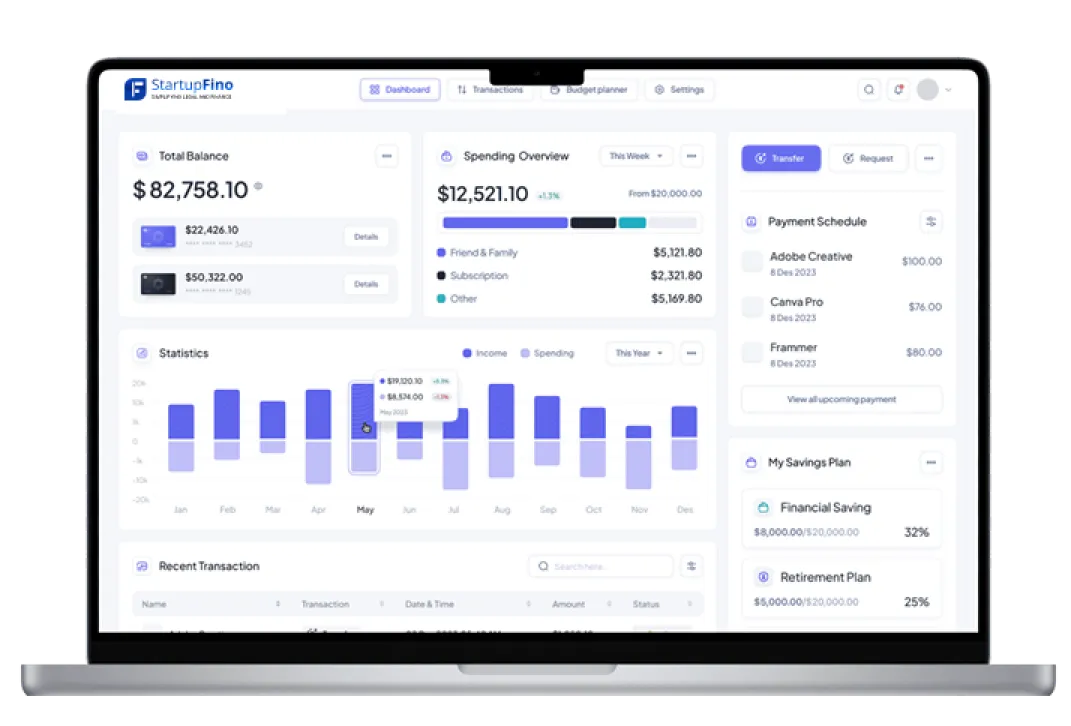

We help startups and small businesses in the US raise capital for growth at StartupFino. Whether you are a novice entrepreneur or a scaling startup, raising funds can be frustrating with all the legal needs, financial planning and investor expectations. That is where our fundraising solutions for startups can be helpful.

We provide venture capital raising, startup fundraising consultant services and nonprofit fundraising consulting using skilled fundraising advisors to get your business the right funding. From investor pitch assistance services to financial planning and legal compliance, our fundraising consulting firm can help you with everything.

The following are our investor and fundraising support services for US businesses, designed for getting you the right investment and in compliance with SEC regulations, corporate fundraising laws & investor disclosure requirements.

Startup Fundraising Strategy & Planning

Raising capital requires a structured strategy which matches your business objectives & industry expectations. As an experienced fundraiser for startups, we help businesses map out a path to get investors. We examine your business model, market positioning and growth potential to suggest the best approach.

Our fundraising advisors for new businesses help determine the right funding - venture capital, angel investors, crowdfunding or small business grants. Additionally, we ensure your fundraising adheres to SEC (Securities and Exchange Commission) regulations, tax regulations and state fundraising laws.

- Customized fundraising strategies specific to your industry and growth stage.

- Identification of funding sources (VCs, angel investors, grants).

- Legal compliance with SEC fundraising regulations and investor disclosures.

- Step-by-step fundraising consulting to help you raise capital.

Investor Pitch Support Services

A compelling investor pitch is the key to raising funds. As a trusted startup fundraising consultant, we help you create a pitch deck, financial projections and investment story. Our experts make your presentation compelling for investors with industry opportunities, revenue models and scalability.

Our fundraising company also prepares you for investor meetings by answering your key questions, objections and negotiations. We help you craft an effective pitch that meets venture capital fundraising expectations and SEC disclosure guidelines.

- Custom pitch deck highlighting your startup vision & economic possibilities.

- Financial modelling and valuation evaluation to support a good business case.

- Investor meeting preparation to boost your confidence in negotiations.

- Compliance with investor disclosure requirements for transparency.

Legal & Compliance Assistance

Avoiding penalties or unsuccessful investment rounds is vital when conducting fundraising for a business startup. With StartupFino, you get access to fundraising consulting companies who have experience in corporate fundraising laws, SEC laws and investment contracts.

We help you comply with US regulations like for private placements, equity crowdfunding rule and 506 (b) & 506 (c) (exemptions for accredited investors). Our nonprofit fundraising consultant services also help with IRS 501 (c) (3) donation laws for fundraising campaigns.

- Fundraising in accordance with SEC, local laws & IRS rules.

- Investor agreement drafting to safeguard your business interests.

- Regulation A + Crowdfunding & equity fundraising compliance.

- Nonprofit fundraising compliance and IRS and tax-exempt status adherence.

Valuation & Financial Modeling

Investors want strong financial projections prior to investment. As an expert fundraising consultant, we help startups produce data-driven financial models which demonstrate growth potential. We maintain your valuation competitive but appealing to investors.

Our startup fundraising consultant services include revenue forecasting, expense management and industry trend analysis. Additionally, we ensure your finances conform to GAAP (Generally Accepted Accounting Principles) and investor expectations for venture capital fundraising.

- Comprehensive financial forecasting to attract serious investors.

- Startup valuation analysis based on industry benchmarks and market developments.

- Investor-friendly financial models highlighting revenue growth potential.

- Financial credibility under GAAP accounting standards.

Term Sheet Negotiation & Due Diligence

Finding investors isn't sufficient to secure an investment. It is also about obtaining the most effective terms. Our fundraising consulting company negotiates investor agreements, term sheets and funding conditions for startups which safeguard your long-term interests.

Additionally, we provide investor-ready legal, financial and operational documents as due diligence support. This helps startups stay away from legal risks and get funding. We assist with SEC filing requirements, investment contracts, and shareholder agreements.

- Investor term sheet negotiating for funding terms.

- Due diligence preparation for investor needs.

- Structured shareholder agreement to safeguard business interests.

- SEC and tax compliance assistance to avoid legal issues.

Crowdfunding & Alternative Fundraising Support

Crowdfunding is among the most common ways that entrepreneurs & small companies raise funds. However, a successful crowdfunding campaign needs a good strategy and compliance with financial laws. As a funder for startups, StartupFino provides complete assistance for equity funding, donation based crowdfunding and reward based fundraising.

Our fundraising services for startups help companies select the right crowdfunding platform, structure campaigns and engage prospective backers. We comply with SEC Regulation Crowdfunding (Reg CF) where businesses can raise up to USD 5 million annually from non accredited investors. We also optimize campaign pages, manage investor communications and produce compelling marketing to draw in money.

- Setup & optimization of crowdfunding campaigns for optimum reach.

- Legal compliance with SEC Regulation Crowdfunding (Reg CF) and State legislation.

- Marketing & investor engagement to boost fundraising success.

- Continual support for campaign management and fund utilization planning.

Government Grants & Startup Incentive Programs

Many startups & small companies disregard government grants & incentive programs as funding sources. Unlike venture capital or crowdfunding, grants don't need repayment and are a great option for early stage companies. As an experienced fundraising consultant, StartupFino helps businesses find and apply for industry-appropriate federal, state and local grants.

We advise on Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs which finance technology-driven start-ups. Our fundraising consulting company also helps businesses meet eligibility requirements, submit compelling grant applications and follow U.S. Department of Commerce and IRS reporting requirements.

- Identifying eligible government grants and startup incentive programs.

- Application assistance for SBIR, STTR and state funding programs.

- Compliance with government reporting and financial transparency regulations.

- Strategic funding roadmap combining grants and other fundraising solutions.

Fundraising Solutions for Nonprofits & Social Enterprises

Nonprofit organizations & social enterprises require efficient fundraising to fulfill their social mission. At StartupFino, we don’t just offer fundraising solutions for small businesses but also provide nonprofit fundraising consultant services to help them raise cash through grants, donor contributions and sponsorships.

We help nonprofits remain tax exempt while raising funds by providing IRS 501 (c) (3) guidance. Our team also assists with foundation grant applications, corporate partnerships and donor engagement for maximum funding potential. So, whether you need assistance with online fundraisers, event based fundraising or capital campaigns, we build custom solutions for long-term sustainability.

- Strategic fundraising planning for nonprofits and social enterprises.

- Meeting IRS 501 (c) (3) tax exempt status and donation regulations.

- Grant application help & corporate sponsorship outreach.

- Digital & event based fundraising for sustainable funding growth.