At StartupFino, we manage accounting and bookkeeping for small businesses and startups throughout the USA. That is the reason we offer specialist bookkeeping and accounting services that meet IRS guidelines, GAAP standards and tax laws while maintaining correct financial records for you.

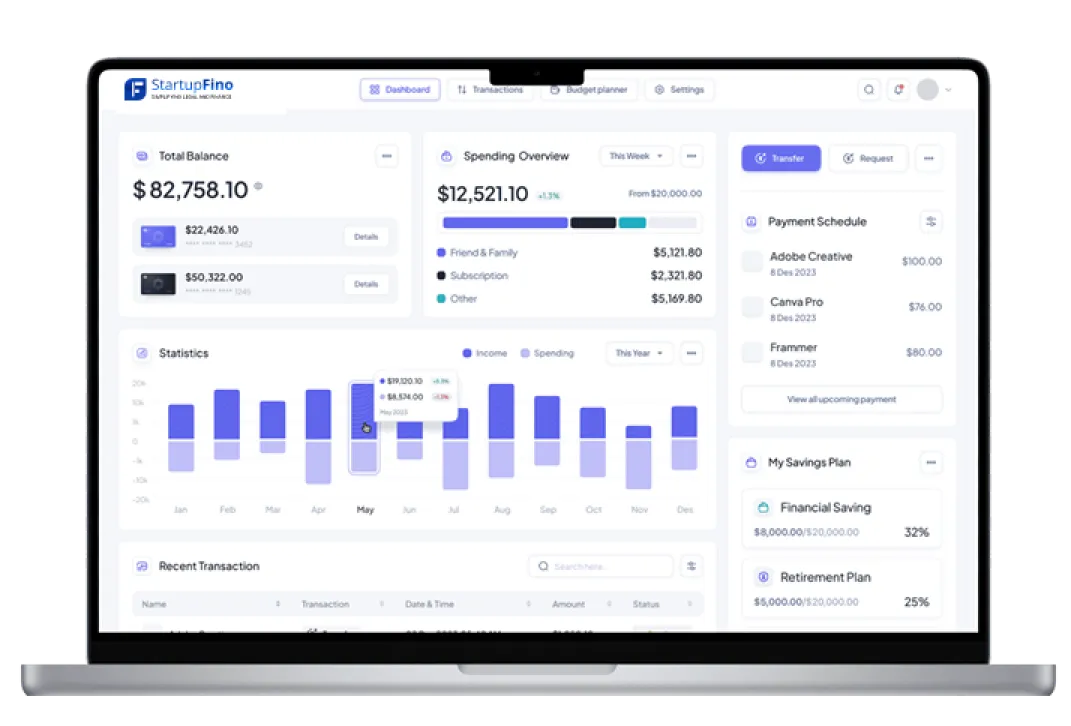

Our accounting services for small businesses consist of bookkeeping & tax services, financial reporting and payroll processing. We offer online bookkeeping for small business people through cloud-based programs including QuickBooks, Xero, and NetSuite.

Complete Bookkeeping Services

Keeping an eye on your business activities is essential for fiscal stability and compliance. Our services on bookkeeping and accounting for small businesses keep your books current and prepared for audits or even taxes. IRS guidelines require businesses to maintain financial records for a minimum of 3 years to comply with tax regulations. Our accounting and bookkeeping service for startups helps companies to be compliant and also save time and effort.

We also track expenses and income and prepare financial reports. With our online bookkeeping solutions for small businesses, you receive automated reports and real time financial insight to help you make wise choices.

- Daily Transaction Recording - track income, expenditures & payments.

- Bank Reconciliation - Ensure each banking transaction conform to your financial records.

- Financial Statement Preparation - Make financial statements, cash flow statements & cash flow reports.

- Expense Tracking & Categorization - Keep track of all business expenditures.

Accounting Services For Small Businesses

Every business needs accurate financial reporting & strategic planning for growth. Our accounting services for small businesses help you monitor cash flow, budget and also conform to IRS and GAAP standards. GAAP (Generally Accepted accounting Principles) states that businesses must use accrual Accounting techniques to report financial statements.

We customize accounting for your business. Whether you need assistance with income & loss analysis, financial forecasting or tax preparation, we got you covered. Our accounting and tax services keep your business healthy and legally compliant year round.

- Financial Planning & Budgeting - Make a structured financial plan for your business growth.

- Cash Flow Management - Check inflows and outflows to prevent financial crises.

- Tax Preparation & Planning - Get accurate tax computations & timely IRS filings.

- Accounting Software Integration - We integrate with QuickBooks, Xero, NetSuite along with other cloud solutions.

Bookkeeping and Tax services

One of the greatest problems for companies is effectively handling bookkeeping and tax services. The IRS requires that all businesses submit accurate tax returns and keep accurate financial records. Our accounting & tax services guarantee error-free filings, proper deductions and compliance with federal and state tax laws.

We lower your tax obligations and maximize deductions by recording your assets, expenses, and income properly. With our bookkeeping and accounting for small business solutions, you can concentrate on growing your company while we manage your tax planning.

- Tax Return Preparation - We prepare timely and error-free taxes for the IRS.

- Sales tax Compliance - Take the stress out of multi-state sales tax filings.

- Tax Deduction Maximization - Find deductible expenses to bring down your Tax bill.

- IRS Audit Support - We help with audits and compliance with tax regulations.

Online Bookkeeping Services for Small Business

Conventional bookkeeping could take you when it comes to keeping up with the US market. That is the reason StartupFino does advanced online bookkeeping for small companies. We make use of cloud accounting platforms to offer anybody access to financial data anywhere in the world in real time.

The IRS guidelines call for businesses to keep accurate digital records to support tax returns and audits. Our accounting & bookkeeping service for startups tracks expenses, generates reports & processes payroll. We eliminate manual errors and increase financial accuracy with AI-driven automation and digital record-keeping.

- Cloud-Based Bookkeeping - Access financial records from anywhere through secure internet platforms.

- Automated Financial Reporting - View real time profit or loss & expense reports.

- Secure information storage & Backup - Encrypted electronic storage for your financial data.

- Integration with Business Apps - Connect to e-commerce, payroll & invoices.

Payroll Processing and Compliance Services

Payroll management can be challenging, particularly for small enterprises & start-ups that have to guarantee that income payments, tax deductions and compliance with IRS payroll rules are timely. At StartupFino, our payroll management services deal with employee salary computations to payroll tax filings - which means you do not need to worry about missing a deadline or compliance.

Businesses must follow minimum wage guidelines, overtime pay guidelines and worker benefits deductions under the FLSA. We process your payroll correctly and legally so you can keep up with payroll tax responsibilities, W-2 filings & 1099 payments for contractors. With our online bookkeeping for small businesses, we automate payroll processing, reducing mistakes and wastage of time.

- Full Service Payroll Processing - Salary calculation, tax withholdings & compliance.

- Payroll tax Filing & Compliance - For IRS, FLSA & state tax law compliance.

- Direct Deposits & Pay Stub Management - Automate payment processing & keep track of records.

- Employee Benefits & deductions - Manage 401 (k), healthcare & insurance deductions.

Accounts Payable & Accounts Receivable Management

Keeping track of bills, invoices & payments is important for a business' cash flow. Our accounting and bookkeeping services for small businesses help you pay vendors on time and also get payments from clients.

Under IRS and GAAP standards, companies must keep correct accounts payable and receivable information for tax purposes. Our bookkeeping and accounting for small business records every transaction so you never have late payments, penalties or cash flow problems. With StartupFino's cloud based bookkeeping tools, you can track payments, set up automatic reminders and avoid cash crunches.

- Vendor Bill Management - Timely payments to vendors to maintain good business relationships.

- Customer Invoice Tracking - Monitor incoming payments to stay away from late collections.

- Cash flow Optimization - Plan appropriate Cash flow to prevent financial bottlenecks.

- Automated Payment Reminders - Stay away from missed payments & collection delays.

Financial Budgeting and Reporting Services

Understanding your business finances is the basis for sound decision making and long term success. Our financial reporting & budgeting services assist startups and small companies achieve their revenue, cost and earnings objectives.

GAAP rules require companies to make accurate financial statements - including income & loss statements, balance sheets, and income reports. Our accounting services for small businesses offer you detailed financial reports to analyze trends, control spending and make much better financial decisions. With our bookkeeping and tax solutions, your business is always financially prepared for tax year and investment opportunities.

- Custom Financial Reports - See real time performance of your business.

- Budgeting & Forecasting - Plan expenses & forecast revenue patterns for the future.

- Expense Tracking & Cost Management - Find more savings potential.

- Profit & Loss Analysis - Understand the way your business is doing financially.

Business Tax Preparation & Filing services

Filing taxes can be time-consuming and stressful, but with StartupFino's bookkeeping & tax services, you never have to stress about IRS due dates or compliance problems. We handle all of the business tax preparation and filing so your returns are accurate, filed promptly and enhanced for tax deductions.

Businesses should file taxes depending on their structure (LLC, S-Corp, C-Corp, or Sole Proprietorship) and abide by federal, state and local tax laws, the IRS states. Our accounting and tax services identify eligible deductions, minimize tax liabilities and prevent penalties. We can assist with quarterly estimated tax payments, payroll tax compliance or tax filings.

- Business tax Return Preparation - File error-free tax returns for the IRS.

- Tax Compliance & Advisory - Follow federal, state along with local Tax laws.

- Deduction & Credit Optimization - Get the most from your deductions with IRS approval.

- Audit Assistance & IRS Representation - We assist with IRS audits & tax questions.