We at StartupFino offer Fractional CFO Services for startups, small business and growing companies in the USA. A Fractional Chief financial Officer provides expert-level Financial strategy and management without the cost of a full time CFO.

Whether you require Fractional CFO Consulting, Fractional Accounting or Part Time CFO Services, we can help. Here is how we could help :

Cash Flow Management & Financial Forecasting

A business with bad cash flow risks failing, even if it is profitable. Cash flow forecasting anticipates future earnings and expenses so your organization has cash readily available for daily operations, payroll, and growth. Our Fractional Chief financial Officer Services discover money leakages, eliminate unnecessary spending and improve working capital. With our expertise, you can stay clear of financial snags and enjoy steady growth.

- Monitor and enhance cash flow to prevent shortages.

- Prepare financial forecasts based on past information and market trends.

- Optimize accounts receivable and payable.

- Comply with IRS cash reporting laws and banking regulations.

Fundraising & Investor Relations

Raising capital in the USA demands good financial reports, accurate valuations & compliance with Investor regulations. Regardless of whether you require VC funding, angel investments or business loans, our Fractional CFO Firm can help you financially. We create investor pitch decks, financial statements and business models which entice funding while meeting SEC (Securities and Exchange Commission) regulations.

- Create investor-friendly financial reports to entice funding.

- Guide you through equity fundraising & debt financing.

- Comply with SEC regulations concerning investor transparency.

- Support due diligence to boost investor confidence.

Budgeting & Financial Planning

Without a proper budget, businesses run the risk of overspending, underestimating costs or not having enough money. A Fractional CFO for startups produces a scalable budget that fits your business needs. We examine your revenues, expenses and market changes to deliver a data driven budget which ensures your long term economic health. We can also assist you to forecast expenses, discover cost-saving opportunities and prepare for unexpected fiscal difficulties.

- Develop detailed financial budgets based on business objectives.

- Find cost saving opportunities to boost profits.

- Monitor financial performance and modify budgets when necessary.

- Ensure compliance with tax regulations to stop penalties & penalties.

Tax Compliance & IRS Reporting

Understanding US tax laws can be really complex. Non-observance of IRS tax codes may result in penalties, legal issues or audits. Our Fractional CFO Company handles your tax filings, deductions and financial disclosures. We help you improve your tax approach, lessen your liabilities and produce accurate financial reporting.

- Ensure IRS taxation conformity with correct filings & deductions.

- Optimize tax planning to minimize liabilities.

- Manage payroll taxes, sales taxes and company tax filings.

- Prepare for audits and create GAAP-compliant financial statements.

Financial Due Diligence & Risk Management

Any merger, acquisition or exit strategy requires thorough financial due diligence. Our Fractional CFO Consulting services help with risk assessment, financial analysis and compliance checks on your company. We keep your financial records transparent, correct and legally compliant - lowering the risk of financial surprises.

- Conduct due diligence on M&A transactions.

- Identify financial risks and suggest solutions.

- Conform to GAAP & SEC reporting guidelines.

- Improve financial reporting transparency to draw in buyers & investors.

Business exit strategy & M&A Support

Planning an exit Strategy, merger or acquisition requires careful financial analysis, due diligence & compliance with law. Whether you're selling your organization, purchasing yet another business or merging with a rival, our Fractional CFO consulting services gets you the very best offer without putting in a monetary risk. A business exit in the USA involves many legal and financial problems including tax implications, valuations in addition to SEC reporting requirements. Our Fractional CFO Firm handles M&A strategy, valuation, due diligence & risk management to help you transition while protecting your financial interests.

- Plan an effective exit plan to obtain the greatest profit.

- Conduct financial due diligence on opportunities and risks.

- Comply with SEC rules & IRS tax laws for business sales.

- Negotiate deals & optimize business valuation for mergers & acquisitions.

Cap Table Management & Equity Planning

Startups that offer equity to investors, staff or co-founders need to manage a cap table (capitalization table). A messy cap table may cause funding issues, ownership disputes and legal issues. Our Fractional CFO for startups organizes, updates and also maintains an accurate cap table to keep your company always investment ready and compliant with SEC regulations. Whether you may be issuing stock options (409A valuations), equity grants, or convertible notes, we can help.

- Maintain a precise cap table to track ownership changes.

- Comply with SEC & IRS guidelines concerning stock options & equity grants.

- Align equity allocation amongst investors, employees and co-founders.

- Be ready for future fundraising rounds by ensuring investor transparency.

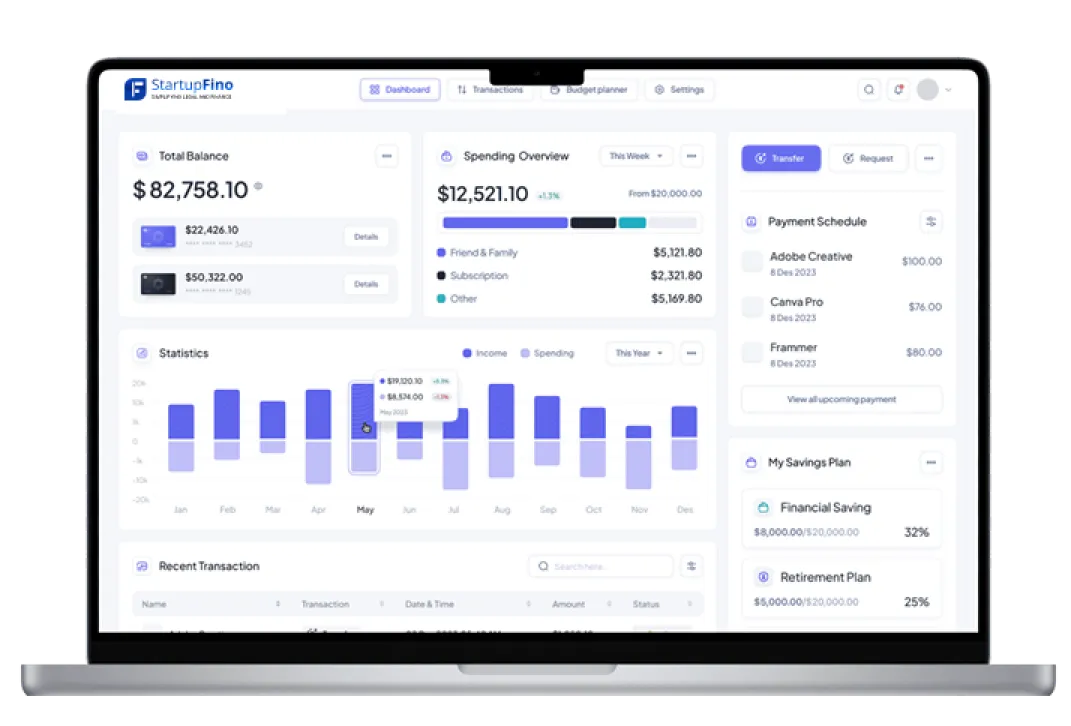

KPI Tracking & Financial Reporting

Tracking the right financial metrics is essential for sound business decision making. Many companies have trouble determining relevant KPIs (Key Performance Indicators) and monitoring financial performance. Our Fractional CFO services monitor profits, revenue growth, cash flow, client acquisition costs and operational effectiveness - which means you can make data driven choices. Our Fractional CFO Firm makes sure your financial reports meet industry standards, are investor ready, and help you grow.

- Identify & track key financial KPIs (cash flow, profit margins, revenue, etcetera.

- Prepare GAAP-compliant investor-ready financial reports.

- Take better decisions based on financial data analysis.

- Comply with IRS & SEC reporting regulations.