and interest charges. TDS returns are required for a variety of reasons, including:

- Proof of tax payment: TDS certificates serve as proof of tax payment and can be used for a variety of purposes, including loan applications and claims.

- TDS credit: TDS deductions can be claimed as a credit when submitting tax returns, lowering the taxpayer's overall tax bill.

- Avoiding Penalties: Failure to file TDS returns by the due date might result in significant penalties and interest costs.

- Tax Law Compliance: Filing TDS returns is a legislative necessity and taxpayers must follow the terms of the Income Tax Act to avoid legal consequences.

- Record Maintenance: TDS returns serve as a record of tax payment, which can be valuable for future reference.

- Boosting Revenue Collection: TDS plays a pivotal role in increasing government revenue, curbing tax evasion and enhancing tax collection efficiency.

- Deterrent to Tax Evasion: TDS compels deductors to withhold taxes, discouraging tax evasion and maintaining the tax system's integrity.

- Facilitating Business Transactions: TDS compliance furthers trust and transparency between deductors and deductees, streamlining business transactions.

- Easing Tax Burden: TDS returns reduce the tax burden by enabling gradual tax payment throughout the year, aiding financial planning.

- Seamless Tax Credit: Accurate TDS returns allow deductees to claim tax credits, reducing their overall tax liability.

- Simplifying Tax Audits: Properly filed TDS returns streamline tax audits, providing clarity on tax deductions and avoiding scrutiny and disputes.

Additional Advantages of Online TDS Filing

The merits of online filing of TDS are as following:

- Convenience: Online TDS filing offers unparalleled convenience, allowing companies and businesses to file their TDS returns from the comfort of their premises.

- Time-saving: Compared to manual TDS filing, online filing saves valuable time for companies and businesses as they no longer need to physically visit the Income Tax Department for submission.

- Accuracy: Online TDS filing minimises the risk of errors, ensuring precise and error-free TDS returns. The TRACES portal incorporates checks and validations to maintain accuracy.

- Real-time Tracking: Companies and businesses can monitor the status of their TDS returns in real-time, eliminating the need to wait for updates from the tax department.

- User-friendly Interface: The online filing process is designed to be user-friendly and intuitive, simplifying TDS compliance for companies and businesses.

- Cost Reduction: By opting for online TDS filing, companies can significantly reduce expenses associated with manual filing, such as paper, postage and stationery costs.

- Environmentally Friendly: Online TDS filing contributes to environmental preservation by reducing paper usage in the filing process, making it an eco-friendly alternative.

What are the Types of TDS in Use in India?

Tax Deducted at Source (TDS) is applicable to various types of payments in India. The different categories of TDS are:

- TDS on Salary: Employers deduct TDS from employees' salaries based on their income tax slab rates.

- TDS on Interest: TDS is deducted from interest earned on fixed deposits, recurring deposits, savings accounts and other interest-bearing instruments. The TDS rate may vary based on the type of interest and threshold limits.

- TDS on Rent: Individuals or entities making rent payments above a specified threshold deduct TDS before paying it to the resident landlord.

- TDS on Professional Fees: TDS is deducted from payments made to professionals like doctors, lawyers, consultants and freelancers.

- TDS on Contractor Payments: TDS is deducted from payments made to contractors for services rendered, including construction, repair or technical services.

- TDS on Commission: TDS is deducted from commission payments made to agents, brokers or intermediaries.

- TDS on Royalty: TDS is deducted from royalty payments made for the use of intellectual property rights, patents, copyrights, etc.

- TDS on Sale of Property: TDS is deducted at the time of property sale if the transaction exceeds specified limits. The buyer deducts TDS before paying the seller.

- TDS on Insurance Commission: TDS is deducted from commission payments made to insurance agents.

- TDS on Lottery and Gambling: TDS is deducted from winnings exceeding a specified threshold from lotteries, card games, horse racing or any other form of gambling.

TDS Rates for Various Regular Payments in India:

|

Type of Payment

|

TDS Rate

|

Threshold Limit (INR)

|

|

Salary

|

Based on Income Tax Slab

|

N/A

|

|

Interest (FD, RD, SA)

|

10%

|

40,000 (in a financial year)

|

|

Interest (Govt. Sec., Corp. Bonds)

|

10%

|

5,000 (in a financial year)

|

|

Rent

|

10%

|

50,000 (monthly)

|

|

Professional Fees

|

10% (20% without PAN)

|

N/A

|

|

Contractor Payments

|

1% (Individual/HUF)

|

N/A

|

|

2% (Other Types)

|

What are the Eligibility Criteria for TDS Deduction in India?

TDS is a mechanism prescribed by the Income Tax Act, 1961, where a certain percentage of payments are deducted at the time of making specified transactions. The following entities are eligible as deductors who can deduct TDS in India:

- Individuals: Individuals who are liable to make specific payments as per the Income Tax Act fall under the purview of TDS deductors. These payments include salaries, commissions, professional fees, rent, etc., exceeding specified thresholds.

- Hindu Undivided Family (HUF): Hindu Undivided Families, considered as a separate entity under the tax law, are eligible to deduct TDS on payments made in the course of carrying out their business or professional activities.

- Limited Companies or Organisations: All limited companies, including private and public limited companies, come under the category of eligible TDS deductors. Such companies are required to deduct TDS on various payments like salaries, interest, rent, consultancy fees, etc.

- Partnership Firms: Partnership firms, which consist of two or more individuals or other entities as partners, are eligible to deduct TDS on specific transactions, such as interest, professional fees, rent or any other payments exceeding the specified threshold.

- Body of Individuals: A Body of Individuals formed for a common purpose, where the members contribute to achieve that objective, is eligible to deduct TDS if they meet the criteria set forth by the Income Tax Act.

- Association of Individuals: An Association of Individuals is a group of individuals coming together for a shared objective. If such associations are liable to make payments attracting TDS, they must comply with the TDS deduction requirements.

- Local Authorities: Local authorities, such as municipal corporations, panchayats and other governmental bodies at the local level, qualify as TDS deductors. They are required to deduct TDS on specific payments as prescribed by the tax laws.

What are the Basic Documents Required for TDS Return Filing?

To ensure a seamless TDS return filing process, it's significant to gather the following key documents:

General Documents:

- TAN (Tax Collection and Deduction Account Number) and PAN of the taxpayer.

- Business incorporation date.

- Tenure for which TDS needs to be filed.

- Details of the last TDS filing.

- Form 16 and Salary Certificate from the employer.

Interest Income:

- Bank statements reflecting interest on savings accounts.

- Interest statements for fixed deposits.

- TDS certificates issued by banks and other financial institutions.

Capital Gains:

- Investment particulars in Capital Gains Accounts Scheme.

- Sale and Purchase Deeds for properties, along with stamp valuation.

- Deed of Re-investment for Capital Gains exemption.

- Records of property improvement expenses.

- Details of expenses incurred during property transfer.

- Stock statements for share trading (sale and purchase values).

Section 80 Investments:

- Documents for Section 80C deductions: PPF, NSC, ELSS, ULIPS and LIC investments.

House Property:

- Information on co-ownership, if applicable.

- Property address and details of property tax and rent.

- Bank-issued interest certificate for housing loan.

Tax Savings Investments:

- PPF passbook indicating contributions.

- Tuition fees receipts for eligible deductions.

- Housing loan repayment certificate.

- Donation receipts (along with PAN of the donee).

- Fixed deposit receipts and senior citizen saving scheme deposit receipts.

- Payment receipts for life and medical insurance.

Miscellaneous:

- Proof of income from sources like horse races, lotteries, etc.

- Accrued interest details on NSC during the year.

- Dividend amount warrants and interest income certificates.

- Bank Passbook or Statements reflecting interest income.

- PPF passbook showing accrued interest.

- Interest certificates for bonds.

- Rent agreement for properties given on rent.

What are the Types of TDS Forms Available for Filing TDS?

When it comes to TDS, it is essential to understand that different types of TDS Return Forms exist for various scenarios, depending on the nature of income or the type of deductee. Here are the main types of TDS Return Forms and their purposes:

This form is used to file the TDS statement of salaries. Employers or deductors must submit Form 24Q when deducting TDS on salary payments to employees.

Form 26Q is utilised to file the TDS statement on all payments other than salaries. It applies to TDS deductions made on payments like professional fees, rent or any other income subject to TDS.

Form 27Q is meant for filing the TDS statement on income received from interest, dividends or any other sum payable to non-residents.

For TDS on payment for the transfer of immovable property, deductors use Form 26QB to file the relevant TDS statement.

This form serves as a statement of collection of tax at source. It is applicable to those involved in collecting tax at source rather than deducting it.

The due date for filing these forms is mentioned below:

|

Type of TDS Returns

|

Due Date

|

|

TDS on Salary (Form 24Q)

|

Quarter 1 - 31st July

|

|

Quarter 2 - 31st October

|

|

Quarter 3 - 31st January

|

|

Quarter 4 - 31st May

|

|

TDS on all forms except salaries (Form 26Q)

|

Quarter 1 - 31st July

|

|

Quarter 2 - 31st October

|

|

Quarter 3 - 31st January

|

|

Quarter 4 - 31st May

|

|

TDS on all payments to non-residents except salaries (Form 27Q)

|

Quarter 1 - 31st July

|

|

Quarter 2 - 31st October

|

|

Quarter 3 - 31st January

|

|

Quarter 4 - 31st May

|

|

TDS on Sale of Property (Form 26QB)

|

30 days from the end of the month in which TDS is deducted

|

|

TDS on Rent

|

30 days from the end of the month in which TDS is deducted

|

How to Include Challans in Your TDS Return for Paying TDS?

The given procedure must be followed in order to include challans for the filing of TDS in India:

- Generate Challan: Calculate the TDS amount for the quarter and generate a challan for TDS payment.

- Choose Payment Method: Opt for online or offline payment methods as per your preference.

- Online Payment: Use internet banking, debit/credit card on the tax authorities' designated website.

- Offline Payment: Visit an authorised bank branch, fill challan details and make payment.

- Obtain Challan Counterfoil: Collect the challan counterfoil from the bank after payment.

- Include Challan Details in TDS Return: Enter challan details when filing the TDS return online.

- Fill in Challan Information: Enter BSR code, challan serial number, payment date and TDS amount.

- Reconciliation: Ensure TDS amount in the return matches the total payment reported through challans.

- File TDS Return: Complete the remaining sections of the TDS return form and submit it online through the designated TDS Portal.

What is the Process of TDS Filing by Offline Mode?

The process of TDS filing(offline) involves the given steps:

- Fill Form 27A Completely: Begin the TDS filing process by thoroughly completing Form 27A, which comprises multiple columns for essential details.

- Verification of Hard Copy and e-TDS Return: If the hard copy of the form is utilised, ensure that it aligns with the electronically filed e-TDS return.

- Accurate TDS and Payment Details: Enter the correct TDS amount and the total amount paid, ensuring they match their respective forms.

- Mention TAN (Tax Deduction and Collection Account Number): Specify the TAN of the organisation filing the TDS returns on Form 27A.

- Provide Challan Number and Tax Payment Mode: Include the appropriate challan number and indicate the mode of payment for taxes in the TDS returns.

- Utilise Basic Form for e-TDS Filing: For consistency, use the basic form designated for filing e-TDS. Enter the 7-digit BSR (Basic Statistical Return) for easy reconciliation.

- Submit Physical TDS Returns at TIN-FC: For physical filings, submit the TDS returns at the TIN-FC (Tax Information Network - Facilitation Center). The NSDL (National Securities Depository Limited) oversees all TIN-FCs.

- Receive Token Number or Provisional Receipt: Upon successful submission, a token number or provisional receipt is received as an acknowledgment of filing the TDS returns.

- Confirmation of TDS Return Filing: The acknowledgment serves as confirmation that the TDS returns have been filed with the relevant authorities.

- Rejection and Resubmission: In case of TDS return rejection, a non-acceptance memo with reasons for rejection is issued. In such a scenario, resubmit the TDS returns after rectifying the errors to ensure successful filing.

What is the Procedure for Online TDS Filing?

Given below is the guide for Online TDS Filing:

- Registration on TRACES Portal: To commence the online TDS filing process, companies and businesses must first register on the TRACES portal. During registration, essential details such as PAN, TAN and similarly other relevant information are required.

- Login to TRACES Portal: When registration is done, startups can log in to the TRACES portal by using their login credentials.

- TDS Return Preparation: Herein, startups are then required to prepare the TDS return in a given prescribed format. The TDS return must include significant details such as the deductor's name and address, the deductee's name and PAN, the amount of TDS deducted and the relevant TDS certificate number.

- Uploading of TDS Return: Next, companies and businesses need to upload the prepared TDS return on the TRACES portal.

- TDS payment: To comply with TDS requirements, startups must pay the TDS amount deducted from deductees' revenue. This payment can be made again via the TRACES portal by using a whole lot of options, like net banking facilities or debit or even credit cards.

- Issuance of TDS Certificates: Companies and businesses are responsible for issuing TDS certificates to the deductees. These certificates can be conveniently downloaded from the TRACES portal and provided to the respective deductees.

How to Check the TDS Payment Status?

The procedure to check the payment status of TDS is as following:

- Visit the Tax Information Network (TIN) website:https://incometaxindia.gov.in/pages/pan.aspx.

- Go to ‘Services’ and select ‘Know Your TAN | AO.’

- Choose the appropriate category (Taxpayer or Deductor).

- Enter PAN or TAN, assessment year and captcha code.

- Click ‘Submit’ to view TDS payment status.

- Check if TDS payments are received and correctly recorded.

- View details like payment date, amount and acknowledgment number.

What is the Consequence of Non-Compliance with TDS Return Filing?

The following penalties can be levied as a result of non-compliance with TDS return filing by eligible entities:

Late Filing Fee (Sec 234E): Under Section 234E of the Income Tax Act, a fine of Rs. 200 per day is imposed on the person responsible for deducting/collecting TDS/TCS until the TDS return is filed. This penalty applies for each day of delay until the fine amount equals the TDS amount to be paid.

For instance, if TDS of Rs 5,000 was deducted on 13th May 2023 and the Q1 return is filed on 17th November 2023 instead of the due date (31st July 2023), the delay is 109 days. Thus, the late filing fee is Rs 200 x 109 days = Rs 21,800. However, since this amount exceeds the TDS amount (Rs 5,000), only Rs 5,000 is payable as the late filing fee.

Penalty (Sec 271H): The Assessing Officer may direct a minimum penalty of Rs.10,000 to Rs 1,00,000 for failure to file the TDS/TCS statement within the due date. This penalty, under Section 271H, is in addition to the late filing fee specified under Section 234E. The penalty also covers cases of incorrect TDS return filing.

- No penalty under Section 271H is levied if the following conditions are met:

- The TDS/TCS amount is paid to the Government's credit.

- Late filing fees and interest (if applicable) are paid to the Government's credit.

- The TDS/TCS return is filed within one year from the specified due date.

Interest on Late Deposit of TDS: Under Section 201(1A), if TDS is not deducted (fully/partly) or not deposited to the government after deduction (fully/partly), interest is levied at a rate of 1% or 1.5% per month, respectively. The interest is calculated from the tax deduction date to the deposit date.

For example, if Rs 5,000 in TDS was deducted on January 13, 2023 and deposited on May 17, 2023, the interest payable is Rs 5,000 x 1.5% p.m. x 5 months (Jan-May) = Rs 375.

Prosecution (Sec 276B): Failure to pay TDS to the Central Government as required by Chapter XVII-B of IT Act may result in rigorous imprisonment for a term between three months to seven years, along with a fine, as per Section 276B of the Income Tax Act.

What is Refund of TDS?

TDS refunds are the returns of excess tax deducted from a taxpayer's income throughout a fiscal year. When an individual's total tax deducted from their income through TDS is incidentally more than their actual tax burden, a refund becomes entitled in their favour.

The procedure that is generally followed for TDS refunds is given below:

- TDS Deductions: Based on the appropriate tax rates and legislation, employers, banks and other organisations deduct TDS from individual income payments.

- Income Tax Return: The taxpayer submits an income tax return for the fiscal year under consideration, detailing their total income, deductions and tax liability.

- TDS Credit: In their income tax return, the taxpayer presents details of the TDS deducted on their income, including the deductor's TAN, the amount deducted and the TDS certificate data.

- Income Tax Department Assessment: The income tax authorities evaluate the taxpayer's return and verify the information submitted. They compare the TDS details indicated in the return to the data in their records.

- Calculation of Refunds: If the TDS deducted exceeds the taxpayer's actual tax due as determined by the assessment, the excess amount is considered for refund. The income tax department computes the refund amount based on the available TDS credit and offsets it against any outstanding tax dues, if any.

- Refund issue: Once the assessment is finished and the return amount has been decided, the income tax department begins the refund issue process. The refund can be credited immediately to the taxpayer's bank account via electronic funds transfer or issued in the form of a cheque.

- Intimation and communication: The income tax agency informs the taxpayer about the refund status via an intimation or notice. The taxpayer can also verify the status of his or her refund online by going to the income tax department's website or the Tax Information Network (TIN) portal.

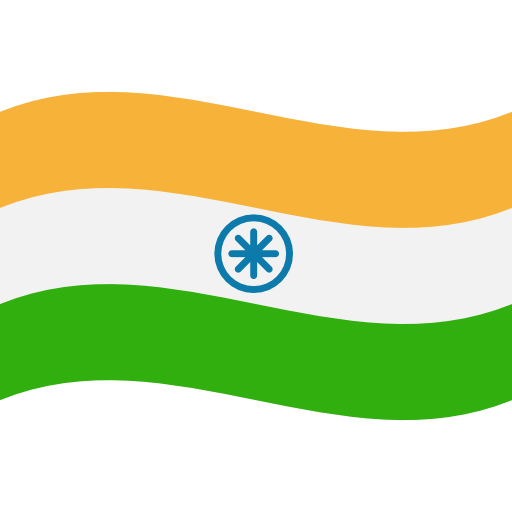

What are the Services Offered by Startupfino for TDS Compliances?

Under the TDS system, when certain types of payments are made, the individual responsible for the payment is required to deduct a specified percentage of tax from the payment amount and send it to the government.

TDS covers a wide range of payments, such as salary, fixed deposit interest, rent, professional fees, contract payments and others. The deduction rates for TDS differ depending on the nature of the payment and the relevant tax regulations.

The TDS amount which is subsequently deposited with the government can be claimed as a credit against the total tax bill when completing income tax return. The TDS amount is used to pay taxes in advance.

Startupfino is a company that specialises in offering complete services for TDS Compliances in India.We can aid with everything from providing advice in the beginning phase to ensuring that you meet all the necessary requirements and also keeping your organisation in good legal standing.

Our services include the below mentioned:

- Simplify TDS compliance with our expert guidance and accurate TDS return filing services.

- Stay tax-compliant effortlessly with our comprehensive TDS management solutions.

- Ensure timely TDS payments and avoid penalties with our reliable TDS compliance services.

- Maximise TDS credits and minimise tax liabilities with our proficient TDS advisory services.

- Stay updated with ever-changing TDS regulations through our proactive compliance support.

- Focus on your core business while we take care of all your TDS compliance needs in India.

By availing our services, entrepreneurs can avoid the negative outcomes of non-followance of rules and compliances. StartupFino works hard to provide services that are prompt and effective, so you can manage your business without any issues and without facing penalties or problems.