At StartupFino, we know that managing workers, payroll and compliance in the US can be complex, especially for startups and growing companies. That is the reason our HR & payroll services are specifically created for small businesses, supported by the newest digital HR & payroll tools, and for compliance with U.S. laws. Whether you are just getting started or scaling up, our services were made to help you grow easily, correctly and in compliance.

Payroll Processing Services

We handle your payroll so each paycheck is in compliance with laws, timely, and accurate as per relevant U.S. tax regulations. We do everything from gross-to-net calculations to tax withholdings, direct deposits and pay stub generation. We also file IRS Form 941, Form W 2 along with other state filings so you do not miss a deadline. StartupFino's payroll system is compliant with federal and state wage laws such as the FLSA.

With our automated system, startups and small companies save many hours a month with full accuracy of payroll.

What we offer:

- An accurate payroll that runs with automatic tax deductions.

- Employees receive direct deposit and online pay stubs.

- Complete compliance with FLSA & IRS filing requirements.

- Easy end of year tax report generation (W-2s, 1099s)

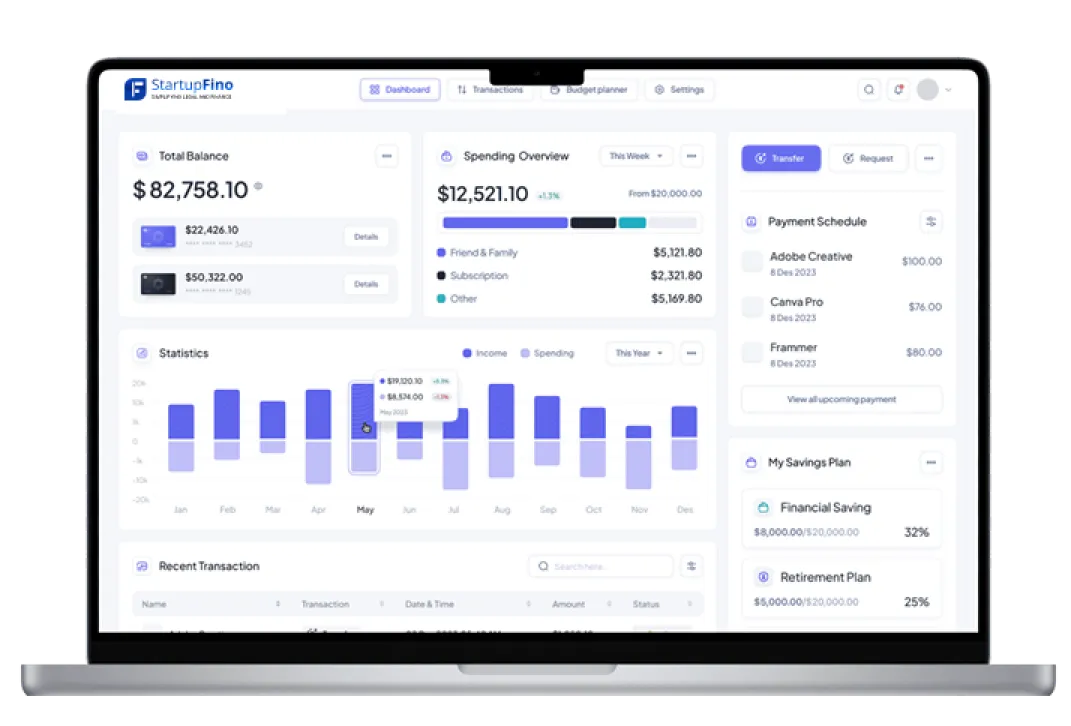

HR Software with Payroll Integration

Our all-in-one HR & payroll Software handles employee management and payroll, all from one intuitive platform. These payroll and HR services for small businesses are good for those who do not wish to struggle with several tools and spreadsheets. From onboarding to exit, each HR task is tied into payroll for HR & payroll management.

Our platform also abides by HR guidelines and adheres to employee data privacy laws including the California Consumer Privacy Act (CCPA) and the EEOC's anti-discrimination regulations.

What we offer:

- Complete employee database with document storage.

- Employees can look at payslips, vacations & benefits through self-service portal.

- Integrated payroll with salary updates and deductions.

- Complies with U.S. labor and data protection rules.

Online HR & payroll services

Cloud based online HR and payroll solutions are an extremely important tool in the modern hybrid and remote work environment. Our system gives you access from personnel records to payroll reports from anywhere, on any device. It is not only convenient but also keeps you secure and audit-ready.

Our online tools also help you comply with remote employment laws like state-specific income tax withholding for remote employees and electronic W-4 filings.

What we offer:

- Cloud-based access to all HR & payroll tools.

- Remote onboarding, payroll & time monitoring.

- Backups secure and role-based access controls.

- Remote worker payroll tax compliance.

Human Resources Management Solutions

Our Human Resources Management Solutions help you maintain a productive compliant workforce. We help in onboarding, performance evaluations, policy information and much more - all in accordance with U.S. labor requirements including OSHA, ADA and other regulations.

StartupFino offers HR assistance beyond software. We bring genuine human guidance to help your company stay away from risks and develop healthy employee relationships.

What we offer:

- Customized employee handbooks & HR procedures.

- Support with FMLA, ADA & anti-discrimination compliance.

- Performance tracking & 360 degree feedback tools.

- Recruitment & onboarding workflows with payroll integration.

HR and Payroll Solutions for Small Businesses

Startups and small teams need scalable, inexpensive and dependable payroll & HR solutions for business, and that is exactly what we offer. Our best HR software for small businesses and startups grows with your company from the moment of your first employee to your 50th employee.

We handle all of the hiring, managing, paying and retaining without having a full on staff HR department.

What we offer:

- Small businesses can use budget friendly HR software.

- Simple UI with auto-alerts and reminders.

- Scalable plans according to business size and growth.

- Support from skilled HR & payroll experts

Employee HR and Payroll Services

Managing employee records, salaries and compliance shouldn't be a challenging task, even for growing companies. From salaries and benefits to tax filings and labor law compliance, our employee payroll and HR services can help. If you are working with non-exempt or exempt workers covered by the FLSA, our platform handles all of the wage calculation and recordkeeping.

As part of our online HR and payroll services, we manage your Social Security, Medicare & federal unemployment tax (FUTA) deductions as well.

What we offer:

- Correct employee classification and wage management.

- Support for federal and state tax withholdings included.

- Availing benefits and PTO tracking.

- Fully compliant with FLSA & IRS wage reporting requirements.

Leave & Time Management with Payroll Integration

Tracking employee leave, hours worked and overtime can be time taking, especially when working remotely or hybrid teams. Our HR & payroll software has integrated leave and time management tools that sync with payroll. You can set up vacation, sick Leave and PTO policies per FMLA and we'll make sure everything appears accurately in the paycheck.

Whether your team clocks in through a mobile app or web portal, our tools record every hour to comply with state overtime laws and employee scheduling requirements.

What we offer:

- GPS-based or web time tracking tools.

- Local laws based overtime calculations automated.

- Custom leave types and real time leave tracking.

- Integrated with payroll for easy payouts.

Tax Filing & Year-End Payroll Compliance

Payroll taxes are a pain to file manually. StartupFino handles all your tax filing from monthly tax deposits to yearly forms with HR & payroll solutions. We file federal, state and local payroll taxes, and we file Form 940, Form 941, W-2 & 1099-NEC for you, as well as the workers you hire.

Additionally, we assist with electronic filing and IRS deadlines, ACA reporting and State Unemployment Tax (SUTA) compliance year round.

What we offer:

- Automatic payroll tax calculation and e-filings.

- End of year support with W-2s, 1099s & ACA forms.

- Compliance with IRS, local and state income tax laws and regulations.

- Alerts & reminders about important deadlines.