We at StartupFino provide accounting services for E-commerce D2C brands and Direct to Consumer companies in the U.S. We know the difference between D2C & E-commerce models and provide solutions for both models, from startups to growing enterprises. Our team ensures your finances are scalable, optimized, and compliant. Here are our main services for D2C commerce and ecommerce direct to customer businesses based on the latest D2C E-commerce trends 2025:

Sales Tax Compliance & Filing

In the U.S., ecommerce businesses are subject to sales tax nexus rules requiring companies to collect and also remit sales tax in states where they have a major presence (such as physical operations or sales volume). For D2C E-commerce platforms this gets challenging, particularly in case you have several fulfillment centers or marketplaces such as Shopify and Amazon. Our team helps you follow these rules, register in the right states and file on time to avoid penalties.

We make sure you're always on the right side of the law by handling all the complicated paperwork & deadlines for you. With us, you can focus on growing your business without the headache of tax issues.

- Monitor & manage economic nexus across the 50 states (based on thresholds like USD 100K in sales or 200 transactions).

- Collect accurate sales tax from your D2C E-commerce software.

- Prepare and submit monthly, annual or quarterly tax returns with local jurisdictions.

- Check state-specific tax law changes to remain in compliance.

Inventory & Cost of Goods Sold (COGS) Management

One of the major challenges facing E-comm & D2C brands is monitoring inventory accurately across warehouses, sales channels and suppliers. Mismanagement here affects your price of goods sold and profit margins. We offer real time inventory accounting synced together with your platforms for correct valuation and COGS calculations for reporting and tax.

Good inventory management is needed for a successful business. We keep an accurate count and valuation of your stock, so you know exactly what you have and what it’s costing you. This helps you cut waste, save money, and make better buying decisions.

- Real-time inventory sync across D2C commerce tools like Shopify, WooCommerce and Amazon.

- Tracking of landed costs, purchase orders and stock levels.

- Automated COGS reporting for financial insight and tax filing.

- Compliance with IRS inventory accounting guidelines (FIFO, LIFO, weighted average).

Multi-Channel Reconciliation & Bookkeeping

Ecommerce D2C companies usually have multiple platforms to deal with (Shopify, Amazon, Etsy among others) and thus must reconcile transactions from several gateways (Stripe, PayPal along with Shopify Payments). Our D2C E-commerce solutions automate this process and reduce manual blunders to keep your books clean and audit-ready.

Keeping your books accurate across all your sales channels is actually not that tough. We make the process easy, reducing errors and giving you clear insights into your finances. This means you can spend less time worrying about numbers and more of it on your business.

- Daily/weekly reconciliation of orders, returns, fees & payouts across platforms.

- Integration with leading accounting tools (QuickBooks, Xero) for generating reports.

- Fix discrepancies with marketplaces or payment processors.

- Maintain GAAP-compliant books for investor reporting and IRS audits.

Financial Reporting & Budgeting

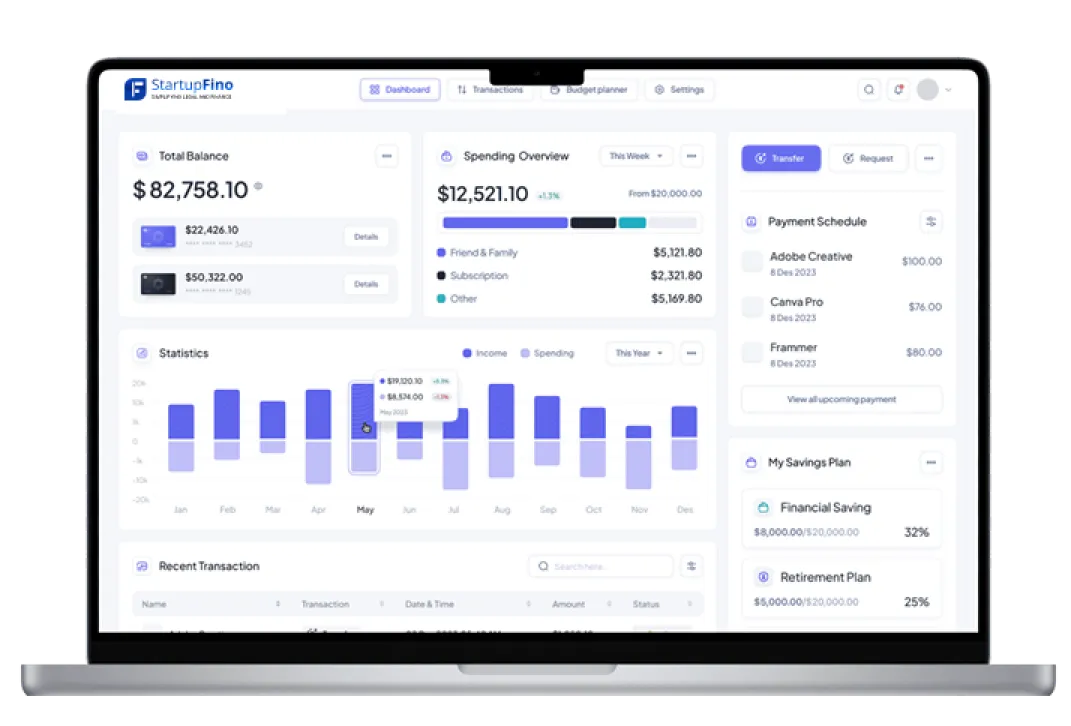

Direct to consumer ecommerce companies require timely accurate financial reports for sound decision making. We deliver monthly financial statements, cash flow reports and performance dashboards. Our team delivers growth insights whether you are preparing for fundraising or even planning for marketing expenditure.

Understanding your business’s financial health is essential and no one can deny this. We provide easy-to-understand reports that show you where your money is going and where it's coming from. This helps you plan better and make good decisions about where to invest.

- Custom dashboards for keeping track of income, expenses & profit across D2C e-commerce systems.

- Advertisement spend, inventory & operating expense budgeting support.

- Rolling forecasts on historical and seasonal sales.

- Compliance with U.S. GAAP and investor ready format for pitch decks.

Payroll & Contractor Payments

If you run a D2C business model with workers, remote teams or 1099 contractors, you need to be accurate about payroll compliance. From withholdings to W-2 & 1099 documents, we handle everything, so that you know you are adhering to federal and state labor laws across states in the USA.

Paying your team correctly and that too on time is important. We handle all the details of payroll and contractor payments, making sure that everyone gets paid the right amount at the right time. This keeps your team happy and helps you be in compliance with employment laws.

- Set up and run payroll with multi-state tax compliance across states.

- File W-2 for personnel and 1099-NEC for contractors.

- Follow IRS deadlines for quarterly payroll tax filings (Form 941).

- Integrate benefits, PTO and end of year reporting into payroll systems.

Cash flow & Profitability Planning

Growing a D2C e-commerce brand demands constant focus on cash flow. We track outflows and inflows, prepare for future expenses and for seasonal demand. Our strategic insights keep you away from any kind of cash crunches and increase your profitability with proven and data-based insights.

As already stated, healthy cash flow is the basis of your business. We monitor your cash closely, alerting you of any potential shortfalls before they actually happen. Our strategies help you boost profits by seeing that you have the funds to make the best of opportunities as they come up.

- Weekly cash flow forecast and burn rate analysis.

- Breakeven assessment for new product launches.

- Plan for tax liabilities and working capital needs.

- Align financial strategy with direct consumer trend and market behavior.

E-commerce Platform Integration & Automation

Running a D2C E-commerce or Ecommerce D2C business means managing a number of resources - Shopify for product sales, Stripe for payments, QuickBooks for bookkeeping and many such other things. With every wrong integration, errors can multiply. At StartupFino, we ensure automations and connect your tools for real time data flow. This means much less manual labor, fewer mistakes and more time for growing your D2C business model.

We connect directly to your D2C E-commerce platform, payment gateways, accounting software and inventory tools so everything communicates smoothly with one another, and your books are updated timely.

- Integration with Shopify, WooCommerce, BigCommerce & any other e-commerce systems for D2C.

- Sync transactions, invoices, payouts and refunds using QuickBooks, Xero or NetSuite.

- Reduce manual data entry and reconciliation errors with automation.

- Keep up with IRS recordkeeping guidelines (IRC Section 6001) and keep all transactions logged and traceable.

Fundraising & Investor Ready Financials

If you're a fast-scaling D2C and E-comm startup raising capital, your finances need to be clean, simple and compelling. Most investors want to see far more than just profit/loss: customer acquisition expenses, gross margins and projections. We prepare complete, GAAP compliant financial statements and performance reports to wow VCs, angel investors and lenders.

Our team knows what direct-to-consumer companies need to demonstrate in due diligence - particularly in a D2C vs E-commerce funding environment. We build financial packages which speak your investors language.

- Produce investor ready financial reports (P&L, balance sheet, cash flow) that satisfy U.S. GAAP specifications.

- Create growth projections & pitch friendly dashboards for D2C fundraising.

- Support for KPI tracking such as CAC, LTV, conversion rate & D2C E-commerce growth.

- Transparency and compliance with IRS and SEC expectations concerning investor reports.