We at StartupFino provide AI Accounting Services designed for artificial intelligence and machine learning companies in the USA. We know your industry, how quickly innovation is progressing and how important it is to be compliant while scaling rapidly. So, whether you require AI bookkeeping services, AI tax planning or a virtual CFO for your AI startup - we have you covered with intelligent, compliant, and forward thinking solutions.

AI-Powered Bookkeeping Services

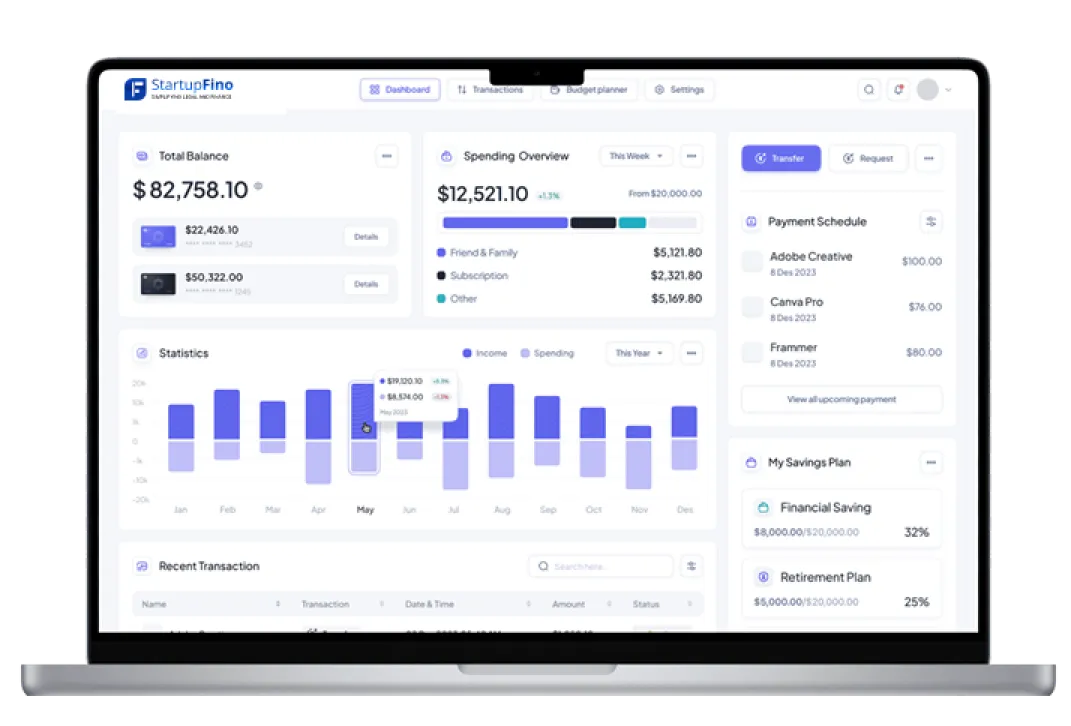

AI startups process lots of transactions, from cloud platform charges to contractor payments. Manual bookkeeping simply does not support this any longer. Our AI bookkeeping services organize, classify and reconcile your transactions automatically using AI accounting software and automation. This guarantees precision, reduces mistakes and also gives you much more time for innovation. All records are produced in accordance with US GAAP standards & IRS guidelines, keeping you audit-ready at all the time.

What we do:

- Make use of AI to classify income and expenses.

- Real time bank reconciliation and ledger updates.

- Maintain GAAP-compliant records for investor and tax readiness.

- Make reports for AI & SaaS business models.

AI Tax Preparation Services

Taxes in the AI world are difficult, particularly with R&D Tax credits, multi-state nexus rules or software capitalization laws. Our AI tax preparation services ensure strategic and accurate filings. We determine every deduction your startup has the right to under IRS guidelines - including Section 174 and Section 41 credits for research & development.

What we do:

- Use IRS-compliant documentation to maximize R&D credits.

- Make sure to update multi-state and local tax filings.

- Track and capitalize software development costs per GAAP and IRS.

- File federal & state returns with AI-assisted error checks.

Virtual CFO for AI Startups

You do not need a full time CFO for getting expert financial guidance. Our virtual CFO services for AI startups offer high-level insights, investor-ready reporting and strategic planning without overhead costs of a full time CFO. Whether you are preparing for a financing round or wish to control your burn rate, we help you make data driven decisions with AI financial services and accounting automation.

What we do:

- Build AI - powered forecasting models.

- Track AI product development / SaaS growth KPIs.

- Build financial decks for investors and board meetings.

- Guidance on budgeting, runway planning and capital allocation.

Accounting Automation with AI

Why use old spreadsheets anymore when you have the power of AI? Our accounting automation with AI solutions eliminate manual mistakes, save costs & speed up your operations. Using tools which integrate with platforms such as NetSuite, Xero, and QuickBooks, we create smart workflows which keep your finances operating smoothly, all while you keep the real control of your business.

What we do:

- Automate recurring transactions like subscriptions or payroll entry processes.

- Set up approval workflows for expense and invoice management.

- Detecting anomalies using machine learning accounting tools.

- Make real time reports for founders, investors and auditors.

Customized Industry-Specific Accounting Solutions

Not all AI companies are alike and neither should be your accounting. We provide solutions for e-commerce AI accounting, manufacturing AI accounting and machine learning in healthcare accounting. We understand industry-specific compliance norms like HIPAA for healthcare or inventory costing for manufacturing.

What we do:

- Design accounting systems that fit your vertical & tech stack.

- Provide HIPAA aligned financial tracking for healthcare clients.

- Automate sales tax collection for AI based e-commerce.

- Establish costing and inventory systems for manufacturing-based AI models.

Financial Reporting and Forecasting for AI Startups

With AI startups growing in the USA, accurate financial reporting is vital not just for compliance but also for getting investors, controlling cash flow and preparation for scaling. At StartupFino, we offer AI financial services that go beyond producing financial reports. We use artificial intelligence accounting tools to evaluate big datasets and also offer real-time visibility in your business's performance. All our financial reports meet US GAAP reporting standards and are structured for due diligence, VC reviews and board meetings. Plus, our AI-powered forecasting shows what is meant to be in your future based on spending and trends.

What we do:

- Prepare balance sheets, profit & loss statements & cash flow reports.

- Use AI accounting tools to forecast past and current trends.

- Complete financial services for AI companies.

- Meet investor expectations and audit requirements on reports.

Payroll & Contractor Management for AI Companies

Many AI startups have hybrid teams composed of regular workers, freelancers and overseas developers. The payments and tax compliance for these distinct roles could be complicated. Our AI accounting services for startups include full payroll processing, contractor payments and IRS compliance. We use AI automation tools to compute pay, deductible taxes and file necessary returns under IRS Form W-2, 1099 and state payroll tax laws. Whether you pay staff across states or hire globally, we help you pay everybody on time and stay within the employment and labor laws.

What we do:

- Payroll processing with AI-integrated software to reduce manual tasks.

- Manage federal/state payroll filings (W-2, 940, 941, and 1099s).

- Create automated contractor onboarding and payments systems.

- Ensure compliance with FLSA, IRS rules and community labor laws.

Fundraising and Investor Ready Financial Services

Raising capital for an AI or machine learning startup requires clean and organized books, dependable metrics and a strong financial foundation. We prepare all the financial documents investors would like, supported by our virtual CFO for AI startups. We build data backed models, financial projections and valuation reports that impress VCs by using AI-powered accounting services. Our team also understands investor due diligence expectations and ensures all reporting within SEC guidelines where applicable.

What we do:

- Make investor pitch financials and 5-year prediction models.

- Carry out internal financial health reviews and cleanup.

- Create cap table reports, valuation models and burn rate summaries.

- Help with financial documentation needs for Seed, Series A and beyond.