At StartupFino, we develop accounting solutions for Fintech companies in USA. Whether you are an expanding Fintech SaaS company, an early stage Fintech business, or perhaps among the leading Fintech startups, we make your financial operations easy, scalable & completely compliant with US laws. We don’t just deal with your books, we enable you to lay the foundation that draws in Fintech startups funding, lowers risk and accelerates development.

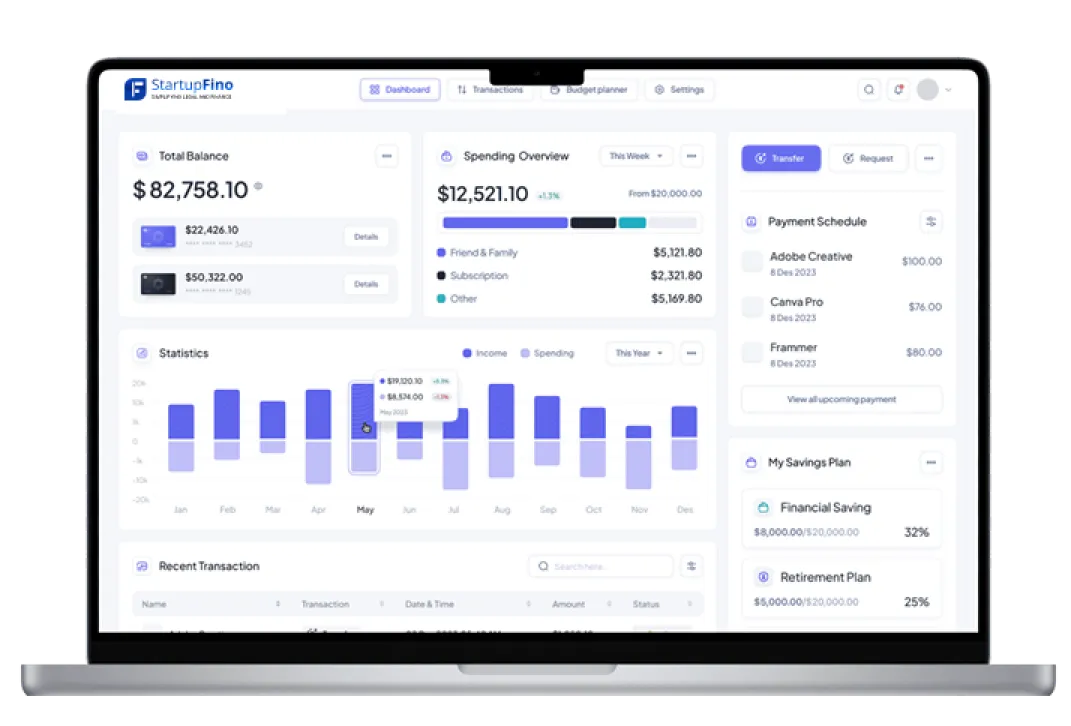

Fintech Bookkeeping & Financial Reporting

Running a Fintech startup involves daily transactions, platform costs, electronic wallets & sometimes even crypto payments. We capture every one of your financial activities and report them on time. Our bookkeeping can handle big revenue streams - whether you operate a Fintech SaaS app, an online financial services business, or a transaction system. Plus our financial reports are built for VC presentations and due diligence.

We make sure you comply with GAAP regulations and provide audit ready reports on demand.

What you get:

- Daily / weekly / monthly bookkeeping with modern Fintech accounting tools.

- Custom reports for investors, boards & venture capital firms.

- GAAP-compliant financials to US standards.

- Tracking of transaction-based, subscription or license revenue in real time.

Tax Planning & Compliance for Fintech Startups

Tax laws can be extremely confusing, especially for Fintech businesses. We bring expertise in Fintech consulting services to help keep you compliant with IRS & state tax laws, such as electronic asset reporting requirements. The IRS requires businesses to report crypto or token related transactions (losses or gains) on its website. Our team helps you lower tax liabilities, take startup deductions and avoid penalties.

We offer fintech services, including tax strategies for Fintech entrepreneurs for small business and scaling companies as well to make the best use of available deductions and credits.

With our tax services, you get:

- IRS compliant reporting for digital assets & crypto transactions.

- Strategic planning to lower taxable income.

- Support for R&D credits & startup tax advantages.

- Full federal & state tax filing & deadline tracking.

Fundraising & Investor Support

Many growing startups look for Fintech startups funding. Whether you're approaching Fintech venture capital companies or angel investors, you need clean financials and solid projections. Our team develops investor ready financial models, pitches-friendly reporting and helps with due diligence. We position your business among the fintech best businesses to invest in.

Plus, we make sure your accounting reflects industry expectations, boosting trust and valuation in the market.

Our fundraising services consist of :

- Financial forecasting & 3-5 year projections.

- Pitch deck financials on par with VC expectations.

- Cap table support & equity planning.

- Assistance with due diligence on term sheets/audits.

FinTech Software & Tech Stack Implementation

All the top Fintech businesses operate on scalable automated platforms. We connect the appropriate tools to help you handle your finances. Whether you use QuickBooks, Xero, Stripe or even a customized billing software, our experts set up your accounting stack based on your business model. This is helpful for Fintech software businesses as well as web based financial institutions with large transaction volume.

We also make sure your tech stack is SOC 2 and PCI DSS compliant (if required) based on your customer data handling.

What we offer your business:

- Fintech end-to-end accounting tech stack.

- Revenue tracking through Stripe / Recurly / Braintree integrations.

- Integration of payroll system for contractor & employee payments.

- Expense management & approval workflow tools.

Fintech CFO & Advisory Services

As a founder you require not just accounting but better and clear understanding of your financial position. Our virtual CFO solutions are geared towards Fintech businesses seeking strategic guidance without a full-time CFO’s cost.

This is great for startups who want to grow into one of the biggest Fintech businesses within their market, with a solid monetary plan from day one.

Our CFO services consist of :

- Budgeting / cash flow planning.

- Board reporting & strategic KPIs.

- Growth & fundraising situation modelling.

- One-on-one advisory with a CFO.

Revenue Recognition for FinTech companies

One of the major problems facing Fintech Startups is how you can recognize revenue. Whether you charge per transaction, provide subscriptions or license your platform, the IRS and GAAP rules require that revenue is recognized consistently and correctly. Misreporting could lead to penalties, failed audits or problems during Fintech startups funding rounds.

At StartupFino, we help Fintech SaaS platforms, online financial services businesses and Fintech software companies implement the proper revenue recognition models, including ASC 606 compliance - the official US revenue recognition standard.

With our assistance, you'll get :.

- ASC 606 compliant revenue tracking.

- Clear recognition for subscription, licensing and transactional income.

- Clean, audit-ready reports for investors and regulators.

- Revenue forecasts correlated with growth and investor targets.

Expense Management & Cost Optimization

As a growing Fintech company, controlling your expenses is vital whether you are targeting Fintech venture capital or controlling your runway. Even the top Fintech startups struggle with untracked software costs, team reimbursements or ad hoc spending which disrupt budgets. That is exactly where we can help.

StartupFino helps Fintech companies for small business and scaling companies to track expenses with intelligent tools and accounting workflows. We keep you within budget, identify irregularities and also boost your burn rate without compromising on quality. Additionally we help you meet IRS guidelines for deductible business costs and maintain correct documentation of each cost.

Our services consist of :

- Monthly expense tracking plus variance alerts.

- Intelligent categorization for SaaS, payroll, advertising and more.

- Integration with expense tools like Expensify and Ramp.

- Support for IRS expense deduction regulations compliance support.

Payroll Processing & Contractor Payments

Paying your team on time is essential, particularly in the Fintech business USA where a lot of businesses use remote teams, developers & part time specialists. Our payroll services ensure your workers & contractors are paid correctly with taxes, deductions and benefits in accordance with US laws.

We help Fintech startups in the USA manage W-2 employees, 1099 contractors & overseas staff via trusted systems. We abide by IRS payroll tax regulations, FICA, FUTA and state certain labor laws. We make payroll easy, whether you are hiring locally or building a remote first Fintech SaaS team.

What we offer:

- Full W-2 and 1099 payroll processing.

- Payroll tax filings & deadline tracking.

- Integration with tools like Gusto or Rippling.

- Contractor payments with proper tax forms and year end filing.