At StartupFino, we offer US-specific crypto and blockchain accounting solutions that comply with the IRS. Whether you are a crypto trader, miner, DeFi user, NFT originator or a blockchain startup - we do everything from crypto tax planning to blockchain bookkeeping in conformity with US tax laws & reporting standards. What we offer:

Crypto Tax Preparation & Filing

Handling crypto taxes is challenging since the IRS is cracking down on digital assets. Conforming with IRS Notice 2014-21, cryptocurrencies are considered property and every purchase, sell or trade must be reported. Our crypto tax services help you file correctly, stay clear of penalties and maximize deductions. We specialize in accurate crypto tax preparation, capturing all transactions from DeFi platforms, exchanges, and wallets.

We handle every detail of your crypto transactions to make sure you're fully covered. No more worrying about IRS issues as we have you completely covered, while also helping you claim every deduction you deserve.

- Full crypto tax accounting for individuals & companies.

- Preparing IRS Form 8949 and Schedule D for capital gains.

- Professional tax services crypto with support for multiple wallets, blockchains and exchanges.

- Expert advice from top cryptocurrency tax advisors.

Blockchain Bookkeeping

Traditional bookkeeping isn't appropriate for crypto businesses. That's why we provide modern, custom blockchain bookkeeping. We track your transactions with top blockchain accounting software. We log everything from staking, lending, and NFT income in audit-ready records.

Our bookkeeping service adapts to the unique challenges of crypto, seeing that every piece of data from your transactions is accurately captured. This means you can relax knowing your books are always ready for scrutiny.

- Transactional bookkeeping for crypto wallets & exchanges.

- Integration with DeFi, NFT & staking platforms.

- Automatic tracking for accounting with blockchain technologies.

- Organized records for audits, compliance and reporting.

Crypto Tax Advisory & Planning

Want to lower your tax bill and be one step ahead of the IRS? Our crypto tax advisors can assist with smart planning based on your trading style, investment volume and holding periods. We review short-and long-term capital gains, tax loss harvesting, and HIFO/FIFO techniques for you.

Our experts work with you to figure out the best ways to lower your taxes based on your specific crypto activities. We help you make smart moves today to save money tomorrow.

- Strategic planning from crypto tax accountants.

- Continuing advice to optimize your crypto tax filing strategy.

- Custom reports for estimated tax payments for quarterly.

- Gifts, airdrops and staking income rules.

Blockchain Financial Reporting

Need clean, understandable financials for your blockchain based business? We provide blockchain financial reporting for compliance, business decisions and fundraising. Whether you are a DAO, NFT studio or blockchain startup, our reports make sense of your crypto balance sheet.

We deliver clear, easy-to-understand financial reports for blockchain businesses. This helps you make better business decisions and keeps everyone from investors to regulators informed and happy.

- Tracking your wallet and portfolio with real time reports.

- Clear reports to investors, auditors and tax departments.

- Support for GAAP-compliant accounting with cryptocurrency.

- Customized blockchain accounting solutions for US businesses.

CFO & Accounting Services for Crypto Startups

Startups in blockchain tech oftentimes require more than just tax filing; they require complete financial leadership. Our accounting company crypto experts are your virtual CFOs - from budgeting to investor reports. We bring blockchain for accountants to early stage ventures as well.

Think of us as your financial co-pilot, taking you through budgeting, planning, and critical financial decisions. We're here to help your startup thrive from the start to your peak.

- Designed budgeting and forecasting for crypto startups.

- Equity, tokenomics and fundraising assistance.

- Blockchain businesses need ongoing accounting.

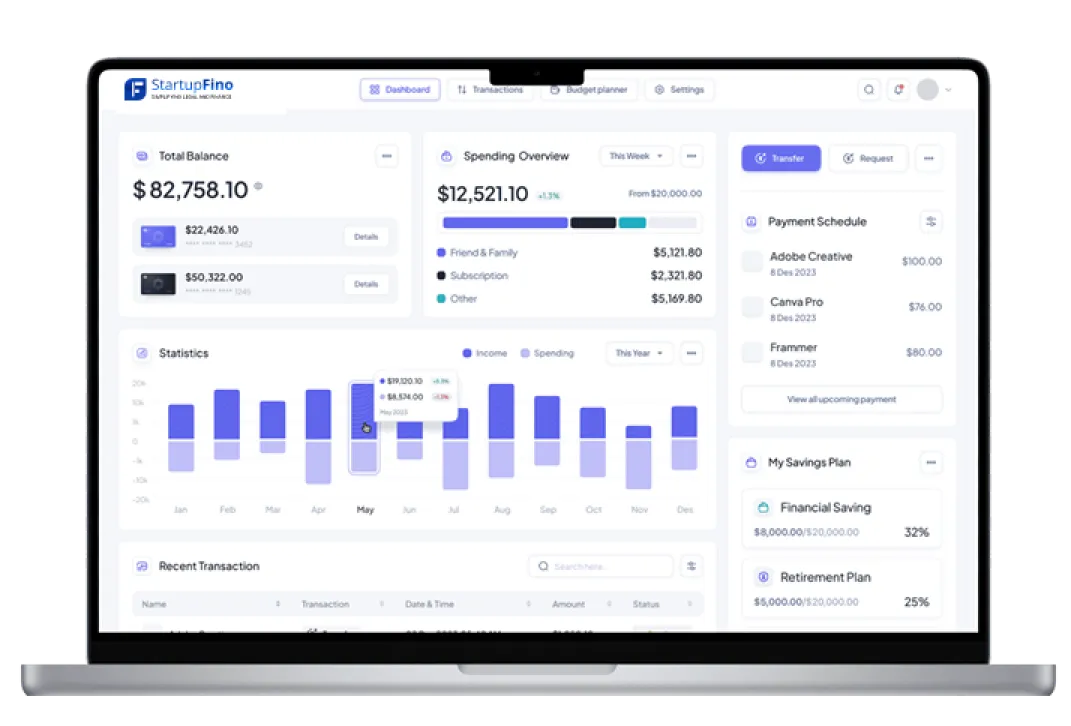

- Blockchain - powered financial dashboards and accounting tools.

Support for Crypto Traders & Investors

We also serve single traders & crypto investors. If you trade often or use several DeFi platforms, we can offer full crypto tax accounting, wallet integration and IRS-ready reports. We simplify your tax season, decrease audit risk and keep you compliant.

Our services simplify the complex needs of crypto taxes for frequent traders and investors. We keep things simple, so you can focus more on trading and less on paperwork.

- IRS compliant tax accounting for cryptocurrency.

- Guidance on wash sales, staking and DeFi gains.

- Help with backdated reporting/amended returns.

- Trusted by hundreds as a top crypto tax firm.

NFT & DeFi Accounting Services

NFT creators & DeFi users have different tax challenges than other individuals. Whether you mint NFTs, earn from royalties, or provide liquidity on decentralized platforms - all these actions carry tax implications under IRS guidelines. A lot of DeFi activities, including staking, lending and farming - are now considered taxable events by the IRS. Our crypto accounting solutions provide advice and reporting on these complicated transactions. We make all these issues crystal clear using smart blockchain accounting solutions.

Whether you're an NFT artist or a DeFi enthusiast, we handle the tricky tax stuff so you can focus on your passion. Let us worry about the IRS while you innovate and create.

- NFT earnings and royalties categorized under IRS regulations.

- Tracking of DeFi activity like staking, farming & liquidity pools.

- Tax ready reports for wallet and token-level transactions.

- Support from DeFi-savvy cryptocurrency tax advisors.

Crypto Payroll & Compensation Management

Paying workers or contractors in cryptocurrency? The IRS demands you report those payments as taxable income based on fair market value at time of payment. Our blockchain accounting solutions make payroll management simple & compliant. We help blockchain startups manage salaries, token grants and bonuses with proper crypto bookkeeping and tax records. No headaches, just accurate, IRS-friendly and automated crypto business accounting.

We make your crypto-based payroll easy and compliant, ensuring every transaction meets IRS standards. With our help, crypto payroll is just as simple as traditional payment methods.

- Reporting for crypto based compensation which is IRS compliant.

- Tracking of payroll in stable coins or tokens.

- Configuration and administration of crypto payroll tools and wallets.

- For startups with worldwide remote teams - ongoing support.

Amended Returns & Crypto Tax Corrections

Made an error on your prior crypto tax filings? You aren't alone - a lot of early adopters have underreported or skipped essential IRS forms like Form 8949 or Schedule D. The good news is that we know how to fix it. We review your prior tax tax returns, discover gaps and file amended tax returns with confidence - with our crypto tax services. Our crypto tax accountants keep things accurate, help you stay away from penalties and defend you from future audits.

Mistakes are going to happen, especially in something as complex as crypto taxes. If you've missed something in the past, we'll help fix it smoothly and defend your case with the IRS.

- Previous filings for cryptocurrency reviewed and audited.

- Amended returns require filing of IRS Form 1040X.

- Correction of missing/misreported trades & wallet data.

- Expert guidance coming from a crypto tax firm.