At StartupFino, we offer agritech accounting solutions for farmers, farming startups and agritech companies in the USA.

How we help you grow with expert farm accounting services, technology, and continuous assistance:

Farm Bookkeeping & Accounting

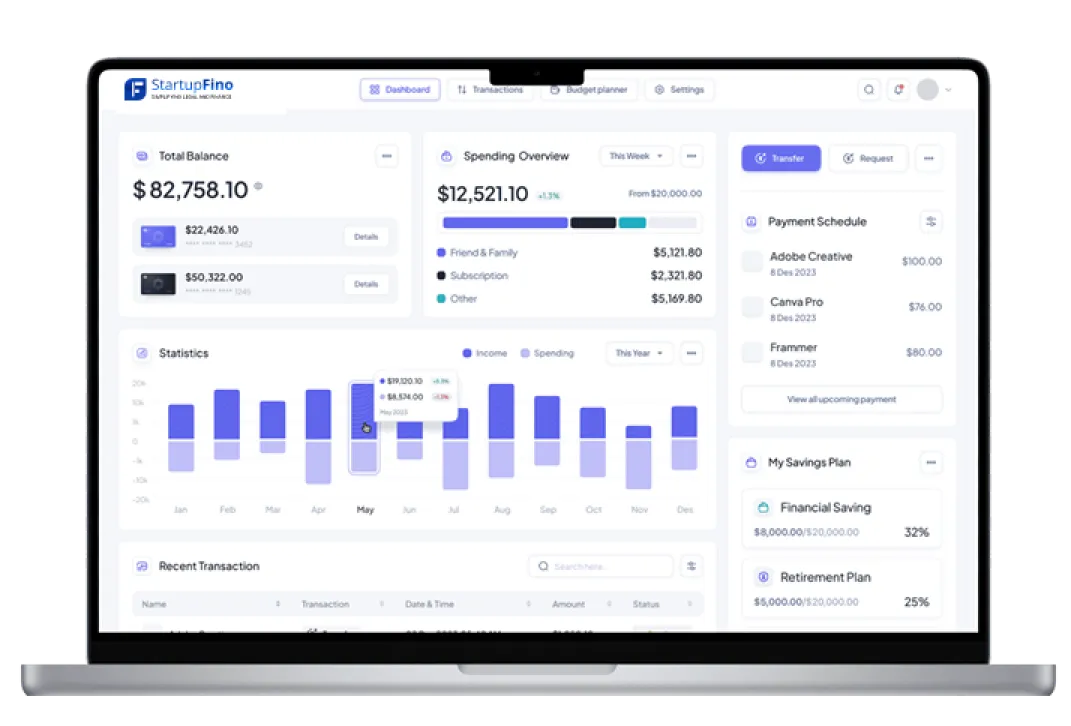

Daily farm transactions, expenses and income must be managed properly for a healthy business operation. Our farm bookkeeping and accounting services organize every little finance and help you meet IRS requirements like Schedule F (Form 1040) that farmers must file to report income and expenses. We get your records right, receipts digitized and information ready for audits, financial analysis and tax filing. We reduce manual work & human error with top farm bookkeeping software - keeping you on track with your farming finance objectives.

- Track every expense - seed, fertilizers, livestock, gas, repairs.

- Digitize invoices and receipts for easy audit trails.

- Keep IRS-approved financial records with farm accounting software.

- Prepare real-time financial reports to check out business health.

Tax Planning for Farmers

Farmers taxes can be complex for both farmers and agriculture accounting firms, particularly deductions for equipment, land upgrades along with subsidies. Our team assists farmers with rules including Section 179 for farm equipment depreciation and IRS Publication 225 for agricultural tax treatment. We reduce your tax liability and enable you to never miss out on filing deadlines.

- Take maximum deductions on tractors, tools, barns and irrigation systems.

- Prepare & file IRS Schedule F on time.

- Set rules for disaster losses, crop insurance, and conservation expenses.

- Handle estimated taxes and quarterly payments for farmers.

Agriculture Payroll Services

Payroll in farming is unique, due to seasonal employees, family members and contract labor being different categories. Our agriculture payroll services offer fair compensation, ample tax withholdings and compliance with laws including the IRS and FLSA Circular E (Employer's tax Guide). We automate & simplify payroll, saving you several hours of work a month.

- Automate payroll and tax reporting for full time, seasonal and part-time personnel.

- Generate pay slips & W 2s, W-3s, 1099s (in case necessary).

- Ensure compliance with FLSA for hourly wages and overtime.

- Track labor costs by department, field or project.

Farm Management Accounting

To run a profitable farm, more than merely working the land is required. Our farm management accounting solutions combine operational insights with financial knowledge to teach you what is profitable and what is not. From crop yield vs cost analysis to livestock profit margins, our data-driven reports inform better decision making and better allocate resources. We also provide farm business consulting that will help you meet your financial and operational objectives.

- Monitor profitability by crop type, field or livestock category.

- Set and track budgets for each farming activity.

- Get financial insights on fertilizer and pesticide planning.

- Get support on strategic decisions like leasing versus purchasing equipment.

Farming Cash Flow Management

Farming earnings aren't always regular due to the seasonal nature of the industry. That is exactly why cash flow management is important. Our farming cash flow management services help you plan in advance, save in surplus months and also prepare for lean periods. We help you create intelligent forecasts, stay away from shortfalls and ensure you have cash flow for payroll, repair & feed at all times.

- Build monthly and seasonal cash flow projections.

- Identify income gaps and plan for funding or credit.

- Control operating expenses without dipping into savings.

- Prepare for emergencies and changes in the markets.

Farm Estate Planning & Asset Management

In case you're planning for the long term of your farm, farm estate planning is vital. We safeguard your legacy and also help you transfer assets via wills, trusts and tax-efficient strategies. We adhere to IRS estate tax limits and engage trusted legal partners when needed to provide full support for generational farms and family run businesses.

- Structure succession plans for heirs or even co-owners.

- Estate taxes could be minimized with smart strategies.

- Inventory & appraise farm assets - farm land, equipment, livestock.

- Coordinate with professional lawyers for wills and trusts.

Agricultural Consulting Services

Modern farms and AgriTech startups need much more than simple bookkeeping. They want expert strategic advice. Our Agritech bookkeeping for startups combines financial know-how and industry insight to help you make more effective decisions about operations, investments and scaling. Whether you are a little family farm or an expanding startup, we enable you to deal with regulatory problems, changing markets and funding opportunities. As a dependable agricultural consulting company, we also help in grant applications, federal programs and monetary restructuring - all while complying with USDA regulations and local compliance laws.

- Identify new revenue streams, cost-saving opportunities and investment alternatives.

- Help apply for USDA loans, grants and relief programs.

- Review and enhance compliance with USDA and EPA regulations.

- Offer strategic planning together with farm business consulting.

Agritech Firm Accounting

For more complex build-tech based solutions for farming - such as IoT systems, intelligent irrigation, or agri data platforms, you need Agritech firm accounting as cutting edge as your company. We assist agritech companies in the USA with their finances from start up to scale-up. Whether it is R&D tax credits, VC financing rounds or subscription based revenue tracking, our experts are here to help you. We also prepare GAAP-compliant financials and also manage agriculture financing rounds, investor reporting and equity tracking.

- Track project based costs such as R&D, software development and pilots.

- Seek help with investor reports, cap table management & fundraising.

- For qualified research activities, claim tax credits like IRS Form 6765.

- Align financials with GAAP standards in the USA.

Farm Business Accounting & Budgeting

Managing a farm as a business is essential to long-term growth. With our farm business accounting solutions, you can track your liabilities, assets, expenses, and income to match your objectives. We set yearly budgets, evaluate planned vs. actual performance & provide adjustments in real time. With farm management services included in the process, you always have the financial control in your operation. We follow IRS Circular A-133 rules concerning audit readiness and federal fund usage (when applicable).

- Prepare yearly and seasonal farm budgets by department or function.

- Monitor actual performance and make data supported financial adjustments.

- Identify savings opportunities and revenue opportunities.

- Keep records audit-ready with documentation and compliance.