Valuation serves the purpose of providing an official estimate of the value of a given asset/property, which is usually prepared by a qualified valuer after taking into account several factors and regulations for ex. market conditions, comparable sales, etc.

The valuation certificate includes details about the appraiser, the date of valuation and a comprehensive analysis supporting the assigned value.

Our valuation practitioners at StartupFino can value business interests, tangible assets, intellectual property, intangible assets, common and preferred stock and other securities, etc. They are provided to assist clients with mergers, acquisitions and dissolutions - taxation planning and compliance; financial reporting; bankruptcy and reorganisation; litigation and dispute resolution and strategic planning.

Laws Governing Business Valuation Services in India

The requirement for a valuation certificate is a subject of laws and regulations in India. Some of the key legislations requiring the use of these certificates are outlined below :

The Companies Act, 2013 (as amended):

Company valuation services are required for certain transactions (such as the valuation of liabilities, assets, or shares following mergers, acquisitions, corporate restructuring) or amalgamations under the Companies Act, 2013. The certificate makes sure such transactions are fair and transparent.

Income Tax Act, 1961:

Such certificates are needed in limited circumstances under the IT Act, for example to set the fair market value of particular properties or assets.

Insolvency and Bankruptcy Code 2016:

IBC requires that companies in insolvency proceedings value their assets. Valuation certificates are important here because they establish the market value of assets that will be resolved or liquidated.

SEBI Regulations:

Fields covered under SEBI Regulations include determining the fair value of assets in mutual funds, REITs, infrastructure investment trusts (InvITs) etc.

Insurance Act of 1938:

This Act requires insurance companies to value their assets and liabilities. These certificates have a main role here since they help judge the financial health and solvency of these insurance companies. They ensure things are in order and the companies are fulfilling their requirements.

Different Approaches Used in Business Valuation Services

Valuation services in India are prepared using various approaches and methods that are recognised and accepted by regulatory authorities, professional bodies and industry standards. Some of the common approaches are:

Asset Valuation

Asset valuation simply means finding the fair value of the company's true assets. Such as stocks, brands, equipment, goodwill, building and so on. This valuation method is chosen in the framework of huge business valuation and also before you sell or buy any asset. Asset valuation services also allow you to exactly calculate the net worth of your business by adding current asset value and less liabilities value.

Market Valuation

A Market valuation method is also known as market comparison approach method. This method uses the market price of comparable assets and includes the appraisal value of an asset and business ownership interest. This method is suitable when a business usually has the same concerns as Industry, revenue, growth, influence and market potential. Market based valuation method works well for real estate businesses and publicly traded companies.

DCF Valuation

Discounted Cash Flow Valuation Method estimates the present value of an investment in a business based on future Cash flows. DCF is used to calculate the required calculated investment to obtain a previously determined return. This DCF method actually works on the basis of time value of money, that is the present money of an individual is worth much more than the same in the future.

Contents of Valuation Report

A valuation report generally covers the following details:

|

Section

|

Description

|

|

Valuation Subject

|

Concise description of the company or business being valued, including name, industry, and operations.

|

|

Proposed Transaction

|

Clearly state the nature and purpose of the transaction (ex- merger, acquisition).

|

|

Key Financials

|

Overview of financial information including revenue, profitability, assets, and liabilities.

|

|

Capital Structure

|

Outline of company's capital structure, including equity shares, debt, and anticipated changes.

|

|

Shareholding Pattern

|

Description of existing shareholding, ownership stakes, and anticipated changes post-transaction.

|

|

Market Volumes and Prices

|

Information on high, low, and average market volumes and prices of shares over the last six months.

|

|

Related Party Issues

|

Addressing related party transactions or conflicts of interest associated with the proposed deal.

|

Purpose of Valuation Services

The following are the purposes of using company valuation services:

|

Purpose

|

Description

|

|

Understanding Real Value

|

Valuation services are conducted to ascertain the true value of entities, business ownership, securities, or intangible assets. It provides a clear comprehension of their market worth.

|

|

Expert Advice

|

Valuation needs the expertise of professionals who offer insights into asset values, particularly those prone to market fluctuations, aiding in informed decision-making.

|

|

Price Determination

|

Valuation services mitigate issues associated with price determination by furnishing a fair and objective evaluation of asset value, ensuring transparency and accuracy in pricing.

|

|

Avoiding Assumptions

|

Proper valuation methodologies have the need for assumptions in price determination, relying instead on established approaches to yield reliable valuation figures.

|

|

Business Practices

|

Valuation services constitute a pivotal component of business practices employed globally, adhering to standardised methodologies and principles for consistency and reliability.

|

|

International Standards

|

Adherence to globally recognised valuation standards is important for valuation services, showing a commitment to equitable practices and instilling investor confidence.

|

|

Investor Confidence

|

Valuation services enhance investor confidence by showcasing transparency, accuracy, and compliance with international valuation standards, bringing trust and credibility.

|

|

Corporate Governance

|

Valuation methodologies contribute to elevating corporate governance standards within organisations by accurately and transparently valuing assets, thereby promoting good governance practices.

|

Eligibility to be a Valuer

The eligibility criteria for becoming a valuer comprises of the following:

|

Criteria

|

Description

|

|

Proper and Fit Person

|

The individual seeking to become a valuer must demonstrate suitability and integrity for the role.

|

|

Qualifications and Experience

|

The individual must possess relevant qualifications and experience in fields such as finance or accounting.

|

|

Membership in Registered Valuer's Organisation

|

Membership in a registered valuer's organisation is required, as these bodies regulate the valuation profession.

|

|

Clearing Examinations

|

Successful completion of examinations conducted by the IBBI is necessary to assess knowledge and competency.

|

Documents Required for Companies Valuation

The following documents are necessary for a business valuation service company:

Basic Information Documents:

- Details about Company Promoters

- Key Management professionals of the Company

- Memorandum of Association

- Articles of Association

- Prospectus

- Prior three years' financial statements

Valuation Engagement Documents:

- Copy of the valuation engagement with the client.

Previous Valuation Report:

- Copy of the previous valuation report of the subject matter, if available.

Assumptions and Limiting Conditions Documents:

- Documents pertaining to assumptions and limiting conditions in the valuation assignment.

Understanding of Value-Related Matters:

- Information gathered and analysed to understand factors affecting the value of the subject interest.

Valuation Approach Selection Documents:

- Documents related to the selection of the valuation approach, including rationale and supporting data.

Scope Limitations:

- Any restrictions or limitations on the scope of the valuer's work or data available for analysis.

Valuation Assumption Basis:

- Documents indicating the basis for using specific valuation assumptions during the engagement.

Additional Relevant Documentation:

- Any other relevant documentation considered important by the valuer for the engagement.

It's important to note that the specific documents required for a valuation exercise may vary depending on the nature of the assignment and the regulations or standards applicable to the valuation profession in India.

Process of Company Valuation

Business valuation services involve a long process followed by professionals to analyse such things as growth rate, future earnings, value of company's tangible and intangible assets and management of the company.

Business Valuation process has few steps as given below:

-

Step One: The Purpose of Valuation:

The purpose of valuing a business is to know its current value minus assets and debts. Business valuation is necessary to understand how long your business will continue to run down the road.

-

Step-2: Keeping the Values of the Premises:

Values among differences in pricing between a seller and a buyer rely on value that is often established by regulation, laws, contract and reasons for valuation. Another reason of valuation purpose and basis of determining business values are going into concern. The permanent operation of the business and use of the business assets are assumed, and later operations and sale of the assets are assumed.

-

Step three: Relevant Data Collection:

Data such as Leases, contracts, customer agreements, financial records, loans and various legal documents. These documents are required to know the company, its history, basics, values, finances, everything that is necessary to know to keep a perfect record.

-

Step-3: Reviewing Business Financial History:

A good valuator needs to know the company history, Previous ownership and last year's financial performance before evaluating a company. To do better and to find better financial opportunities one has to know the business at its source.

-

Step-5: Final Determined Value:

The final step arrives at a conclusion of the value. This is generally followed by a typical valuation report, including all the required information and valuation approach as well as assumptions from previous projects used as the assumptions.

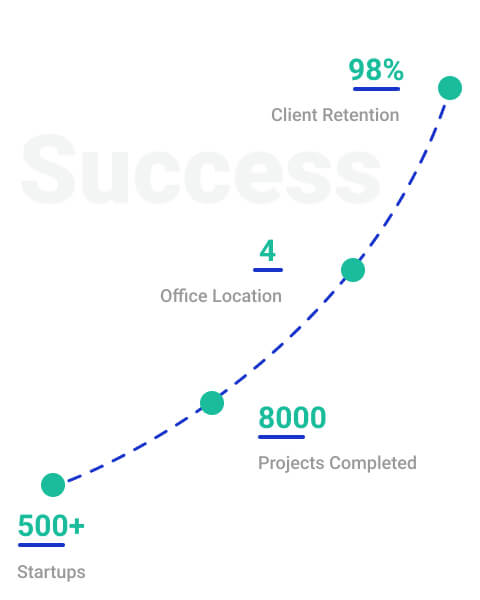

Why Choose StartupFino for Company Valuation?

Company and business valuation are used for more than just figuring out how much a share or security is actually worth. StartupFino is a company specialising in offering complete services for business valuation of a company. We can help you with all requirements from initially providing advice to ensuring that you meet all the necessary requirements and necessary compliances.