We at StartupFino know that SaaS accounting services for startups in USA need more than just basic bookkeeping. Your financials are different, with subscription models, deferred revenue and regular product updates. That is why our SaaS accounting services are built custom for software as a service startups, helping with everything from US law compliance to incorporating the best SaaS management software for quicker operations.

The key services we provide to help SaaS companies like yours grow while meeting US accounting and tax requirements are given below:

Bookkeeping & Financial Management for SaaS

We develop bookkeeping solutions for SaaS software as a service companies. We do much more than track your revenue & expenses; we manage your deferred revenue, client billing cycles and/or monthly recurring revenue (MRR) - all within GAAP accounting principles and ASC 606.

Whether you are among the best SaaS startups or just starting out, we keep your financial records constantly current & organized.

What we offer:

- Manage recurring revenue, deferred revenue and upgrades/downgrades.

- Monthly financial reports supporting investor discussions.

- GAAP compliant bookkeeping for SaaS startups.

- Incorporate with your existing SaaS billing software & tools.

Revenue Recognition & Compliance

One of the major issues with software SaaS businesses is right revenue recognition. Under ASC 606, you can not recognize money when it comes in unless you match it with services delivered. We keep you compliant despite complex billing cycles or multi-year agreements.

From trial periods to renewals, we handle every revenue stream the right way so your books are investor-friendly and accurate.

What we offer:

- ASC 606 compliant revenue recognition.

- Track revenue by contract, plan or product type.

- Treatment of deferred revenue and promotions.

- Works with most SaaS accounting software.

Payroll & HR Software Integration

Hiring & managing an in-house team? We automate payroll, satisfy IRS regulations and help you stay away from costly blunders when doing salary calculations or tax filings. We also integrate with SaaS HR software to manage employee records, benefits and onboarding from one place.

This service is ideal for growing teams that want more of a hands free payroll and HR tool that can scale with the company.

What we offer:

- Fully compliant with US labor laws & payroll tax rules.

- Automated payroll with built in reports.

- Integration with leading payroll SaaS/HR platforms.

- Error-free filings of state, federal, and local payroll taxes.

Cash Flow & Budgeting for SaaS Startups

Cash flow is extremely important, especially as new SaaS businesses require capital to develop. We build detailed budgets, forecast cash flow & plan for future expenses. We draw on our experience with the best SaaS startups to help you get ready for funding rounds, market shifts & staff expansion.

Even when your revenue is recurring, bad cash management can stall you. We help to fix that. StartupFino brings years of experience supporting SaaS solutions that propel your startup’s success.

What we offer:

- Cash flow forecasting based on MRR and churn.

- Budgeting by scenario for hiring, launching or scaling.

- Connects with your SaaS management software program for real time insight.

- Regular check-ins & budget V/s actual cash flow analysis.

Tax Filing & Advisory for SaaS Companies

Taxes are challenging for SaaS services, particularly if you have to cover several states, remote workers and complicated revenue models. We handle federal and state tax filings, sales tax responsibilities and even R&D tax credit claims, per IRS guidelines & state-specific tax codes.

We don’t just file your taxes, we lower them so that you are able to spend much more on your growth and development in new streams and fields.

What we offer:

- Corporate tax filing in all 50 states.

- Sales tax compliance with digital SaaS solutions.

- Assist claiming R&D tax credits.

- Strategic tax planning to minimize liabilities.

SaaS Metrics Reporting & Analysis

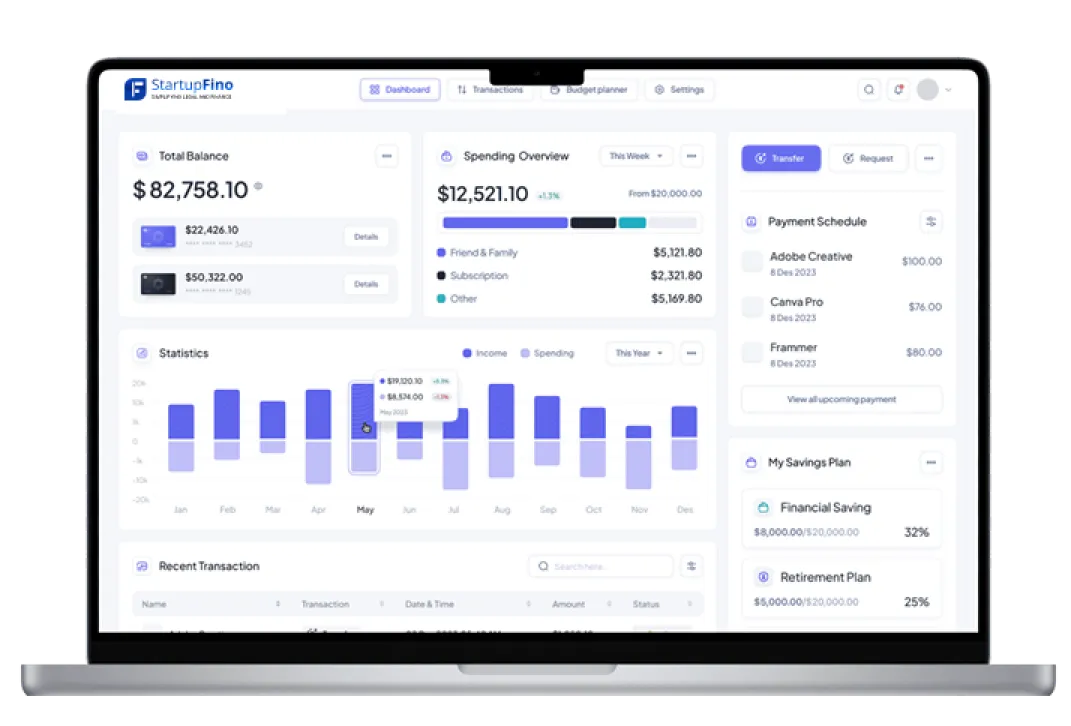

As a startup, you must know your numbers clearly to grow. We create reports on CAC, MRR, churn, LTV, ARR and much more - metrics that matter for SaaS business founders and investors. Our team sets up your dashboards using leading SaaS accounting software and also provides you real time performance visibility.

This is how best SaaS businesses stay ahead, with the use of expert insights given after analysing years of data.

What we offer:

- Weekly, monthly & quarterly financial dashboards.

- Deep SaaS metrics - LTV, MRR, CAC, Churn among others.

- Custom reporting for board & investor updates.

- Integrated with your onboarding SaaS software and CRM

Invoicing & SaaS Billing Management

Managing invoices in a SaaS business involves not just sending bills. You also have subscriptions, downgrades, upgrades, free trials & proration. Our SaaS billing software specialists assist you with all the billing errors and user-friendly processes. Regardless of whether you bill each month, quarterly or yearly, we deal with your invoicing - keeping in mind GAAP requirements in the USA.

We also integrate your billing process with your SaaS accounting program to monitor and reconcile revenues in real time.

What we offer:

- Automatic invoicing for subscriptions-based plans.

- Accurate billing for trials, add ons and prorated charges.

- Integration with ecommerce SaaS platforms & CRMs.

- Reduction in payment delays with built-in reminders and reports.

Inventory Management for SaaS & hybrid Models

When your small business combines SaaS software with hardware or electronic goods (for instance, a Hybrid ecommerce SaaS model), tracking inventory becomes important. We build specialized inventory management SaaS solutions for managing bundled, subscriptions, and stock offers in one place.

This is helpful for SaaS tools which contain physical products like routers, devices or pre-loaded drives. Our system tracks shipments, returns and inventory value, all while complying with IRS inventory valuation guidelines.

What we offer:

- Real-time inventory tracking across sales channels.

- FIFO / LIFO / Weighted Average valuation methods per IRS.

- Inventory & revenue recognition reporting integrated.

- Works with leading SaaS management software & ecommerce systems.

ERP Implementation for SaaS Startups

As new SaaS businesses develop, managing a number of systems becomes chaotic, as finance, billing, HR, CRM & functions all operate separately. We implement and manage ERP systems that consolidate everything under one roof. Our staff customizes ERP setups for SaaS HR programs, accounting, SaaS strategies and much more, to enable your startup to run smoothly and also help save time.

We make your ERP system compliant with US accounting regulations, tax codes and compliance - always ready for audits, investors and scaling.

What we offer:

- End to end ERP implementation for SaaS workflows.

- Unified SaaS payroll and accounting software management dashboard.

- Compliance with GAAP and state tax laws Regulatory compliance.

- Integration with onboarding SaaS software & billing tools.