At StartupFino, we understand that managing cash flow is a top business challenge. If you are a startup, a small company or even an expanding company, proper cash flow planning and budget management is essential to your financial health. Our cash flow management services track earnings, expenses and investments so businesses never encounter unexpected financial issues.

We adhere to US financial laws including IRS and GAAP reporting standards. From cash flow forecasting to budget planning, we help businesses keep positive cash flow and expand.

Cash Flow Forecasting & Planning

Understanding the movement of future cash is vital for a business. Our cash flow forecasting services enable companies to forecast income, expenses and financial obligations. We interpret past transactions, anticipated revenue and market developments to provide a detailed cash flow statement that helps businesses plan for cash shortages. In the USA, companies have to keep accurate cash flow records according to IRS tax regulations and financial reporting laws. Our cash flow online planning services keep businesses ready for future financial requirements.

What We Offer:

- Accurate Cash Flow Forecasting: We evaluate future and past transactions to predict your business cash flow.

- Regulatory Compliance: Our reports satisfy GAAP guidelines and IRS guidelines.

- Customized Cash Flow Solutions: We create strategies specific to your company size and sector.

- Prevention of Cash Shortages: Plan ahead to avoid financial crises.

Cash Flow Statement Analysis

A cash flow statement demonstrates how cash moves into or from your business. Our experts examine cash flow statements for accuracy, compliance and better economic decision making. Proper cash flow accounting is vital for tax filing and business loans. The IRS demands that businesses keep correct records of their cash flow to justify deductions and taxes. With our cash flow statement analysis services, you maintain organized financial reports.

What We Offer:

- Detailed Statement Review: We review all your earnings, expenses, and investments.

- Compliance with Financial Laws: All cash flow statements are prepared to meet IRS and GAAP requirements.

- Better Decision Making: Determine financial weaknesses and strengths using cash flow analysis.

- Better Loan Approval Rates: A strong cash flow statement can land businesses more funding.

Budget Planning & Management

Budget management is essentially needed for financial stability. Businesses may end up overspending or underusing their resources without a proper spending budget. Our budget planning services help businesses allocate funds effectively while meeting financial objectives. The SBA recommends businesses keep a structured budget for improved financial stability and funding. At StartupFino we design custom budgets that fit your business objectives and keep your cash flow healthy.

What We Offer:

- Customized Budgeting Strategies: We design financial plans specific to your company.

- Expense Control: We cut unnecessary costs and boost profitability for companies.

- Compliance with SBA Guidelines: We match budgets with Small Business Administration best practices.

- Long-term Financial Stability: A budget helps ensure sustainable growth.

Managing Business Cash Flow

Efficient business cash flow management helps companies keep up constant operations, avoid financial pressure and cash in on growth opportunities. Late payments, unexpected expenses and bad cash flow management cause financial instability for many US businesses. IRS guidelines say businesses should track cash flow to report financial transparency and taxes. At StartupFino, we offer effective cash flow solutions for companies.

What We Offer:

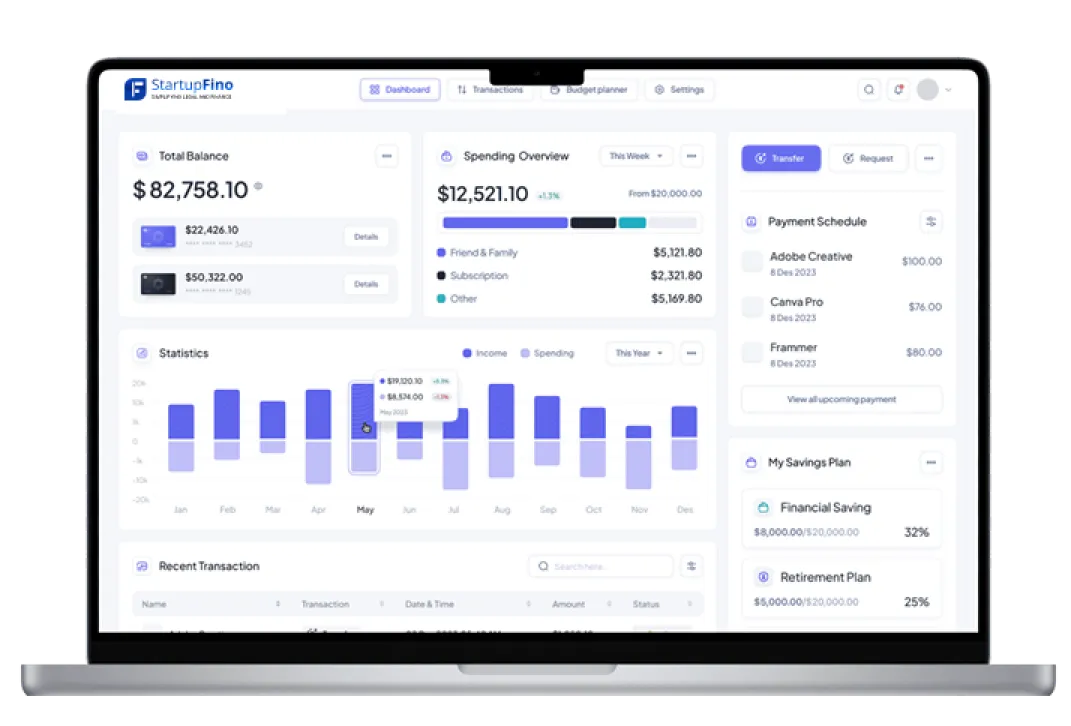

- Real Time Cash Flow Tracking: Monitor income and expenses in real time.

- Late Payment Management: Make sure clients pay on time to keep cash flow accounting.

- Tax-Ready Reports: Keep accurate financial records for filing IRS taxes.

- Business Growth Support: Use financial cash flow to invest in new opportunities.

Personal Cash Flow Management

Cash flow planning is not only for companies but it is also essential for individuals. Our personal cash flow management services track earnings, expenses and investments for financial security. The FTC recommends people keep a personal budget and watch financial inflows to avoid debt and financial mismanagement. We help individuals create a structured personal cash flow statement for better financial planning.

What We Offer:

- Detailed Income & Expense Tracking: See where your money goes each month.

- Debt Management Strategies: Plan ahead to reduce financial liabilities.

- Investment & Savings Planning: Allocate cash smartly on your future financial goals.

- Financial Security: Control your personal cash flow for more savings.

Cash Flow Accounting & Reporting

Correct cash flow accounting is the basis of a healthy business. Every business in the USA must keep correct financial records. Also, the IRS demands that all companies report their cash flow for tax authorities. Bad financial tracking can cause mistakes in tax filing, economic mismanagement, and possibly legal problems. At StartupFino we handle your cash flow management so your income, expenses and transactions are all recorded properly. With our cash flow statement analysis, companies can know their company cash flow and make sound financial decisions.

What We Offer:

- Accurate Financial Records: Track cash flows for tax compliance.

- GAAP-Compliant reports: We prepare reports meeting GAAP guidelines.

- Detailed Cash Flow Analysis: See the weaknesses, strengths, and trends of your finances.

- Tax-Ready Documentation: Get organized cash flow reports for IRS tax filing.

Working Capital & Cash Flow Optimization

A business requires good financial cash flow to compete in the US economy. Multiple businesses have trouble controlling cash flow, thereby missing opportunities and becoming financially unstable. Based on SBA, 82% of US based business failures are because of bad cash flow management. At StartupFino we help companies manage company cash flows better by boosting cash reserves, accelerating collections & controlling expenses. Our strategies keep a healthy cash flow statement and enable businesses to always have working capital for growth.

What We Offer:

- Faster Payment Collections: Reduce delays and enhance cash inflows.

- Cost Reduction Strategies: Reduce unnecessary expenditures.

- Optimized Cash Flow Solutions: Keep a steady flow of available funds.

- Working Capital Planning: Maintain financial stability for operation and expansion.

Debt Management & Cash Flow Stability

Debt is a significant challenge for business cash flow management. In case a business assumes too much debt without planning, this could cause slow growth and financial stress. In the USA, businesses must report debt under the Federal Reserve and Financial Accounting Standards Board (FASB), which could cause negative cash flow, credit risk and even legal problems. At StartupFino, we help companies manage and restructure debt so they can keep positive financial cash flow and continue operations.

What We Offer:

- Debt Restructuring: Optimize repayment plans for much better cash flow.

- Interest Rate Analysis: Find low-cost solutions to relieve financial burdens.

- Cash flow Impact Assessment: Debt repayments shouldn't damage cash flow accounting overall.

Regulatory Compliance: Continue to report proper debt, as per FASB and Federal Reserve guidelines.