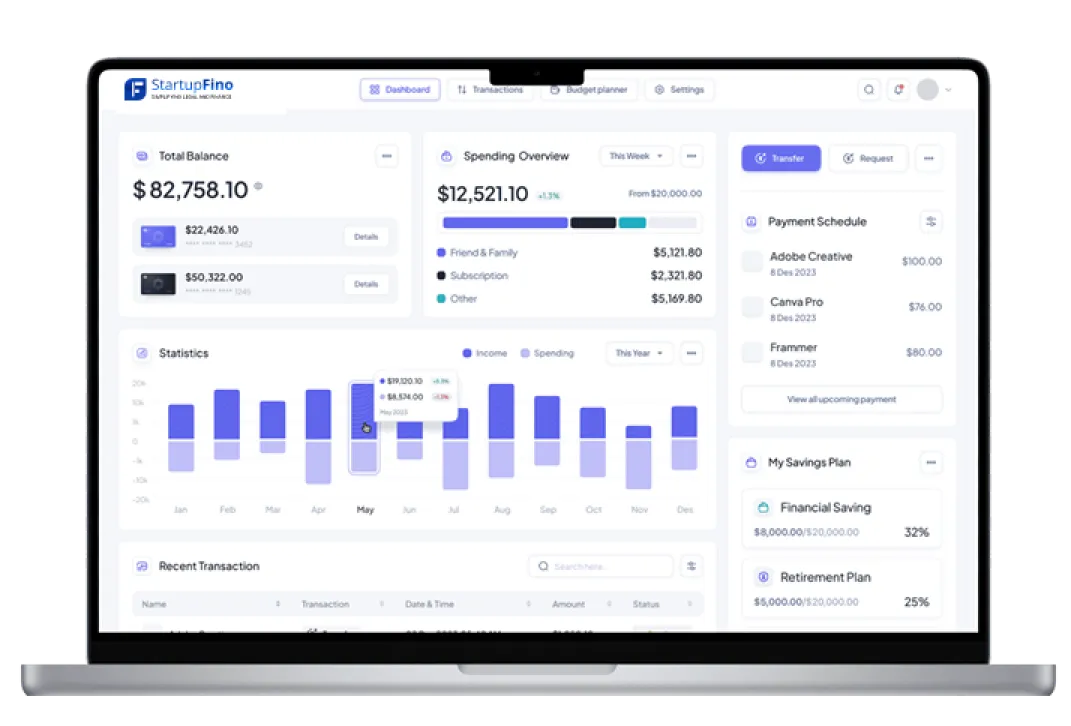

Managing finances can be tough, particularly when there are several tax laws, compliance requirements and financial forecasting involved like in the USA. That is the reason businesses, particularly startups and small businesses, require expert advice. At StartupFino, our Virtual CFO services USA help companies simplify financial management, optimize cash flow and comply with IRS regulations, GAAP accounting standards and SEC reporting requirements.

Unlike employing a full-time CFO, our CFO virtual services deliver top financial knowledge at a fraction of the price. If you require Virtual CPA services, Virtual bookkeeping services or Virtual accounting programs, we can help you maintain your finances in great condition so you can concentrate on your company's success.

Financial Strategy & Planning

A good financial Strategy is critical to a successful business. Our Virtual CFO for small businesses and startups develops a customised financial plan to fit your growth requirements. From managing burn off rates, revenue projections and investment strategies to handling financial risks, we offer advisory services to keep your business financially strong.

We prepare your financial statements for you to satisfy GAAP (Generally Accepted Accounting Principles) and SEC (Securities and Exchange Commission) regulations. Our VCFO services also include monthly financial reviews, cash flow optimization and forecasting to keep you always ahead.

- Customized financial strategy based on business needs.

- Prevention of financial losses through proper risk management.

- GAAP-compliant financial reporting for accuracy.

- Monthly cash flow / financial performance analysis.

Budgeting & Forecasting

Proper budgeting & financial forecasting is vital for business success. Our Virtual CFO advisory services offer real time forecasting models based on market developments, company performance and regulatory changes. We help companies anticipate potential cash flow, expense and revenue to make informed choices.

We also help you comply with IRS tax laws (IRC Section 162 for business expenses) and SEC financial disclosure requirements to present accurate financial projections. Our Virtual accounting firms present monthly, quarterly and annual financial forecasts using the latest tools.

- Proper financial forecasting for strategic growth.

- Budgeting plans to control costs and boost profitability.

- IRS compliant financial documentation for tax benefits.

- Quarterly reports & KPI tracking for much better decision making.

Tax Compliance & Optimization

Taxes can be complex, but with our Virtual CPA services, they are manageable. We help your business comply with IRS tax laws, state laws & federal tax codes - reducing tax debts & maximizing savings. Be it income tax, payroll tax or company deductions - we take care of everything for you.

We help you take advantage of legal tax deductions under IRC Sections 179 (enterprise asset depreciation) and 199A (qualified company cash flow deduction) so you pay just what is necessary. Our Virtual accounting firms also handle quarterly tax estimates, payroll taxes and IRS filings to keep your business audit-proof.

- Tax strategy & compliance with state and federal regulations.

- Quarterly and yearly tax filing to avoid penalties.

- Using IRS codes like Section 179 to maximize deductions.

- Audit-ready documentation for stress-free tax seasons.

Fundraising & Investor Relations

Our Virtual CFO small business solutions can help you raise capital. We assist with financial modeling, investor pitch decks, valuation analysis and capital structure planning. Our team ensures your business financials comply with SEC regulations and GAAP reporting standards - helping build investor trust.

Additionally, we negotiate with investors and lenders so startups can receive seed funding, venture capital and company loans. Our CFO virtual services prepare your company for due diligence including SEC Form-D for private fundraising and the financial disclosures that investors want from you.

- Investor-ready financial statements & pitch decks.

- Fundraising strategy & capital planning.

- Compliance with SEC regulations for efficient funding rounds.

- Valuation and financial due diligence support.

Virtual Bookkeeping & Payroll Management

Being able to track daily finances is essential for any business. Our Virtual bookkeeping services and virtual accounting service offers clear financial, payroll, and bookkeeping reports. We do bank reconciliations, accounts payable / receivable, tax compliance & payroll tax filings for your business.

We also help you comply with IRS payroll tax guidelines, FICA (Federal Insurance Contributions Act) and local wage laws so your workers are paid out correctly and avoid tax penalties. Our Virtual accounting firms also generate monthly financial reports for you.

- Correct bookkeeping and payroll processing.

- IRS & FICA payroll tax compliance.

- Accounts payable / receivable management.

- Real time financial reporting & cash flow tracking.

Business Expansion & Exit Planning

Thinking of growing your business or perhaps selling your business? Our Virtual CFO remote services help you structure acquisitions, mergers and business exits. We help with financial restructuring, valuation evaluation and SEC reporting rules compliance for transactions.

Our experts help startups and small businesses lower taxes and optimize sale value by complying with IRS Section 1202 (Qualified small Business Stock Exemption) and SEC M&A guidelines.

- Financial planning for Business expansion.

- Exit strategies & M&A support.

- SEC / IRS compliance for business product sales.

- Financial restructuring for profitable transitions

Cash Flow Management & Profit Optimization

Managing cash flow is essential for a company to survive. Many startups and small businesses face the challenges of unforeseen expenses, late payments and unpredictable revenue, which can produce financial instability. Our Virtual CFO services USA track income along with expenses, optimize pricing and increase profitability for companies.

We maintain your financial documents clean and audit-ready - in accordance with GAAP (Generally Accepted Accounting Principles) and IRS rules. Our Virtual CPA services additionally evaluate financial statements, eliminate unnecessary costs and negotiate better vendor contracts for maximum profit for companies. Whether you're a startup or an established company, our Virtual CFO for startups keeps your business well-stocked with cash to continue on its path to growth.

- Cash flow tracking and forecasting to avoid Cash flow shortfalls.

- Expense management and cost cutting to achieve higher profits.

- Optimization of pricing and revenue enhancement strategies.

- Conformity with IRS tax laws and GAAP reporting guidelines.

Risk Management & Internal Controls

Every business has financial risks, which range from fraud & mistakes to regulatory non-compliance and market volatility. Our Virtual CFO advisory services identify, assess and mitigate risks before they affect your company. We have internal controls to avoid fraud, minimize error and keep financial transparency.

We enforce SOX (Sarbanes-Oxley Act) compliance for corporate financial accountability, IRS audit requirements and SEC risk disclosure regulations. Our Virtual accounting firms also perform periodic audits and financial reviews to improve risk management. Businesses can protect their property, stay clear of fiscal mismanagement and comply with federal and state laws with our Virtual CFO remote assistance.

- Fraud prevention / financial risk assessment.

- Internal control implementation for secure financial operations.

- Compliance with SOX, IRS audit laws and SEC regulations.

- Regular financial reviews and internal audits.