We at StartupFino offer financial planning and forecasting for startups, small businesses, and corporations throughout the USA. Whether you need assistance with budgeting, financial risk management, or investment forecasting, our financial planning advisors create tailored strategies to fit your business.

We prepare all financial plans and projections in accordance with US regulations, including IRS tax laws, SEC requirements, and GAAP financial reporting standards. Our services help businesses optimize profits, secure funding, and reduce financial risk while ensuring compliance with financial laws and regulations.

Small Business Financial Planning

Small businesses must plan their finances to remain stable and grow. Most startups and small companies fail because of bad budget forecasting and lack of financial strategy. Our small business financial planning services help you control cash flow, manage expenses, and plan for future development while complying with IRS tax regulations and state-specific company laws.

- Custom budget planning to manage expenses and maximize profits.

- Cash flow forecasting for operation along with financial stability.

- Tax planning and compliance with IRS rules to minimize liabilities.

- Growth-oriented financial strategies for small companies to scale.

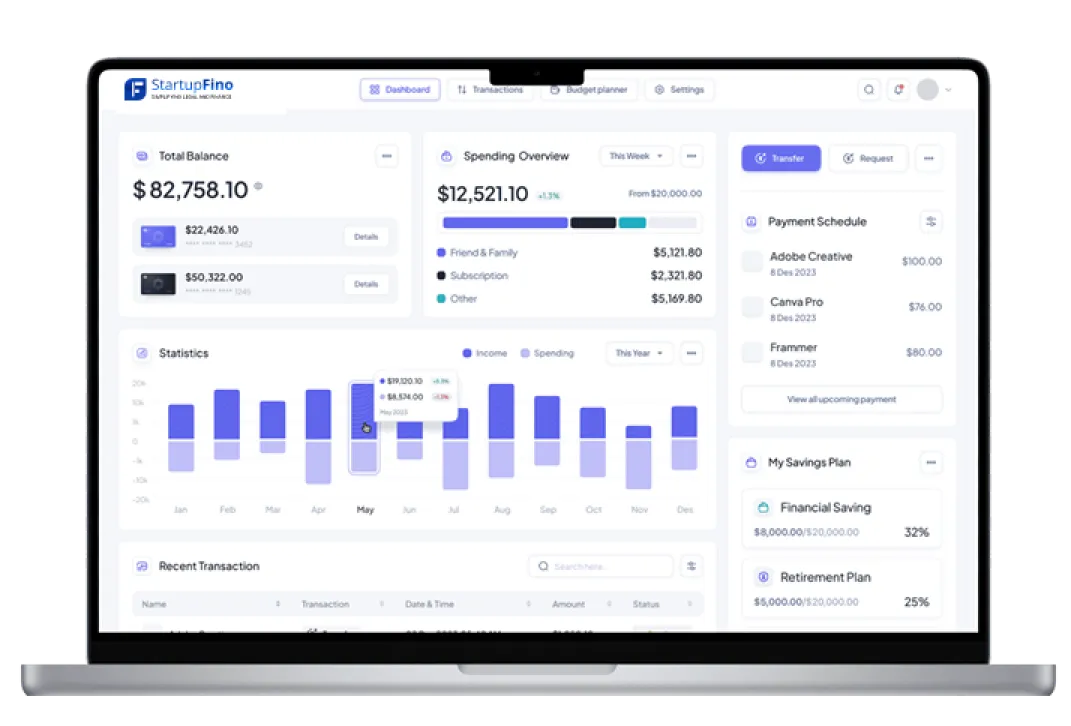

Budgeting and Forecasting

A good budgeting and forecasting strategy helps companies plan for their resources and avoid financial issues. Our financial planning advisors create accurate forecasts based on historical data, market developments, and economic trends. We ensure your financial analysis and planning meet US financial reporting laws (SEC and GAAP standards) so you can make data-driven decisions.

- Realistic revenue and expense projections for managing business finances.

- Variance analysis of actual performance versus budgeted figures.

- Budget planning tools and strategies for resource allocation optimization.

- Adherence to GAAP financial reporting standards to avoid legal issues.

Corporate Financial Planning

US-based companies require a proper corporate financial planning strategy to remain competitive and profitable. Our financial planning firms help corporations with long-range financial planning, investment forecasting, and risk management. We assist businesses in meeting SEC financial reporting rules and SOX regulations for transparency and accountability.

- Long-term financial forecasting for investments and expansion.

- Financial risk management strategies for corporate asset protection.

- Mergers & acquisitions (M&A) financial planning for company growth.

- Corporate tax compliance with IRS and SEC financial regulations.

Financial Planning for Startups

Startups require expert financial planning services to attract investors and grow. Our financial planning for startups focuses on fundraising, financial risk management, and budgeting for early-stage businesses. We help startups meet US investor disclosure laws (like SEC Rule 506(c) and GAAP regulations) and financial reporting standards to build credibility with investors.

- Investor-ready financial modeling and pitch decks for funding.

- Startup tax planning & compliance to maximize tax advantages.

- Burn rate or runway forecasting for cash flow management.

- Capital structuring & fundraising strategy for venture capital & angel investments.

Real Estate Investment Forecasting

The real estate sector demands accurate financial planning and analysis to recognize industry trends, property values, and investment risks. Our real estate investment forecasting services help companies and investors make wise choices while complying with Fannie Mae and Freddie Mac lending laws, IRS real estate tax guidelines, and SEC funding reporting standards.

- Market trend analysis for identifying investment opportunities.

- Cash flow and ROI forecasting for optimal property investments.

- Real estate tax planning for maximum deductions and minimum liabilities.

- Regulatory compliance with IRS and SEC real estate investment laws.

Financial Risk Management

Every business faces economic risks ranging from market turbulence to operational issues. Our financial risk management services help companies identify potential risks and develop strategies to safeguard their assets. We ensure that risk assessments meet Dodd-Frank Act regulations, GAAP financial reporting rules, and SEC risk disclosure requirements.

- Risk evaluation & mitigation of business assets.

- Economic scenario planning for market changes.

- Debt management & financial restructuring for stability.

- Regulatory compliance with US financial risk management laws.

Personal Financial Planning for Business Owners

As a business owner in the USA, your personal finances are just as important as your company's. Our personal financial planning services help entrepreneurs, startup owners, and small businesses manage their money, reduce taxes, and secure their financial future. We assist with IRS tax regulations, estate planning laws, and retirement savings guidelines (401(k), IRA, and SEP IRA) to maximize earnings.

- Retirement planning (401(k), IRA, SEP IRA) for future wealth.

- Tax optimization for business owners to reduce personal and business tax burdens.

- Investment & wealth management to grow personal assets systematically.

- Estate planning and asset protection for a secure future.

Financial Strategy for Business Growth

Growing a business in the US market demands a sound financial strategy that reflects industry trends and long-term goals. Our specialists create custom financial planning and forecasting models to help companies prosper, raise funds, and attain profitability. We ensure all financial growth plans comply with SEC fundraising regulations, IRS corporate tax laws, and GAAP financial reporting standards to help businesses grow without compliance risks.

- Growth-phase financial modeling for expansion and investment planning.

- Capital funding strategy to attract investors and secure funding.

- Cost management and profit optimization to improve business revenue.

- Regulatory compliance with IRS and SEC financial laws.

Budget Forecasting for Sustainable Financial Planning

A structured budget forecasting plan helps companies anticipate future financial requirements and avoid unexpected financial issues. Our budgeting & forecasting specialists analyze past performance, business trends, and market conditions to develop precise projections. We ensure forecasts meet GAAP financial reporting requirements, IRS tax regulations, and corporate financial planning guidelines.

- Long and short-term budget planning for financial stability.

- Tracking expenses and variance analysis to control business spending.

- Cash flow forecasting for business operations.

- Regulatory compliance with IRS and GAAP tax laws for accurate financial reports.